Various Forms of returns for various kinds of persons

(For Specific Monthwise or district/state etc

due date extensions - Refer Due date for various returns in GST Table at end of this part)

Type |

Form No. |

Due Date* |

Details of Outward Supply. |

GSTR-1 (Functional) |

a) For Aggregate T/O up to ₹ 1.5 crore in preceding or current FY - QUARTERLY - End of the month following the quarter.

b) For other than a) above - MONTHLY - 11th day of succeeding month |

Details of inward Supplies will be auto populated on the basis of GSTR-1 filed by suppliers. |

GSTR-2A (Functional) |

|

Monthly Return |

GSTR-3B |

For return periods from

a) Jul 2017-Dec 2019 - on or before 20th day of succeeding month

b) Jan 2020 onwards - 20th, 22nd & 24th of succeeding month (depending on T/o & states under which registered). |

Annual Return for Composition Dealers (Notification No. 21/2019 CT dated 23/04/2019) |

GSTR-4 (Functional) |

Annual Return from FY 2019-20 - Within 30th day of April, following the end of such FY.

(Quarterly Returns for the periods from July 2017 to Mar 2019) |

Quarterly statement for Composition Dealers (Notification No. 21/2019 CT dated 23/04/2019) |

GST CMP-08 (Functional) |

Within 18 days after the end of such quarter (applicable for return period from Q1 FY 19-20) |

Monthly Return by Non-resident taxable person |

GSTR-5 (Functional) |

For the Return periods from

a) Jul 2017 to Dec.2017 - on or before 31-01-2018

b) Other than (a) above - Within 20 days of succeeding Month or within 7 days after the last day of the period of registration specified under section 27(1), whichever is earlier |

Monthly Returns by persons providing online information and database access or retrieval services (OIDAR) |

GSTR-5A (Functional) |

20th of succeeding month |

Monthly Return by Input Service Distributor |

GSTR-6 (Functional) |

a) For return periods from July 2017 to Aug., 2018 - on or before 30/09/2018

b) For other than (a) above : Within 13 days after the end of such month |

Monthly Return of TDS |

GSTR-7 (Functional) |

a) For return periods from Oct.2018 to July 2019 - on or before 31/08/2019

b) For Other than (a) above :

Within 10 days after the end of such month |

Monthly Return of TCS by e-commerce operator |

GSTR-8 (Functional) |

a) For return periods from Oct., 2018 to Dec., 2018 is 07/02/2019

b) For Other than (a) above :

Within 10 days of succeeding Month |

Persons having UIN (Unique Identification Number) |

GSTR-11 (Functional) |

For claiming Refund on quarterly Basis or as and when required to file by Proper officer |

Final Return |

GSTR-10 (Functional) |

a) Registration cancelled on or before 30/09/2018, till 31/12/2018

b) For Others: Within 3 months from cancellation date or date of order of cancellation whichever is earlier |

Annual Return to be filed by every registered person (other than ISD, casual taxable person, non-resident taxable person and a person deducting TDS or collecting TCS) |

GSTR-9 (Functional) [Optional for RTP whose T/o < 2 crores for the F.ys. 2017-18 & 2018-19] |

a) For FY 2017-18: On or before 05.02.2020 or 07.02.2020 (depending on states under which registered)

b) For FY 2018-19: On or before 30.06.2020

c) For others: On or before 31st December of following end of each financial year |

Annual Return by Persons opted for Composition |

GSTR-9A (Functional) [Optional for RTP whose T/o < 2crores for the F.ys. 2017-18 & 2018-19] |

a) For FY 2017-18: On or before 05.02.2020 or 07.02.2020 (depending on states under which registered)

b) For FY 2018-19: On or before 30.06.2020

c) For others: On or before 31st December of following end of each financial year |

Annual Return by E-Commerce Operator |

GSTR-9B (Non- Functional) |

a) For FY 2017-18: Not Applicable

b) For others: On or before 31st December of following end of each financial year |

Audited Annual Accounts & Reconciliation (to be filed by every Registered Person whose aggregate turnover during a financial year exceeds ₹ 2 crores) |

GSTR-9C (Functional) [Relaxation to MSME's from furnishing 9C for F.Y. 2018-19 for RTP having T/o

< 5 crores] # |

a) For FY 2017-18: On or before 05.02.2020 or 07.02.2020 (depending on states under which registered)

b) For FY 2018-19: On or before 30.06.2020 #

c) For others: 31st December of following end of each financial year |

# Notfn. No. 16/2020 dt. 23.03.2020

♦ As the GST Portal is not ready with all the return Forms (either online or offline), the last date for filing the returns has been extended from time-to-time by issuing the Notifications. Therefore taxable persons should keep a close watch on the extended dates. The Forms which are not functional may be deleted from the Act.

1. FORM GSTR-1: Furnishing Details of outward supplies

Every registered person other than

- Input Service Distributor,

- Non-resident taxable person,

- Person paying tax under composition scheme,

- Persons who are liable for TDS

- E-Commerce Operator

is required to file this Form showing details of outward supplies of goods or services on or before 11th day of the succeeding month. For dealers having aggregate turnover not exceeding ₹1.5 crore in preceding or current FY shall file GSTR 1 quarterly on or before end of the month following the quarter.

(i) Following details are required to be filed in

FORM GSTR-1:

(a) Invoice wise details of all inter-State and intra-State supplies made to registered persons;

(b) Invoice wise details of all inter-State supplies with invoice value more than two and a half lakh rupees made to unregistered persons;

(c) Consolidated details of all intra-State supplies made to unregistered persons for each rate of tax;

(d) Consolidated details of all State wise inter-State supplies with invoice value less than two and a half lakh rupees made to unregistered persons for each rate of tax;

(e) Debit and Credit notes, if any issued during the month for invoices issued previously.

(f) Details of Nil Rated, Exempted & Non-GST Supplies

(g) HSN wise summary of outward supplies

(h) Documents issued for the return period.

(ii) The details of outward supplies furnished by the supplier vide FORM GSTR-1 shall be made available to the recipient in Part A of FORM GSTR-2A, in FORM GSTR- 4A and in FORM GSTR-6A.

(iii) If the recipient finds that there is a difference in FORM GSTR-2A and inward supply as per his books, then such recipient has to make necessary follow up with the suppliers for differences in the same and for necessary amendments/corrections in succeeding GSTR-1 to be filed by the supplier.

(iv) After filing FORM GSTR-1, if the supplier on his own realises any error or omission, or is informed by the recipients, that GSTR-1 is not matching with them, such supplier can rectify such error or omission and to that extent GSTR-1 shall get amended.

