Introduction

The introduction of Goods and Services Tax (GST) w.e.f. 1st July 2017 in India is very significant step in the field of indirect tax reforms in the country. By amalgamating a large number of Central and State taxes into a single tax, it would mitigate a cascading effect or double taxation in a major way and pave the way for a common national market. GST would make Indian products competitive in the domestic as well as international markets.

In a nutshell, GST is a destination based tax on consumption of goods and/or services. It is levied at all stages right from manufacture/inception up to final consumption with a credit of taxes paid at previous stages, available as set off i.e. input tax credit (ITC) of the taxes paid. It means only value addition will be taxed and burden of tax is to be borne by the final consumer.

The GST law is to facilitate seamless credit across the entire supply chain and across all states under a common tax base. It is a tax on goods and/or services, levied at each point of supply of goods or provision of services, made or agreed to be made for a consideration by a person in the course or furtherance of business. The supplier of goods/services can claim the input tax credit which he/she has paid on procuring the inputs or services or capital goods. The burden of GST is ultimately borne by the final consumer, who can’t claim ITC of GST. The Implementation of GST is a milestone for the Indian economy that is expected to result in overall growth of the country in the long run.

Dual Model of GST

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. The Central & State Governments both have distinct responsibilities to perform and accordingly the powers to collect revenue are provided in the Constitution of India.

Dual GST Model signifies that GST is levied by the Centre and the States concurrently, on supply of Goods and/or Services. Under GST regime, the powers to tax supply of goods and services are vested with both i.e. the Centre and the State. The State levies tax as SGST and the Centre as CGST. However, in case of inter-State transactions, Integrated GST (IGST), which is the sum total of SGST & CGST is levied. The power to levy & administer IGST is vested with the Central Government, while the IGST revenue would get distributed between the Centre and the Destination State. In fact the levy of IGST is to transfer the tax to the State of destination of goods/services where the Recipient of same will be entitled to its ITC, unlike CST (Central Sales Tax) which was the cost under Earlier Tax Laws. Considering the concurrent taxation power of Central Government & State Government to tax transaction under GST, the structure is referred to as dual GST.

Taxes which are subsumed and not subsumed

Under the GST law, certain levies and collection of duty or tax on the goods and/or services levied either by the Centre or by States are subsumed.

The GST subsumes the following taxes:

1) Central Taxes

- Central Excise Duty

- Excise Duties under the (Medicinal and Toilet Preparations) Act

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textile and Textile Articles)

- Additional Duties of Customs (Commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Central surcharges and cesses on above duties/taxes

Note: On supply of petroleum crude, high speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel GST shall be levied with effect from such date as may be notified by the Government on the recommendations of the GST Council.

2) State Taxes

- State VAT (except tax on alcoholic liquor for human consumption)

- Central Sales Tax (though levied under Central Law, it is retained by States from where the goods started its movement to other State)

- Luxury Tax

- Entry Tax (including octroi & LBT)

- Entertainment and Amusement Tax (except when levied by the Local Authorities/Bodies)

- Taxes on Advertisements

- Purchase Tax

- Taxes on lotteries, betting and gambling

- Tax on sale of Forest Produce

- State surcharges and cesses on above taxes

The GST Law of the Centre i.e., CGST Law and the States i.e. SGST law are almost same though enacted separately by each States, to levy & collect tax on intra-State i.e. local supplies. There are certain exceptional variation in a clause pertaining to the Transitional provisions. IGST law to levy tax on inter-State supplies, UTGST Law to levy tax on intra-State supplies in Union Territories and GST (Compensation to States) Law to levy cess on certain supplies of goods/services to compensate to the States for loss of revenue arising on account of implementation of GST for a period of first 5 years period as provided in law based on recommendation of the GST Council.

Important Definitions under GST

Section 2 defines many terms used in the CGST Act. The important ones are discussed below:

“Aggregate Turnover” u/s. 2(6):- “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes Central tax, State tax, Union Territory tax, integrated tax and cess.

Said term is to be referred for knowing when the threshold turnover is reached triggering liability for registration and eligibility for composition scheme.

2) Business u/s. 2(17): “business” includes—

- Any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit;

- Any activity or transaction in connection with or incidental or ancillary to sub-clause (a);

- Any activity or transaction in the nature of sub-clause (a), whether or not there is volume, frequency, continuity or regularity of such transaction;

- Supply or acquisition of goods including capital goods and services in connection with commencement or closure of business;

- Provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members;

- Admission, for a consideration, of persons to any premises;

- Services supplied by a person as the holder of an office which has been accepted by him in the course or furtherance of his trade, profession or vocation;

- Services provided by a race club by way of totalisator or a license to book maker in such club; and

- Any activity or transaction undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities.

