- Every supplier shall be liable to be registered under this Law in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds threshold.

- Aggregate Turnover : Section 2(6)

“aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis

[Section 9(3)]), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes Central tax, State tax, Union Territory tax, integrated tax and cess;

- The taxable threshold shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals (by an agent).

|

Sr. No. |

Category of Registration |

Category of person |

Turnover limit ₹

|

When to Apply |

Effective date of Registration |

Deposits |

|

1 |

Normal |

All types of Dealers except Casual and Non-Resident |

- 20 Lakhs

- 10 Lakhs for special category States i.e. [Mizoram, Manipur, Meghalaya, Arunachal Pradesh, Nagaland, Sikkim, Tripura, Himachal Pradesh, UttaraKhand]

|

Within 30 days from exceeding the Turnover Limit |

If applied within time – Date of exceeding T.O. If Not Applied in Time- Date of Application

|

NIL |

|

2 |

Voluntary |

All types of Dealers except Casual and Non-Resident |

No T.O. Limit |

Any time |

Date of application |

NIL |

|

3 |

Compulsory |

Casual and Non-Resident |

No T.O. Limit |

5 days prior to the commencement of business |

Date of application maximum for 3 months which can also be extended for further 3 months |

Estimated Tax Liability to be paid in Advance |

|

4 |

Migration |

Registered persons in existing laws like Excise, Vat, Service Tax |

N.A. |

Prior to 30-6-2017 |

1-7-2017 |

NIL |

Persons exempted from Registration

- Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax.

- An agriculturist, to the extent of supply of produce out of cultivation of land.

- Persons who are exclusively engaged in the business of supply of taxable goods or services or both, but the entire tax on same is payable by a person under reverse charge mechanism.

Certain categories of persons will be liable to get registered irrespective of threshold limit

|

Sr. No. |

Category of Persons |

|

1 |

Persons making any Inter-State taxable supply |

|

2 |

Casual taxable persons |

|

3 |

Persons who are required to pay tax under reverse charge [Import of Goods - Section-9(3), purchase of goods by Registered Taxable Person from unregistered person - Section 9(4)] |

|

4 |

Specified categories of services the tax on Intra-State supplies of which shall be paid by the electronic commerce operator or any person representing such electronic commerce operator where an electronic commerce operator does not have a physical presence in the taxable territory or any person appointed by electronic commerce operator who does not have physical presence in the taxable territory and also he does not have a representative in the said territory [Section 9(5)] |

|

5 |

Non-resident taxable persons |

|

6 |

Persons who are required to deduct tax under section 51 |

|

7 |

Persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise |

|

8 |

Input service distributor |

|

9 |

Persons who supply goods and/or services, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under Section 52 |

|

10 |

Every electronic commerce operator |

|

11 |

Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person |

|

12 |

Such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council |

- Liability on transfer of business

- Where a business carried on by a taxable person is transferred, whether on account of succession or any other reason, to another person as a going concern, the transferee, or the successor, shall be liable to be registered with effect from the date of such transfer or succession.

- Where the business is transferred pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, demerger of two or more companies by an order of a High Court, the transferee shall be liable to be registered with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court.

- The Input Service Distributors who are registered under an earlier law shall be required to apply for fresh registration.

- As per Section 23(2) of the CGST Act, a person having multiple business verticals in a State may be allowed to obtain a separate registration for each business vertical.

- Person having multiple business verticals may apply for separate registrations in form GST-REG-01 for each one of them.