(v) The proviso to Section 37(3) clarifies that no rectification of error or omission can be made in respect of the details of outward supplies after furnishing of return for the month of September following the end of the Financial Year to which such details pertain or furnishing of the relevant annual return, whichever is earlier. For FY 2017-18, such rectification can be made till due date of furnishing the return for return period ending March 2019.

(vi) Late Fees for GSTR-1 returns filed during the period from 22nd December, 2018 to 31st March 2019 for the return periods from July 2017 to Sept., 2018 was waived off as per Notification No. 75/2018-Central Tax dated 31/12/2018.

(vii) Late Fees for GSTR-1 returns filed during the period from 19th December, 2019 to 17th January, 2020 for the return periods from July 2017 to Nov. 2019 was waived off as per Notification No. 74/2019-Central Tax dated 26/12/2019 r.w. Notif. 4/2020 dt. 10-01-2020.

2. Form GST CMP-08: Submission of Quarterly Statement by Composition Dealers (As amended pursuant to Notification No. 21/2019-CT dated 23/04/2019)

(i) Composition Dealer registered u/s 10 or paying tax by availing the benefit of Notification No. 02/2019-CTR dated 07/03/2019 shall furnish quarterly statement in Form GST CMP-08.

(ii) Filing of GSTR-1 and GSTR-2 is not applicable to Composition Dealers.

(iii) GST CMP-08 should be furnished on or before 18th day of the month succeeding such quarter

(iv) This Return shall include the:—

a) Consolidated details of outward supplies (including exempt supplies);

b) Inward Supplies attracting RCM including Import of Services.

c) Tax, Interest Payable & Paid

(v) Nil statement is required to be filed even if there is no tax liability due during the quarter.

3. FORM GSTR-4: Submission of Annual Return by Composition Dealers (As amended pursuant to Notification No. 21/2019 - CT dated 23/04/2019)

(i) Composition Dealer registered u/s. 10 or paying tax by availing the benefit of Notification No. 02/2019 - CTR dated 07/03/2019 shall furnish the Return in FORM GSTR-4 for each FY.

(ii) Filing of GSTR-1 and GSTR-2 is not applicable to Composition Dealers.

(iii) GSTR-4 should be furnished on or before 30th day of the April following the end of such FY.

(iv) This Return shall include the:—

a) Invoice wise details of goods liable to pay tax under Reverse Charge Mechanism and purchases from unregistered person;

b) Details of Import of Services.

c) Consolidated details of outward supplies.

(v) Person who has opted for composition scheme from the beginning of Financial Year and then if he opts out of the said scheme, such person have to furnish details of outward supply, inward supply and return as applicable to normal taxable person

(vi) Late Fees for GSTR 4 returns filed during the period from 22nd December, 2018 to 31st March 2019 for return periods from July 2017 to Sept., 2018 was waived off as per Notification No. 77/2018 - Central Tax dated 31/12/2018.

(vii) GSTR-4 was required to be filed Quarterly for the periods from July 2017 to Mar. 2019

4. FORM GSTR-5: Return by Non-resident taxable person

(i) GSTR-5 is applicable to non-resident taxable person and it is a monthly Return.

(ii) The due date for furnishing the return is 20th of the succeeding tax period or within 7 days from the last date of the registration whichever is earlier.

(iii) FORM GSTR-1 and GSTR-2 are not applicable to this Return.

(iv) The details of invoices furnished by a Non- Resident Taxable Person in FORM GSTR- 5 shall be made available to the recipient of credit in Part A of Form GSTR-2A.

5. FORM GSTR-5A: Every person providing online information and database access or retrieval services from a place outside India to a unregistered person shall file Return in FORM GSTR-5A. Due date for this Return is 20th of next month or part thereof.

6. FORM GSTR-6: Return by Input Service Distributor

(i) FORM GSTR-1 is not applicable for this Return.

(ii) Every Input Service Distributor, on the basis of details contained in GSTR- 6A, shall furnish GSTR-6, after adding, correcting or deleting said details.

(iii) The details of invoices by an Input Service Distributor in his Return in GSTR-6 shall be made available to the recipient of credit in Part B of GSTR-2A.

7. FORM GSTR-7: Return of Tax Deducted at Source

(i) FORM GSTR-1 and FORM GSTR-2 is not applicable for this Return.

(ii) The due date for furnishing GSTR-7 is 10th of the next month.

(iii) The details of tax deducted at source furnished by the Deductor in GSTR-7 shall be made available in Part C of GSTR-2A and GSTR 4A.

(iv) Provisions of TDS is applicable from 01/10/2018 thus question of filing Form GSTR-7 for period from 01/07/2017 to 30/09/2018 doesn't arise.

8. FORM GSTR-8: Return of Tax Collected at Source by E-Commerce Operator

(i) FORM GSTR-1 and FORM GSTR-2 are not applicable for this Return.

(ii) The due date for furnishing GSTR-8 is 10th of the next month.

(iii) Refund from electronic cash ledger can be claimed ONLY when all the TCS liability for the tax period has been discharged.

(iv) E-commerce operator can file GSTR-8 ONLY when full TCS liability has been discharged.

(v) Amount of tax collected at source will flow to Part C of GSTR-2A of the taxpayer on filing of GSTR-8.

(vi) The following details relating to the supplies made by E-commerce operator declared in GSTR-8 shall match with the corresponding details declared by supplier:—

a) State of supply

b) Net taxable value

(vii) Provisions of TCS is applicable from 01/10/2018 thus question of filing Form GSTR-8 for period from 01/07/2017 to 30/09/2018 doesn't arise.

9. GSTR-11: Persons having UIN (Unique Identification Number)

(i) Every UIN holder

- Who wish to claim refund of taxes paid on his inward supplies or

- UIN holder who is required to file details of taxes paid on his inward supplies by Proper officer,

shall furnish such details of taxable goods or services or both in FORM GSTR-11 on quarterly Basis or as and when required to file by Proper officer.

(ii) UIN holder is not allowed to add or modify any details in GSTR-11

10. GSTR-10: Final Return

(i) Every Registered Person who is required to furnish a Return other than—

a) Input Service Distributor

b) Non-Resident Taxable Person

c) Person paying composition

And

Whose Registration has been cancelled,

shall furnish a final Return in FORM GSTR-10 within 3 months of the date of cancellation or date of order of cancellation, whichever is later.