Thus business may be carried on for non-profit motive or charitable purpose, yet it is a business for the purpose of GST law. Profession or vocation is a business. Incidental or ancillary transactions are also part of business. Society or club or AOP doing any service/supply to its members for a consideration/subscription is a business. Mutuality concept is tried to overcome. The coverage of the term is very wide.

3) Business vertical u/s. 2(18): “business vertical” means a distinguishable component of an enterprise that is engaged in the supply of individual goods or services or a group of related goods or services which is subject to risks and returns that are different from those of the other business verticals.

Explanation.— For the purposes of this clause, factors that should be considered in determining whether goods or services are related include—

- The nature of the goods or services;

- The nature of the production processes;

- The type or class of customers for the goods or services;

- The methods used to distribute the goods or supply of services; and

- The nature of regulatory environment (wherever applicable), including banking, insurance, or public utilities.

Said term is used for deciding when some person opts to get separate GST Registration even in same State for different business lines, though under same PAN. E.g. a Company manufacturing/trading in cement and also executing infrastructure jobs, thus having two different business verticals. However, one must opt for separate registration taking into consideration main aspect that inter se supply between different verticals will be treated as a supply, liable to tax.

4) Capital goods u/s. 2(19): “capital goods” means goods, the value of which is capitalized in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business;

5) Casual taxable person u/s. 2(20): “casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he/she has no fixed place of business;

E.g. The person of one State going to any other State for exhibition of goods & sale therefrom is covered here who can register temporarily & comply with Law.

6) Consideration u/s. 2(31): “consideration” in relation to the supply of goods or services or both includes—

- Any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or Services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

- The monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

Provided that a deposit given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies such deposit as consideration for the said supply;

Thus consideration can be in money or kind. Barter of services/goods will be taxable in both person’s hand, under GST Law. Consideration may be received from a person other than the recipient of goods/services.

7) Goods u/s. 2(52): “Goods” means every kind of movable property other than money and securities but includes actionable claims, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

However, “actionable claims” (other than lottery, betting & gambling) are neither supply of goods nor supply of services as per Schedule III annexed to Act read with section 7 of the CGST Act.

E.g. A claim for arrears of rent, right to claim provident fund and Lottery ticket is actionable claims.

Goods includes all movable property. Steam, animals & birds in captivity, copyright in film or songs or music and Technical drawings are movable properties is goods.

Growing crops, grass trees attached to earth are goods. Standing tress are not ‘goods’. However, standing timber is identified and is in deliverable State, is goods.

Money and securities have been specifically excluded from the definition of goods as well services. Thus, the transaction in securities shall not be liable to GST.

8) Location of the recipient of services u/s. 2(70):-

“location of the recipient of services” means,–

- Where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

- Where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

- Where a supply is received at more than one establishment, whether the Place of business or fixed establishment, the location of the establishment must Directly concerned with the receipt of the supply; and

- In absence of such places, the location of the usual place of residence of the recipient.

9) Location of the supplier of services u/s. 2(71):- “location of the supplier of services” means,–

- Where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

- Where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), The Location of such fixed establishment;

- Where a supply is made from more than one establishment, whether the Place of business or fixed establishment, the location of the establishment must directly concerned with the provisions of the supply; and

- In absence of such places, the location of the usual place of residence Of the supplier;

The above two definitions are important to decide the jurisdiction of the State for revenue & about which tax attracted in a transaction, either SGST & CGST or IGST.

10) Market value u/s. 2(73): “market value” shall mean the full amount which a recipient of a supply is required to pay in order to obtain the goods or services or both of like kind and quality at or about the same time and at the same commercial level where the recipient and the supplier are not related;

Said concept will be of use when the transaction is between two related persons or two distinct persons of the single owner/taxable person and value of supply of goods/services is to be found out to levy tax where the consideration is not wholly in money.

11) Non-resident taxable person u/s. 2(77): “non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India;

E.g. the person of any other country coming to any state in India for exhibition of goods & sale there from or to render/supply services in India is covered here who can register temporarily & comply with Law.

12) Services u/s. 2(102):- “services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged;

Definition of services is a residuary one i.e. what are not goods are services. It can cover a wide range. Thus immovable property is covered here.

However, money & securities are neither goods nor services, thus out of GST net.