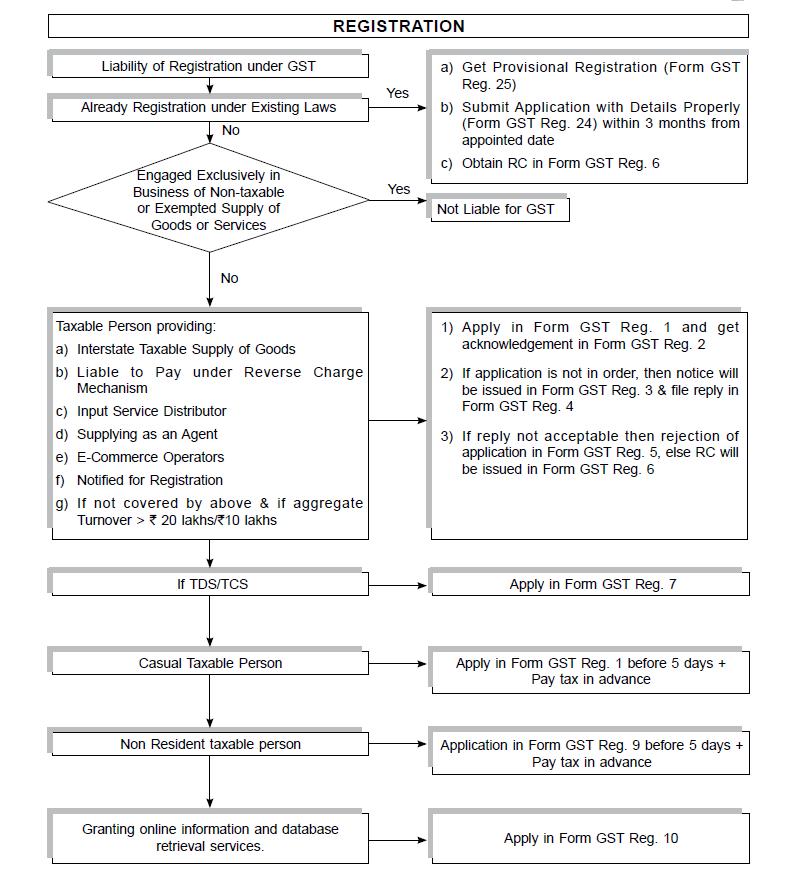

- Procedure for Registration

- Application to be made within 30 days from the date on which the taxpayer becomes liable to pay tax.

- GST common portal will be set up by GSTN with backend integration with respective IT systems of Centre and State.

- Procedure � Application in Form GST REG-01 on GST portal to be submitted with all fields duly filled up. Part A thereof consists of PAN, e-mail address and mobile number which shall be first verified in the prescribed manner with the respective database and then application reference no. shall be generated.

- Part B of the form to be submitted duly filled up using the said Reference Number and duly signed along with necessary documents.

- Once a complete application is submitted online, a message asking for confirmation will be sent through e-mail and SMS to the authorized signatory of the applicant.

- On receipt of such confirmation from the authorized signatory, acknowledgement Number in Form GST-REG-02 would be generated and intimated to the applicant

- Casual/non resident taxable person shall be allotted a temporary ID No. for payment of advance amount of tax.

- Documents to be uploaded

- Constitution of business - GSTN will pick up as per PAN

- Partnership deed for a firm, Registration Certificate for other entities like society, trust etc., needs to be uploaded

- No documents are required in case of proprietors and companies (Verification through PAN/Company Identification Number through MCA 21)

- POB-Principal as well as additional POB – own premises – ownership documents such as property tax paid receipt, Municipal khata copy, electricity bill etc.

- Rented or Leased premises- agreement, ownership document of the lessor as above.

- Premises obtained from others – Consent Letter, duly notarized, obtained from the lessee of the premises, where the main lease allows sub-lease.

- Letter of authorisation and copy of Resolution of the Managing Committee or Board of Directors to that effect.

- Required to verify whether the person signing as authorised Signatory is duly empowered to do so.

- Photograph

- Proprietary concern – Proprietor.

- Partnership Firm/LLP – Managing/ Authorized Partners

- Personal details of all partners to be submitted but photos of only 10 partners including managing partner to be submitted

- HUF – Karta

- Company – MD/authorized person

- Trust – managing trustee

- AOP/ BOI – Members of Managing Committee –

- Personal details of all members is to be submitted but photos of only 10 members including Chairman to be submitted

- Local Body – CEO or his equivalent

- Statutory Body - CEO or his equivalent

- Others – Person In charge

- Photographs only in .jpg and .png format

- Details of bank account – opening page copy of the Bank passbook in the name of the Proprietor/Business Concern containing A/c No., Name of the Account Holder, MICR, IFS code and Branch details.

- Required for all bank accounts where business is conducted by the entity.

- Structure of the GST RC

- First two digits, State Code allotted by Indian Census 2011. For example, 09 for UP and 27 for Maharashtra.

- 3-12 places for PAN/TAN/TCN of the legal entity.

- 13 & 14 Entity Code

- 15th digit is check digit.

- Unique Identity Number for certain categories of persons

- As per Section 25(9) of the CGST Act, following categories of persons will be required to obtain a Unique Identity Number (UIN)

- UNO agencies, Multinational Financial Organizations, Consulate or Embassy of foreign countries, any other notified person as may be notified by the Board / Commissioner

- Registration of TDS Deductor and E-commerce operator

- Special persons like Central/State Government departments, local authority, Government agencies or other notified persons required to deduct tax from the payments made to suppliers u/s. 51(1) have to obtain RC.

- Similarly, e-commerce operators while making payments to suppliers of goods/services have to deduct tax u/s 52 are required to obtain RC

- Failure to Obtain Registration

- As per clause (xi) in section 122(1) of the CGST Act, where a taxable person who is liable to be registered under this Act but fails to obtain registration, he shall be liable to a penalty of:

- ₹ 10,000/- or an amount equivalent to the tax evaded or the tax not deducted or short deducted or deducted but not paid to the Government, or

- Input tax credit availed of or passed on or distributed irregularly, or

- The refund claimed fraudulently,

whichever is higher.

- Suo motu Registration

- As per section 25(8) of the CGST Act , a person, who is liable to be registered under this Act, fails to apply for registration, the tax authority will proceed to register such person.

- Date of effect from date of order of registration.

- Such person to apply for RC within 30 days from the date of grant of above RC unless appeal is filed against temporary RC order.

- Amendment in Registration Certificate : Section 28

- Changes relating to name of the business, POB, details of proprietor, partner, director, members of MC, board of trustees etc. are reqd. to be approved and incorporated in RC. Order to be issued in form GST-REG-14 within 15 working days. Effect of amendment from the date of the event causing it.