11. GSTR 9: Annual Return

GSTR 9 - 6 Parts & 19 Tables.

| |

Part |

Description |

Tables |

| |

I |

Basic Details |

1-3 |

| |

II |

Details of outward and inward supplies made during the financial year |

4-5 |

| |

III |

Details of ITC for the financial year |

6-8 |

| |

IV |

Details of tax paid as declared in returns filed during the financial year |

9 |

| |

V |

Particulars of the transactions for the FY 2017-18 declared in returns between April 2018 to March 2019 & Differential Tax paid. For FY 2018-19, Particulars of the transactions for the FY 2018-19 declared in returns between April 2019 till September 2019 |

10-14 |

| |

VI |

Other Information |

15-19 |

12. GSTR 9C - 5 Parts & 16 Tables.

| |

Part |

Description |

Tables |

| |

I |

Basic Details |

1-4 |

| |

II |

Reconciliation of turnover declared in audited Annual Financial Statement with turnover declared in Annual Return (GSTR 9) |

5-8 |

| |

III |

Reconciliation of tax paid |

9-11 |

| |

IV |

Reconciliation of Input tax Credit (ITC) |

12-16 |

| |

V |

Auditor's recommendation on additional Liability due to non-reconciliation |

|

13. Claim of ITC and its Provisional Acceptance

(i) Every Registered Person, subject to prescribed conditions and restrictions is entitled to take the credit of eligible input tax as self-assessed, in his return and such amount shall be credited on a PROVISIONAL basis to his Electronic Credit Ledger.

(ii) This said credit shall be utilised only for payment of self-assessed output tax as per Return.

(iii) Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 10% w.e.f. 01.01.2020 (Earlier 20% i.e. 09.10.2019 - 31.12.2019) of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.

14. FORM GSTR-3A: (Notice to non-filers of Returns): Notice in FORM GSTR-3A shall be issued to registered person who has failed to furnish any return including Monthly, Quarterly, Final and Annual return.

15. Late Fee

(i) Any registered Person who fails to furnish the details of outward or inward supply by the due date shall pay late fee of ₹25 per day till the contravention continues. Maximum late fee is ₹5,000/-. Similar provisions also exists under Maharashtra GST Act, 2017.

(ii) Any registered Person who fails to furnish the Annual return by the due date shall pay late fee of ₹100/- per day under each Act till the contravention continues. Maximum late fee is quarter per cent of his turnover in the State or Union Territory.

(iii) Reduction in late Fee because of technical glitches in the GST Portal: - Various notifications have been issued for reduction of late fee as shown below:-

(iv) Late fees for filing GSTR-3B returns after their due dates reduced to:

♦ ₹ 25 per day of delay in normal cases under each act

♦ ₹ 10 per day of delay for taxpayers having nil tax liability for the month under each act

♦ Late fees for Form GSTR 3B filed between 22/12/2018 to 31/03/2019 for return period July 2017 to Sept., 2018 was waived off as per Notification No. 76/2018-Central Tax dated 31-12-2018.

(v) Late fees for filing GSTR-4 returns after their due dates reduced to:

♦ ₹ 25 per day of delay in normal cases under each Act

♦ ₹ 10 per day of delay for taxpayers having nil tax liability under each Act

♦ Late fees for Form GSTR 4 filed between 22/12/2018 to 31/03/2019 for return period July 2017 to Sept., 2018 was waived off as per Notification No. 77/2018-Central Tax dated 31-12-2018.

(vi) Late fees for filing monthly/quarterly GSTR-1 returns after their due dates reduced to:

♦ ₹ 25 per day of delay in normal cases under each Act

♦ ₹ 10 per day of delay for taxpayers having nil tax liability under each Act

♦ Late fees for Form GSTR 1 filed during the period from 22/12/2018 to 31/03/2019 for return period July 2017 to Sept., 2018 was waived off as per Notification No. 75/2018-Central Tax dated 31-12-2018

♦ Late Fees for GSTR-1 returns filed during the period from 19th December, 2019 to 17th January, 2020 for the return periods from July 2017 to Nov. 2019 was waived off as per Notification No. 74/2019-Central Tax dated 26/12/2019 r.w. Notif. 4/2020 dt. 10-01-2020.

(vii) Late fees for filing GSTR-5 returns after their due dates reduced to:

♦ ₹ 25 per day of delay in normal cases under each Act

♦ ₹ 10 per day of delay for taxpayers having nil tax liability under each Act

♦ (Notifn. 5/2018 dt. 23-01-2018)

(viii) Late fees for filing GSTR-5A returns after their due dates reduced to:

♦ ₹ 25 per day of delay in normal cases under each Act

♦ ₹ 10 per day of delay for taxpayers having nil tax liability under each Act

♦ The Notification No. 6/2018 granting above concessional late fees was rescinded by Notification No. 13/2018

(ix) Late fees for filing GSTR-6 returns after their due dates reduced to ₹ 25 per day of delay under each act.

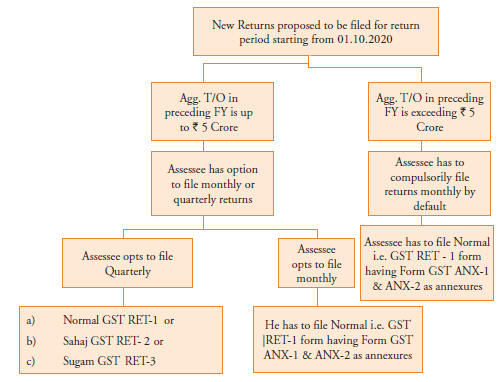

New Returns forms proposed to be introduced from return period and onwards (The new return filing system shall be introduced on a trial basis from 01.04.2019 and on mandatory basis from 01.10.2020):

There are constant efforts by the Government to make all GST form filings user friendly. There are many more issues which are yet to be addressed by the Government. One of the step towards resolving such issues is introduction of simplified GST returns.

Following is the flow chart depicting the proposed types of returns to be filed by the Assessee's for return period starting from 01.10.2020:

Salient Features of New GST Returns are as follows:

♦ Assessee with aggregate turnover of more than ₹ 5 Crores in the preceding FY has to by default compulsorily file monthly returns.

♦ Assessee with aggregate turnover less than ₹ 5 Crores in the preceding FY has the option to file monthly or quarterly returns.

♦ For newly registered taxpayers, turnover will be considered as zero and hence they will have the option to file monthly, Sahaj, Sugam or Quarterly (Normal)

♦ If assessee has chosen quarterly option, then he will have a choice to opt for Normal, Sahaj or Sugam

♦ Sahaj can be opted only if you have outward supplies under B2C category and inward supplies including supplies attracting reverse charge only.