13) Turnover in State or turnover in Union Territory u/s. 2(112):- “turnover in State” or “turnover in Union territory” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis) and exempt supplies made within a State or Union territory by a taxable person, exports of goods or services or both and inter-State supplies of goods or services or both made from the State or Union territory by the said taxable person but excludes central tax, State tax, Union territory tax, IGST & Cess.

14) Works contract u/s. 2(119):- “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract;

Thus repairs or maintenance of an immovable property is covered here as a works contract. However, if it is related to movable property then it is not covered here but will be covered under the term “composite supply” or “mixed supply” . The tax provisions will apply accordingly.

Levy and Scope of Supply

In the earlier indirect tax regime the term “production” or manufacture” or “sale” was used with reference to goods whereas the term “provision” was used wrt services. The new term which replaces all these term for goods as well as services is ‘Supply’. ‘Supply’ has very wide scope and coverage which is provided u/s. 7 of the CGST/SGST Act, 2017. Said provision is expanded by making it inclusive.

As per section 7(1)(a) “Supply” includes all forms of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business.

Under section 7(1)(b), the specific inclusion has been made for importation of services for consideration whether or not in the course or furtherance of business.

Section 7(1)(c) read with Schedule I, it specifies the activities to be treated as supply even if made or agreed to be made without consideration.

Thus, the following transactions will be subject to GST even if there is no consideration.

- Permanent transfer or disposal of business assets where input tax credit has been availed.

- Supply of goods or services or both between related persons or between distinct persons when made in the course or furtherance of business.

Provided that gifts upto ₹ 50,000 in a financial year by an employer to an employee shall not be treated as supply of goods or services or both.

- Supply of goods by a principal to his agent where the agent undertakes to supply such goods on behalf of the principal or by an agent to his principal where the agent undertakes to receive such goods on behalf of the principal.

- Importation of services by a taxable person from a related person or from any of his/her other establishment outside India, in the course or furtherance of business.

Section 7(1)(d) read with Schedule II, provides the activities to be treated

as supply of goods or supply of services. The list of such specified activities of supply are as under:

I. Activities/transactions treated as supply of ‘Goods’:-

- Any transfer of the title in goods is a supply of goods.

- Any transfer of title of goods under an agreement which stipulates that property in goods will pass at a future date upon payment of full consideration as agreed like hire purchases.

- Permanent transfer or disposal of business assets with or without consideration.

- Supply of goods by any unincorporated association or body of persons to a member thereof for consideration.

II. Activities/transactions treated as supply of ‘Services’

- Transfer of right or undivided share in goods without transfer of title.

- Any lease, tenancy, easement or licence to occupy land.

- Any lease or letting out the building for business or commerce either wholly or partially.

- Any treatment or process applied on another person’s goods like job works.

- Any business assets put for private use whether or not for consideration.

- Renting of immovable property.

- Construction of a complex, building, civil structure or part thereof, intended for sale, wholly or partly.

- Works Contract as defined u/s. 2(119).

- Temporary transfer or permitting the use or enjoyment of any intellectual property right.

- Development, design, programming, customization, adaptation, upgradation, enhancement, implementation of information technology software.

- Agreeing to the obligation to refrain from an Act or to tolerate an act or a situation, or to do an act.

- Supply, by way of or as part of any service, of food or any other article for human consumption or any non-alcoholic drink. Thus food/drink served in a hotel or by a caterer is deemed as services under this law.

As per schedule III read with section 7(2)(a), the following activities or transactions shall be treated as neither supply of goods nor supply of services:

- Services by an employee to the employer in the course of or in relation to his employment.

- Services by any Court or Tribunal.

- The functions performed by any Members of Parliament, State legislator, panchayats, municipalities and other local authorities.

- The duties performed by any person as a Chairperson/ Members/Director in a body established by the Central Government, State Government and local authority and who is not deemed as on employee before the commencement of this clause.

- Services of funeral burial, crematorium or mortuary including transportation of deceased.

- Sale of land, sale of building, after the issuance of completion certificate or after its first occupation, whichever is earlier.

- Actionable claims other than lottery betting and gambling.

Thus above transactions are out of GST net.

As per section 7(2) (b), certain categories of activities or transaction undertaken by the Central Government, State Government or any local authority in which they are engaged as public authorities as may be specified by the Central/ State Government shall be treated neither as a supply of goods nor a supply of services. Therefore, no tax is payable by recipient of such services.

In short, the term “supply” under GST has been made very wide which may cover many type of transactions.