- Proper officer may reject the amendment if found deficient after issuing notice in form GST-REG-03 within 15 working days. Person to be heard before rejection. Dealer to reply in form GST REG-04 and RC to be amended within 7-days.

- Rejection/approval under CGST/SGST Act is deemed rejection/approval under SGST/CGST Act.

- RC shall stand amended upon failure of the officer to respond within 15 or 7 working days, as the case may be.

- Cancellation of Registration : Section 29

- Cancellation of RC either on own motion of the officer or upon application in form GST-REG-15 in the following events:

- Discontinuation or transfer of business due to death of the proprietor, amalgamation, demerger or disposal.

- Change in the constitution.

- T.O. falling below threshold limit.

- Form GST-REG-15 shall give details of closing stock and liability thereon.

- Person who is voluntarily registered cannot apply for cancellation before expiry of one year.

- Person seeking cancellation has to file a final return.

- Suo Motu Cancellation of RC by officer

- Proper officer may cancel the RC even from an anterior date in the following events by issuing notice in form GST- REG-16

- RC holder has contravened the prescribed provisions of the Act or Rules

- Composition dealer has not filed returns for 3 consecutive periods

- Any other person has not filed returns for continuous period of 6 months.

- Person with voluntary RC has not commenced business within 6 months.

- RC has been obtained by fraud, wilful misstatement or suppression of facts.

- Order of cancellation is in Form GST-REG 18. Person to be heard before cancellation and liability for periods prior to cancellation is not affected.

- Cancellation under CGST is deemed cancellation under SGST and vice-versa.

- Revocation of cancellation : Section 30

- RC cancelled by officer on his own motion may be restored upon application in Form GST-REG-20 by the person within 30 days from the date of receipt of cancellation order.

- Revocation to be done on appreciation of the facts, within 30 days.

- Rejection of revocation on good and sufficient grounds. Dealer required to file the pending returns and pay the tax, interest, penalty etc., before revocation.

- Revocation under CGST Act is deemed revocation under SGCT Act and vice-versa.

- Forms prescribed for Registration;

|

Sr. No. |

Form No. |

Content |

|

1 |

GST REG-01 |

Application for Registration |

|

2 |

GST REG-02 |

Acknowledgement |

|

3 |

GST REG-03 |

Notice for Seeking Additional Information / Clarification / Documents relating to Application for Registration/Amendment/Cancellation |

|

4 |

GST REG-04 |

Application for filing clarification/additional information/document for Registration/Amendment/Cancellation/Revocation of Cancellation |

|

5 |

GST REG-05 |

Order of Rejection of Application for Registration / Amendment / Cancellation/ Revocation of Cancellation |

|

6 |

GST REG-06 |

Registration Certificate issued |

|

7 |

GST REG-07 |

Application for Registration as Tax Deductor or Tax Collector at Source |

|

8 |

GST REG -08 |

Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source |

|

9 |

GST REG-09 |

Application for Registration for Non-Resident Taxable Person. |

|

10 |

GST REG-09A |

Application for Registration for person supplying online information and data base access or retrieval services from a place outside India to a non-taxable online recipient |

|

11 |

GST REG-10 |

Application for extention of period of Registration by casual taxable person and non-resident taxable person |

|

12 |

GST REG-11 |

Order of Allotment of Temporary Registration/ Suo Motu Registration |

|

13 |

GST REG-12 |

Application for Allotment of Unique ID to UN Bodies/Embassies/any other person |

|

14 |

GST REG-13 |

Application for Amendment in Particulars subsequent to Registration |

|

15 |

GST REG-14 |

Order of Amendment of existing Registration |

|

16 |

GST REG-15 |

Application for Cancellation of Registration |

|

17 |

GST REG-16 |

Show Cause Notice for Cancellation of Registration |

|

18 |

GST REG-17 |

Reply to Show Cause Notice for Cancellation of Registration |

|

19 |

GST REG-18 |

Order for Cancellation of Registration |

|

20 |

GST REG-19 |

Order for Dropping of Cancellation of Registration |

|

21 |

GST REG-20 |

Application for Revocation of Cancelled Registration |

|

22 |

GST REG-21 |

Order for Approval of Application for Revocation of Cancelled Registration |

|

23 |

GST REG-22 |

Notice for Seeking Clarification/Documents relating to Application for Revocation of Cancellation |

|

24 |

GST REG-23 |

Reply to Notice for Seeking Clarification / Documents relating to Revocation of Cancellation |

|

25 |

GST REG-25 |

Provisional Registration Certificate to existing taxpayer |

|

26 |

GST REG-24 |

Application for Enrolment of Existing Taxpayer |

|

27 |

GST REG-26 |

Order of cancellation of provisional certificate |

|

28 |

GST REG-27 |

Notice for Hearing before Cancellation of provisional certificate |

|

29 |

GST REG-28 |

Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Service Tax Act 2017 |

|

30 |

GST REG-29 |

Form for Field Visit Report |

Back to Top

|

|