♦ Sugam can be opted only if you have outward supplies under B2B & B2C categories and inward supplies including supplies attracting reverse charge only.

♦ Assessee supplying under Exports, Imports, Supplies to SEZ units and deemed exports cannot opt for Sahaj or Sugam. Also Assessee supplying through e-Commerce Operators on which tax is required to be deducted u/s. 52 cannot opt for Sahaj or Sugam Returns.

♦ The erstwhile GSTR-1 & GSTR-2 will be substituted with GST Anx-1 and GST Anx-2. These would be annexures to the Normal, Sahaj or Sugam Returns without any requirement to file them separately. Thus filing of GSTR-1 will be done away with.

♦ Once the applicable GST RET 1/2/3, are filed it would be deemed that the GST Anx-1 and 2 are also filed.

♦ Taxpayers who opted Sahaj (or) Sugam cannot claim input credit on missing invoices.

♦ Taxpayers who opted Sahaj (or) Sugam need not report on nil rated, exempted and Non-GST supplies.

♦ Normal returns allows reporting of all types of inward and outward supplies.

♦ Switching between Monthly and Quarterly option can be exercised only at the beginning of each Financial Year

♦ Switching from Normal to Sugam (or) Sahaj can also be exercised only once in a financial year at the beginning of any quarter.

♦ Switching from Sugam to Sahaj is available only once in a financial year at the beginning of any quarter.

♦ Switching from Sugam to Normal is available more than once in a financial year at the beginning of any quarter.

♦ Switching from Sahaj to Sugam (or) Normal (under Quarterly option) is available more than once in a financial year at the beginning of any quarter.

♦ While opting for any type of return, there is a questionnaire provided at the GST Portal which needs to be answered. Hence taxpayers need to answer the questionnaire with great caution to comply with returns procedure provisions.

DUE DATES FOR VARIOUS RETURNS IN GST

[Updated as on 30th March, 2020]

|

GSTR-1 (Below ₹ 1.5 Crores)

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 to Sep-17 |

31-10-2018 |

30/2017-CT; 57/2017-CT; |

(i) Notfn No. 38/2018-CT & 43/2018-CT extend due date for filing of GSTR-1 by taxpayers of Kerala, Kodagu District of Karnataka and Mahe of Puducherry, for the quarter from July, 2018 to September, 2018 to 15th November, 2018.

(ii) Notfn No. 43/2018-CT as amended by Notification No. 71/2018-CT, extends due date for filing of GSTR-1 for the period July, 2018 to December, 2018 by taxpayers who have obtained GSTIN in terms of Notfn No. 31/2018-CT, to 31-03-2019.

(iii) Notfn No. 64/2018-CT extends due date for filing of GSTR-1 for the quarter July to September, 2018 by Taxpayers of Srikakulam District of Andhra Pradesh to 30-11-2018.

(iv) Notfn. 24/2020 - Due date is 24.03.2020 for J&K

(v) Notfn. 21/2020 - Due date is 24.03.2020 for J&K & Ladakh UT

|

|

|

71/2017-CT; 43/2018-CT; |

Oct-17 to Dec-17 |

31-10-2018 |

57/2017-CT; 71/2017-CT; 43/2018-CT;

|

Jan-18 to Mar-18 |

31-10-2018 |

57/2017-CT; 71/2017-CT; 43/2018-CT; |

Apr-18 to Jun-18 |

31-10-2018 |

17/2018-CT; 43/2018-CT; |

Jul-18 to Sep-18 |

31-10-2018 |

33/2018-CT; 43/2018-CT; |

Oct-18 to Dec-18 |

31-01-2019 |

33/2018-CT; 43/2018-CT; |

Jan-19 to Mar-19 |

30-04-2019 |

33/2018-CT; 43/2018-CT; |

Apr-19 to Jun-19 |

31-07-2019 |

11/2019-CT; |

Jul-19 to Sept, 19 |

31-10-2019 |

27/2019-CT; |

Oct-19 to Dec, 19 |

31-01-2020 |

45/2019-CT; |

Jan-20 to Mar, 20 |

30-04-2020# |

45/2019-CT; |

# Late fees shall stand waived if GSTR 1 for Jan - Mar 2020 is filed before 30.06.2020 Notification No. 33/2020 - CT dt. 03.04.2020 |

Apr-20 to Jun, 20 |

31-07-2020 |

27/2020-CT; |

# The requirement of furnishing FORM GSTR-1 for 2019-20 to be waived for taxpayers who could not opt for availing the option of special composition scheme under notification No. 2/2019-Central Tax (Rate) dated 07.03.2019 by filing FORM CMP-02 - as per Press Release dt. 14.03.2020 (Notification awaited) |

Jul-20 to Sep, 20 |

31-10-2020 |

27/2020-CT; |

|

|

GSTR-1 (Above ₹ 1.5 Crores)

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

31-10-2018 |

18/2017-CT; 29/2017-CT; 30/2017-CT;

58/2017-CT;72/2017-CT; 44/2018-CT; |

(i) Notfn No. 37/2018-CT extends due date for filing of GSTR-1 by taxpayers of Kerala, Kodagu District of Karnataka and Mahe of Puducherry, for the months of July, 2018 and August, 2018 to 5th October, 2018 and 10th October, 2018, respectively.

(ii) Notfn No. 44/2018-CT as amended by Notification No. 72/2018-CT extends due date for filing of GSTR-1 for the period July, 2018 to February, 2019 by taxpayers who have obtained GSTIN in terms of Notfn No. 31/2018-CT, to 31-03-2019.

(iii) Notfn No. 63/2018-CT extends due date for filing of GSTR-1 for the month of September, 2018 by Taxpayers of Srikakulam District of Andhra Pradesh to 30-11-2018.

(iv) Notfn No. 63/2018-CT extends due date for filing of GSTR-1 for the month of October, 2018 by Taxpayers of Srikakulam District of Andhra Pradesh to 30-11-2018.

(v) Notfn No. 63/2018-CT extends due date for filing of GSTR-1 for the month of October, 2018 by Taxpayers of Cuddalore, Thiruvarur, Pudukkottai, Dindigul, Nagapatinam, Theni, Thanjavur, Sivagangai, Tiruchirapalli, Karur and Ramanathuram of Tamil Nadu to 20-12-2018.