Tax liability on “composite supplies” and “mixed supplies”

Under the GST, as per Section 8 two new concepts of supply are introduced viz “Composite supply” and “mixed supply” .

As per, the definition u/s. 2(30) “Composite Supply” means a supply made by a taxable person to a recipient, consisting of two or more taxable supplies of goods or services or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

The term “principal supply” (Sec. 2(90)) means the supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.

For e.g., in case where goods are packed and transported with insurance, the supply of goods, packing materials, transportation and insurance is a composite supply and supply of goods is the principal supply.

All such supplies will be taxed at the rate applicable on ‘principal supply’, as provided u/s. 8(a) of CGST Act.

As per the definition u/s. 2 (74) “Mixed Supply” means two or more individual supplies of goods or services, or any combination thereof made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

For e.g., in case of supply of a package consisting of watch, tie, belts, as a combo pack for a single price then although always these items can be sold individually and are not dependent on each other. Then such supply would be termed as mixed supply.

It shall not be a Mixed Supply if these items are supplied separately.

All such supplies will be taxed at the rate applicable on supply of that particular supply which attracts highest rate of tax, as provided u/s. 8(b) of CGST Act.

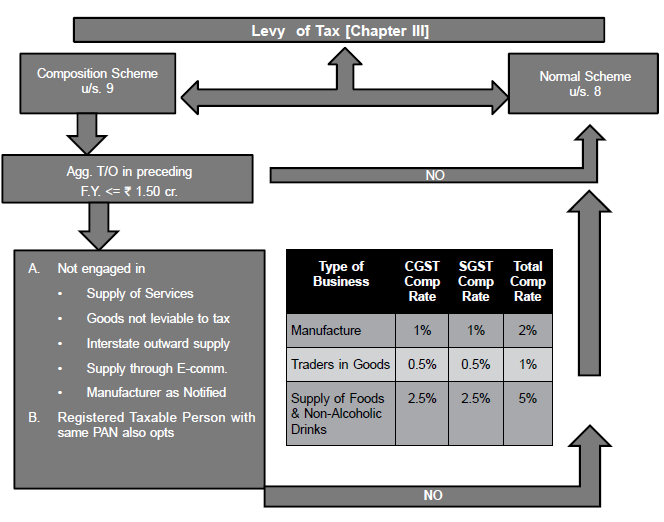

Composition Scheme

The GST law has introduced a composition scheme in order to simplify the tax payability by small dealers dealing in variety of products attracting different rates of taxes. Section 10 of the CGST Act deals with composition levy. It is optional. The eligibility criterion for composition dealers is as under:

- Registered person whose annual aggregate turnover in the preceding financial year did not exceed ₹ 75 lakh. Said turnover limit increased to ₹ 1 crore vide Notification # 46/2017 - Central Tax dt 13th October 2017.

- The rates of composition are as follows:

- 0.50% of the turnover in State or in Union Territory in case of a manufacturer.

- 2.5% of the turnover in State or in Union Territory in case of persons engaged in restaurant, eating house, club etc., where food and other articles, drinks other than alcoholic drinks are served for human consumption, by way of supply and/or service for a consideration.

- 0.5% of the turnover in State or Union Territory, in any other case.

There will be equal SGST/UTGST. Thus, total tax to be payable shall be double the aforesaid rates.

- Composition scheme dealer is liable to pay tax on RCB (Reverse Charge Basis) as applicable to other taxable persons.

- Only registered person is eligible for Composition scheme.

- Other conditions for the said composition scheme are as under:

- Service provider is not eligible for composition scheme except a restaurant, eating house, club etc. Thus supplier of goods only is eligible. However, if such person along with supply of goods, is providing exempt services (like having interest income) then eligible for composition scheme.

- Supplier should not be engaged in supply of alcoholic liquor or petroleum goods.

- Supplier shall not have any inter-State outward supplies.

- Supplier shall not supply through an electronic commerce operator who is required to collect tax at source under section 52.

- Manufacturer of “Ice-cream and other edible ice, whether or not containing cocoa” , “pan masala” and “tobacco & manufactured tobacco substitutes” are not eligible to opt for composition scheme as per Notification No. 8027 dated 27-6-2017.

However, the benefit of composition scheme is admissible to the trader of pan masala and ice cream.

- He/she shall not collect the tax separately i.e. he shall issue the bill without showing tax separately instead of tax invoice for a supply.

- He/she is not entitled to any ITC.

- The option of composition shall lapse from the day when his aggregate turnover exceeds the permissible limit.