(vi) Notfn No.23/2019-CT extends due date for filing of GSTR-1 for the month of April, 2019 by the taxpayers of the districts of Angul, Balasore, Bhadrak, Cuttack, Dhenkanal, Ganjam, Jagatsinghpur, Jajpur, Kendrapara, Keonjhar, Khordha, Mayurbhanj, Nayagarh and Puri in the State of Odisha to 10-06-2019.

(vii) Notfn 76/2019 - Extends due date for Nov 2019 for RTP of Assam, Manipur & Tripura till 31-12-2019

(viii) Notfn 23/2020 - Extends due date for Jul-Sep 2019 for RTP of J & K till 24-03-2020

(ix) Notfn 22/2020 - Extends due date for Oct 19 -Feb 2020 for RTP of J & K and UT of Ladakh till 24-03-2020

|

Aug-17 |

31-10-2018 |

18/2017-CT; 29/2017-CT; 30/2017-CT;

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Sep-17 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Oct-17 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Nov-17 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Dec-17 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Jan-18 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Feb-18 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Mar-18 |

31-10-2018 |

58/2017-CT; 72/2017-CT; 44/2018-CT; |

Apr-18 |

31-10-2018 |

18/2018-CT; 44/2018-CT; |

May-18 |

31-10-2018 |

18/2018-CT; 44/2018-CT; |

Jun-18 |

31-10-2018 |

18/2018-CT; 44/2018-CT; |

Jul-18 |

31-10-2018 |

32/2018-CT; 44/2018-CT; |

Aug-18 |

31-10-2018 |

32/2018-CT; 44/2018-CT; |

Sep-18 |

31-10-2018 |

32/2018-CT; 44/2018-CT; |

Oct-18 |

11-11-2018 |

32/2018-CT; 44/2018-CT; |

Nov-18 |

11-12-2018 |

32/2018-CT; 44/2018-CT; |

Dec-18 |

11-01-2019 |

32/2018-CT; 44/2018-CT; |

Jan-19 |

11-02-2019 |

32/2018-CT; 44/2018-CT; |

Feb-19 |

11-03-2019 |

32/2018-CT; 44/2018-CT; |

Mar-19 |

13-04-2019 |

32/2018-CT; 44/2018-CT; 17/2019-CT; |

Apr-19 |

11-05-2019 |

12/2019-CT; |

May-19 |

11-06-2019 |

12/2019-CT; |

Jun-19 |

11-07-2019 |

12/2019-CT; |

July-19 |

11-08-2019 |

28/2019-CT; |

Aug-19 |

11-09-2019 |

28/2019-CT; |

Sept-19 |

11-10-2019 |

28/2019-CT; |

Oct-19 to Mar-20 |

11th of succeeding month |

46/2019-CT |

# Late fees shall stand waived if GSTR 1 for Mar 2020 is filed before 30.06.2020

Notification No. 33/2020-CT dt. 03.04.2020 |

Apr-20 to Sep-20 |

11th of succeeding month |

28/2020-CT |

# Late fees shall stand waived if GSTR 1 for Apr & May 2020 is filed before 30.06.2020

Notification No. 33/2020-CT dt. 03.04.2020 |

Note: 1. Rectification of error or omission is allowed up to the due date for furnishing GSTR-1 for March, 2019.

|

GSTR-3B

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

25-08-2017 |

21/2017-CT; 23/2017-CT; 24/2017-CT; |

(i) Notfn No. 24/2017-CT says If Tran-1 is filed by 28.08.17 then balance cash should be paid on or before 25.08.17

(ii) Notfn No. 36/2018-CT extends due date for filing of GSTR-3B by taxpayers of Kerala, Kodagu District of Karnataka and Mahe of Puducherry, for the months of July, 2018 and August, 2018 to 5th October, 2018 and 10th October, 2018, respectively. Further, Notfn No. 47/2018-CT extends due date for filing of GSTR-3B for the above months by taxpayers who have obtained GSTIN in terms of Notfn No. 31/2018-CT to 31-12-2018.

(iii) Notfns No. 21/2017-CT, dated 8-8-2017 and 56/2017-CT, dated 15-11-2017 as amended by Notification No. 68/2018-CT, dated 31-12-2018 extend due date for filing of GSTR-3B for the months July, 2017 to February, 2019 by the Tax payers who obtained GSTIN in terms of Notfn No. 31/2018-CT, dated 6-8-2018, to 31-03-2019.

(iv) Notfns No. 35/2017-CT, dated 15-9-2017 and 16/2018-CT, dated 23-3-2018 as amended by Notification No. 69/2018-CT, dated 31-12-2018 extend due date for filing of GSTR-3B for the months July, 2017 to February, 2019 by the Taxpayers who obtained GSTIN in terms of Notfn No. 31/2018-CT, dated 6-8-2018, to 31-03-2019.

(v) Notfn No. 45/2018-CT extends due date for filing of GSTR-3B for the months July, 2017, August, 2017, January 2018, February, 2018 and March, 2018 by taxpayers who have obtained GSTIN in terms of Notfn No. 31/2018-CT to 31-12-2018.

(vi) Notfn No. 46/2018-CT extends due date for filing of GSTR-3B for the months May, 2018 June, 2018, July, 2018, August, 2017, September, 2017, October, 2017, November, 2017 and December, 2017 by taxpayers who have obtained GSTIN in terms of Notfn No. 31/2018-CT to 31-12-2018.

(vii) Notfn No. 62/2018-CT extends due date for filing of GSTR-3B for the months of September & October, 2018 for taxpayers of Srikakulam District of A.P., to 30-11-2018.

(viii) Notfn No. 62/2018-CT further extends due date for filing of GSTR-3B for the month of October, 2018 for taxpayers of Cuddalore, Thiruvarur, Pudukottai, Dindigul, Nagapatinam, Theni, Thanjavur, Sivagangai, Tiruchirappalli, Karur and Ramanathapuram of Tamil Nadu to 20-12-2018.

(ix) Notfn No. 09/2019-Central Tax, dated 20-02-2019 extends due date for filing of GSTR-3B to 28-02-2019 for registered persons whose principal place of business is in the State of Jammu and Kashmir.

(x) Notification No. 24/2019-Central Tax, dated 11-05-2019 extends due date for filing of GSTR- 3B to 20-06-2019 for registered taxpayers whose principal place of business is in the districts of Angul, Balasore, Bhadrak, Cuttack, Dhenkanal, Ganjam, Jagatsinghpur, Jajpur, Kendrapara, Keonjhar, Khordha, Mayurbhanj, Nayagarh and Puri in the State of Odisha. |

Aug-17 |

20-09-2017 |

21/2017-CT;35/2017-CT; |

Sep-17 |

20-10-2017 |

35/2017-CT; |

Oct-17 |

20-11-2017 |

35/2017-CT; |

Nov-17 |

20-12-2017 |

35/2017-CT; |

Dec-17 |

22-01-2018 |

35/2017-CT; 02/2018-CT; |

Jan-18 |

20-02-2018 |

56/2017-CT; |

Feb-18 |

20-03-2018 |

56/2017-CT; |

Mar-18 |

20-04-2018 |

56/2017-CT; |

Apr-18 |

22-05-2018 |

16/2018-CT; 23/2018-CT; |

May-18 |

20-06-2018 |

16/2018-CT; |

Jun-18 |

20-07-2018 |

16/2018-CT; |

Jul-18 |

24-08-2018 |

34/2018-CT; 35/2018-CT; |

Aug-18 |

20-09-2018 |

34/2018-CT; |

Sep-18 |

25-10-2018 |

34/2018-CT; 55/2018- CT; |

Oct-18 |

20-11-2018 |

34/2018-CT; |

Nov-18 |

20-12-2018 |

34/2018-CT; |

Dec-18 |

20-01-2019 |

34/2018-CT; |

Jan-19 |

22-02-2019 |

34/2018-CT; 09/2019-CT |

Feb-19 |

20-03-2019 |

34/2018-CT; |

Mar-19 |

23-04-2019 |

34/2018-CT; 19/2019-CT; |

Apr-19 |

20-05-2019 |

13/2019-CT; |

May-19 |

20-06-2019 |

13/2019-CT; |

Jun-19 |

20-07-2019 |

13/2019-CT; |

Jul-19 |

22-08-2019 |

29/2019-CT; 37/2019-CT Due date - 20-09-2019 for Districts mentioned in Table of the Notfn & the state of J & K |

Aug-19 |

20-09-2019 |

29/2019-CT; |

Sep-19 |

20-10-2019 |

29/2019-CT; |

|

GSTR-3B

|

|

Month |

Due Date |

Notification |

Remarks |

Oct-19 |

20-11-2019 |

44/2019-CT |

(x) (i) Notfn 77/2019 - Extends due date for Nov 2019 for RTP of Assam, Manipur & Tripura till 31-12-2019

(xi) Notfn 10/2020 - RTP whose principal place of business or place of business was in the erstwhile Union territory of Daman and Diu or in the erstwhile Union territory of Dadra and Nagar Haveli and is in the merged Union territory of Daman and Diu and Dadra and Nagar Haveli, shall ascertain the tax period as per sub-clause (106) of section 2 of the said Act for the purposes of any of the provisions of the said Act for the month of January, 2020 and February, 2020 as below:- (a) January, 2020: 1st January, 2020 to 25th January, 2020; (b) February, 2020: 26th January, 2020 to 29th February, 2020

(xii) Notfn 26/2020 - Extends due date for Jul -Sep 2019 for RTP of J & K till 24-03-2020

(xiii) Notfn 25/2020 - Extends due date for Oct 19 for RTP of J & K till 24-03-2020

(xiv) Notfn 25/2020 - Extends due date for Nov 19 -Feb 2020 for RTP of J & K and UT of Ladakh till 24-03-2020

(xv) Extension of due dates for FORM GSTR-3B for the month of July, 2019 to January, 2020 till 24th March, 2020 for registered persons having principal place of business in the Union territory of Ladakh.

(Press Release dt. 14.03.2020, Notification awaited) |

Nov-19 |

23-12-2019 |

73/2019-CT |

Dec-19 |

20-01-2020 |

44/2019-CT |

Jan-20 to Mar-20 |

20th day of the succeeding month - T/o > 5 crores

22nd day of the succeeding month - T/o < 5 crores (in 15 states)

24th day of the succeeding month - T/o < 5 crores ( in other states) |

7/2020-CT;

32/2020-CT & 33/2020-CT

# - Conditional waiver of Late Fees & Interest if GSTR 3B filed before :

1) T/o < 1.5 crores :

| |

Period |

Due date for benefit |

Int. |

Late Fees |

| |

Feb 2020 |

30.06.2020 |

0% |

NIL |

| |

Mar 2020 |

03.07.2020 |

0% |

NIL |

| |

April 2020 |

06.07.2020 |

0% |

NIL |

2) T/o between 1.5 - 5 crores :

| |

Period |

Due date for benefit |

Int. |

Late Fees |

| |

Feb 2020 |

29.06.2020 |

0% |

NIL |

| |

Mar 2020 |

29.06.2020 |

0% |

NIL |

| |

April 2020 |

30.06.2020 |

0% |

NIL |

3) T/o > 5 crores :

| |

Period |

Due date for benefit |

Int. | Late Fees |

| |

Feb 2020 |

24.06.2020 |

0% for first 15 days from original due date & 9% thereafter |

NIL |

| |

Mar 2020 |

24.06.2020 |

0% for first 15 days from original due date & 9% thereafter |

NIL |

| |

April 2020 |

24.06.2020 |

0% for first 15 days from original due date & 9% thereafter |

NIL |

|

Apr-20 |

20th day of the succeeding month - T/o > 5 crores

22nd day of the succeeding month - T/o < 5 crores (in 15 states) 24th day of the succeeding month - T/o

< 5 crores ( in other states) |

29/2020-CT;

# - see above note/table as specified against Jan- Mar 2020 also, for Apr 2020 |

|

May-20 |

27th June - T/o > 5 crores

12th July - T/o < 5 crores ( in 15 states)

14th July - T/o < 5 crores ( in other states) |

36/2020-CT |

|

Jun-20 to Sep-20 |

20th day of the succeeding month - T/o > 5 crores

22nd day of the succeeding month - T/o < 5 crores (in 15 states)

24th day of the succeeding month - T/o < 5 crores ( in other states) |

29/2020-CT; |

|

|

GSTR-4 (Composition)

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 to Sep-17 |

24-12-2017 |

41/2017-CT; 59/2017-CT; |

|

Oct-17 to Dec-17 |

18-01-2018 |

Sec. 39(2) |

|

Jan-18 to Mar-18 |

18-04-2018 |

Sec. 39(2) |

|

Apr-18 to Jun-18 |

18-07-2018 |

Sec. 39(2) |

|

July-18 to Sept-18 |

30-11-2018 |

65/2018-CT, dated 29-11-2018 |

Extension is only for the taxpayers of Srikakulam District of Andhra Pradesh. |

Oct-18 to Dec-18 |

18-01-2019 |

Sec. 39(2) |

|

Jan-19 to Mar-19 |

18-04-2019 |

Sec. 39(2) |

|

Apr-19 to Mar-20 |

15-07-2020 |

21/2019 - CT, dated 23-04-2019

Notfn. 34/2020-CT dt. 03-04-2020 |

|

|

GSTR-5 (Non-Resident Taxpayer)