- Where a person holding same PAN has more than one registration either in the same State or different States, he/she has to opt for the composition scheme in respect of all such registrations.

- The option to pay as per composition scheme will commence from the first day of the financial year or the appointed day or the date of effect of the registration certificate, as the case may be.

Certain conditions are prescribed in Rules 3 to 7 which are as under:

- He/she is neither a casual taxable person nor a non-resident taxable person.

- The goods held in stock by him/her on the appointed day have not been purchased in the course of inter-State trade or imported from a place outside India or received from his/her branch situated outside the state or from his/her agent or principal outside the state where the option is exercised at the time of provisional registration.

- The goods held in stock by him/her have not been purchased from an unregistered person and if so purchased, and then he pays the tax under sub-section (4) of Section 9.

- He/she shall pay RCB tax under sections 9(3) & (4) on inward supplies as applicable to others.

- He/she is not engaged in the manufacture of goods notified u/s. 10(2)(c) during the preceding financial year.

- He/she shall mention the words “composition taxable person, not eligible to collect taxes on supplies” at the top of the bill of supply, issued by him/her.

- He/she shall mention the words “composition taxable person” on every notice or signboard displayed at a prominent place at its principal place of business and his/her every additional place or places of business.

Person opting for composition scheme need not intimate every year so long as he/she wishes to continue with the scheme.

The registered person paying composition tax shall have to furnish only one return per quarter within 18 days of the end of such quarter..

The composition rules have been framed wherein the procedure for opting for the scheme is prescribed. A person who has been allotted a provisional registration can electronically file intimation in form GST-CMP-01 duly signed on the common portal prior to the appointed day but not later than 30 days after the said date or such further period as may be extended by the Commissioner in this respect. Thus, the option for composition can be availed right from the appointed day. In case such intimation is made after the appointed day, the registered person will have to issue the bills for supply without collecting the tax right from the appointed day.

Persons obtaining registration after the appointed day may choose the option for composition scheme in Part B in Form GST-REG-01 which will be considered as intimation to pay the tax under the said scheme.

Other persons who wish to opt for the composition scheme have to electronically file intimation in Form GST-CMP-02 on the common portal before the commencement of the financial year for which he wishes to exercise the option of composition. He/she will also have to furnish the statement in form GST ITC-3 within 60 days from the commencement of the financial year, which gives the details of the stock held on the previous day since he is not entitled to the ITC on such stocks and corresponding purchases.

Any person who files an intimation to pay composition tax shall furnish the details of stock, including the inward supply of goods received from the unregistered persons, held by him on the day preceding the date from which he opts to pay tax, electronically, in Form GST-CMP-3, on the common portal within 60 days of the date from which the option for composition levy is exercised or within such period as may be extended by the Commissioner in this behalf.

An application for withdrawal from the composition Scheme shall be filed in Form GST-CMP-04, on the common portal electronically, within 7 days from the day a registered person ceases to satisfy any of the conditions mentioned in section 10 or composition rules or by a person who wants to withdraw from the composition scheme and shall issue tax invoice for every taxable supply made thereafter.

Where the proper officer has reason to believe that the registered person was not eligible to pay tax u/s. 10 or has contravened the provisions of the Act or Composition rules, the proper officer may issue a Notice to such a person in Form GST-CMP-5 to show cause as to why option to pay tax under section 10 should not be denied.

The registered person shall have to file reply in Form GST-CMP-06 within 15 days of the receipt of such show cause notice.

Upon receipt of reply to the show cause notice from the registered person in Form GST-CMP-06, the proper officer shall issue an order in Form GST-CMP-07 within 30 days of receipt of such reply, either accepting the reply or denying the option to pay tax u/s.10 from the date of option or from the date of the event concerning such contravention, as the case may be. Proper officer can pass an order withdrawing the scheme upon contravention of any of the conditions of the scheme after affording an opportunity of being heard to the dealer.

Where if Composition Dealer in case of any default in tax payment, then Proper Officer has reason to believe that a composition dealer has wrongly availed the benefit under the composition scheme, then such a person shall be liable to pay all the taxes which he would have paid under the normal scheme and also he will be liable to pay a penalty equivalent to an amount of tax payable as per the provisions of sections 73 and 74 respectively. This penalty will not be levied without giving a show cause notice to the dealer.

When existing registered person switching from normal scheme to composition scheme, the Registered Person shall be liable to pay an amount equal to the credit of input tax in respect of inputs held in stock on the day immediately preceding the date of such switchover. The balance of input tax credit after payment of such amount, if any, lying in the credit ledger shall lapse.