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

31-01-2018 |

60/2017-CT; 68/2017-CT; |

Or, within seven days after the last day of the period of registration specified under sub-section (1) of Section 27, whichever is earlier.

|

Aug-17 |

31-01-2018 |

60/2017-CT; 68/2017-CT; |

Sep-17 |

31-01-2018 |

60/2017-CT; 68/2017-CT; |

Oct-17 |

31-01-2018 |

60/2017-CT; 68/2017-CT; |

Nov-17 |

31-01-2018 |

68/2017-CT; |

Dec-17 |

31-01-2018 |

68/2017-CT; |

Jan-18 |

20-02-2018 |

Sec. 39(5) |

Feb-18 |

20-03-2018 |

Sec. 39(5) |

Mar-18 |

20-04-2018 |

Sec. 39(5) |

Apr-18 |

20-05-2018 |

Sec. 39(5) |

May-18 |

20-06-2018 |

Sec. 39(5) |

Jun-18 |

20-07-2018 |

Sec. 39(5) |

Jul-18 to Mar-20 |

20th of the succeeding month |

Sec. 39(5)

# Notfn 35/2020 CT |

# Due dates for returns etc.. time limit for any compliance falling between 20.03.2020 to 29.06.2020 extended till 30th June 2020 |

|

GSTR-5A (OIDAR)

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

31-01-2018 |

25/2017-CT; 42/2017-CT; 61/2017-CT; 69/2017-CT; |

|

Aug-17 |

31-01-2018 |

42/2017-CT; 61/2017-CT; 69/2017-CT; |

Sep-17 |

31-01-2018 |

42/2017-CT; 61/2017-CT; 69/2017-CT; |

Oct-17 |

31-01-2018 |

61/2017-CT; 69/2017-CT; |

Nov-17 |

31-01-2018 |

69/2017-CT; |

Dec-17 |

31-01-2018 |

69/2017-CT; |

Jan-18 |

20-02-2018 |

Rule 64 |

Feb-18 |

20-03-2018 |

Rule 64 |

Mar-18 |

20-04-2018 |

Rule 64 |

Apr-18 |

20-05-2018 |

Rule 64 |

May-18 |

20-06-2018 |

Rule 64 |

Jun-18 |

20-07-2018 |

Rule 64 |

Jul-18 to Mar-20 |

20th of the succeeding month |

Rule 64 |

|

GSTR-6 (ISD)

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

30-09-2018 |

26/2017-CT;31/2017-CT;43/2017-CT;62/2017-CT; 08/2018-CT;19/2018-CT; 25/2018-CT; 30/2018-CT. |

|

Aug-17 |

30-09-2018 |

26/2017-CT;31/2017-CT;43/2017-CT;62/2017-CT; 08/2018-CT;19/2018-CT; 25/2018-CT; 30/2018-CT. |

Sep-17 |

30-09-2018 |

43/2017-CT;62/2017-CT;08/2018-CT;19/2018-CT; 25/2018-CT; 30/2018-CT |

Oct-17 |

30-09-2018 |

62/2017-CT;08/2018-CT;19/2018-CT;25/2018-CT; 30/2018-CT. |

Nov-17 |

30-09-2018 |

08/2018-CT;19/2018-CT;25/2018-CT; 30/2018-CT. |

Dec-17 |

30-09-2018 |

08/2018-CT;19/2018-CT;25/2018-CT; 30/2018-CT. |

Jan-18 |

30-09-2018 |

08/2018-CT;19/2018-CT;25/2018-CT; 30/2018-CT. |

Feb-18 |

30-09-2018 |

08/2018-CT;19/2018-CT;25/2018-CT; 30/2018-CT. |

Mar-18 |

30-09-2018 |

19/2018-CT;25/2018-CT; 30/2018-CT. |

Apr-18 |

30-09-2018 |

19/2018-CT;25/2018-CT; 30/2018-CT. |

May-18 |

30-09-2018 |

25/2018-CT; 30/2018-CT. |

Jun-18 |

30-09-2018 |

25/2018-CT; 30/2018-CT. |

Jul-18 |

30-09-2018 |

25/2018-CT; 30/2018-CT. |

Aug-18 |

30-09-2018 |

25/2018-CT; 30/2018-CT. |

Mar-19 |

13-03-2019 |

|

Apr-19 to Mar-20 |

13th of the succeeding month |

# Notfn 35/2020 CT # Due dates for returns etc. time limit for any compliance falling between 20.03.2020 to 29.06.2020 extended till 30th June 2020 |

|

|

GSTR-7

|

|

Month |

Due Date |

Notification |

Remarks |

Oct, 2018 |

31-08-2019 |

66/2018-CT; 7/2019-CT; 26/2019-CT; |

1) Notfn No. 40/2019 - Extends due date for Jul 2019 for RTP of Districts mentioned in Table of the Notfn & the State of J & K till 20-09-2019

2) Notfn 78/2019 - Extends due date for Nov 2019 for RTP of Assam, Manipur & Tripura till 25-12-2019

3) Notfn 20/2020 - Extends due date for Jul 2019 - Feb 2020 for RTP of J & K till 24-03-2020

|

Nov, 2018 |

31-08-2019 |

66/2018-CT; 7/2019-CT; 26/2019-CT; |

Dec, 2018 |

31-08-2019 |

66/2018-CT; 7/2019-CT; |

Jan, 2019 |

31-08-2019 |

8/2019-CT; 26/2019-CT; |

Feb, 2019 |

31-08-2019 |

26/2019-CT; |

Mar, 2019 |

31-08-2019 |

18/2019-CT; 26/2019-CT; |

April, 2019 |

31-08-2019 |

26/2019-CT; |

May, 2019 |

31-08-2019 |

26/2019-CT; |

June, 2019 |

31-08-2019 |

26/2019-CT; |

July, 2019 |

31-08-2019 |

26/2019-CT; |

Aug, 2019 to Mar 2020 |

10th of the succeeding month |

# Notfn 35/2020 CT |

# Due dates for returns etc. time limit for any compliance falling between 20.03.2020 to 29.06.2020 extended till 30th June 2020 |

|

GSTR-9/9C

|

|

Period |

Due Date |

Notification |

Remarks |

July, 2017 to March, 2018 |

05.02.2020 - For 11 states 07.02.2020 - other states |

ROD Order No. 1/2018-CT, dated 11-12-2018; ROD Order No. 3/2018-CT, dated 31-12-2018;

ROD Order No. 6/2018-CT, dated 28-07-2019, Notfn. 06/2020 - CT |

1) Notfn. 30/2019 - GSTR 9 & 9C exemption to OIDAR

2) Notfn. 47/2019 - GSTR 9 optional for RTP having T/o

< 2 crores for F.Ys. 2017-18 & 2018-19

3) Notfn. 09/2020 - GSTR 9C exempt to Foreign airlines but statement of receipts & payments of Indian business Operation - authenticated by CA to be submitted by 30th Sept. of succeeding year |

F.y. 2018-19 |

30-06-2020 |

Notfn. 15/2020 - CT - GSTR 9 extended till 30.06.2020 |

# Late fees not to be levied for delayed filing of the Annual return and the Reconciliation Statement for financial years 2017-18 and 2018-19 for taxpayers with aggregate turnover less than ₹ 2 crores.

# Relaxation to MSME's from furnishing 9C for F.y. 2018-19 for RTP having T/o

< 5 crores Notfn No. 16/2020 dt. 23.03.2020 |

|

GSTR-10 (Final Return)

|

|

Period |

Notification |

Remarks |

GSTR-10 (Final Return) |

Notification No. 58/2018-Central Tax, dated 26-10-2018.

|

Due date for persons whose registration has been cancelled on or before the 30th September, 2018 : 31-12-2018 |

Other persons : Within three months from the date of cancellation. |

|

GST ITC-01

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 |

31-01-2018 |

44/2017-CT; 52/2017-CT; 67/2017-CT; |

Notfn No. 42/2018-CT extends the time limit for making the declaration in FORM GST ITC-01, by registered persons who have filed the application in FORM GST-CMP-04 (withdrawal from Composition levy) between the 2nd day of March, 2018 and the 31st day of March, 2018, for a period of thirty days from 04-09-2018, i.e., up to 02-10-2018.

|

Aug-17 |

31-01-2018 |

44/2017-CT; 52/2017-CT; 67/2017-CT; |

Sep-17 |

31-01-2018 |

44/2017-CT; 52/2017-CT; 67/2017-CT; |

Oct-17 |

31-01-2018 |

67/2017-CT; |

Nov-17 |

31-01-2018 |

67/2017-CT; |

|

GST ITC-04

|

|

Month |

Due Date |

Notification |

Remarks |

Jul-17 to June-19 |

31-08-2019 |

53/2017-CT; 63/2017-CT; 40/2018-CT; 59/2018-CT;

78/2018-CT; 15/2019-CT; 32/2019-CT; |

|

Jul - 17 to Mar - 19 |

- |

38/2019 - CT |

Seeks to waive filing of FORM ITC-04 for F.Ys. 2017-18 & 2018-19 provided the details of goods dispatched but not received back form the job worker as on 31-03-19 are reflected in the ITC-04 of Apr-Jun'19 |

|

Miscellaneous

|

|

Return |

Notification |

Remarks |

CMP-01 |

Order-01/2017 dt. 21-07-2017 |

Last Date:16.08.17 |

CMP-03 |

Order-04/2017-GST dt. 29-09-2017; Order-05/2017- GST, dt. 28-10-2017;

Order-11/2017-GST dt. 21-12-2017; |

Last Date:31.01.18 |

CMP-08 |

Notfn. 35/2019-CT |

Apr - Jun 2019 - Due date - 31.08.2019 |

|

Notfn. 50/2019-CT |

Jul - Sep 2019 - Due date - 22.10.2019 |

|

Notfn. 34/2020-CT |

Jan - Mar 2020- Due date - 07.07.2020 |

TRAN-1 |

Order-03/2017-GST dt. 21-09-2017; Order-07/2017-GST dt. 28-10-2017;

Order-09/2017-GST dt. 15-11-2017;

Order No. 4/2018-GST, dt. 17-09-2018 read with Notfn No. 48/2018 -CT dt. 10-09-2018; Order No. 1/2019-GST, dated 31-01-2019. |

(i) Last Date:27.12.17

(ii) Last date : 31-03-2019 for the class of registered persons who could not submit the said declaration by the due date on account of technical difficulties on the common portal and whose cases have been recommended by the Council. |

TRAN-1 Revision |

Order-02/2017-GST dt. 18-09-2017; Order-08/2017-GST dt. 28-10-2017; Order-10/2017-GST dt. 15-11-2017; |

Last Date: 27.12.17 |

TRAN-2 |

Order-01/2018-GST dt. 28-03-2018; Notfn No. 48/2018 - CT dt. 10-09- 2018 |

(i) Last Date: 30.06.18

(ii) Last Date : 30-04-2019 for the registered persons who filed TRAN-1 in accordance with sub-rule (1A) of Rule 117 of CGST Rules (persons who could not submit Tran-1 by the due date on account of technical difficulties on the common portal and whose cases have been recommended by the Council extending due date till 31-01-2019). |

REG-26 |

Order-06/2017-GST dt. 28-10-2017; Notfn No. 31/2018-CT; |

Last Date: 31.12.17; 31-08-2018 |

|

Late Fee Waived

|

|

Return |

Months |

Notification |

Remarks |

GSTR-1 |

All months |

04/2018-CT; |

10/- for NIL; 25/- for others |

GSTR-3B |

Jul-17 |

28/2017- CT; |

Complete waiver |

GSTR-3B |

Aug-17 & Sep-17 |

50/2017- CT; |

Complete waiver |

GSTR-3B |

From Oct-17 |

64/2017- CT; |

10/- for NIL; 25/- for others |

GSTR-3B |

Oct-17 to Apr-18 |

22/2018-CT; |

Waived for those who submitted but not filed Tran-1 on or before 27-12-2017. Conditions : (i) Filed Tran-1 on or before 10-05-2018.

(ii) Filed GSTR-3B for Oct-17 to Apr-18 before 31-05-2018. |

GSTR-4 |

all months |

73/2017-CT; |

10/- for NIL; 25/- for others |

GSTR-5 |

all months |

05/2018-CT; |

10/- for NIL; 25/- for others |

GSTR-6 |

all months |

07/2018-CT; |

10/- for NIL; 25/- for others |

Notifications related to conditional waiver of Late Fees :

1) Notification No. 41/2018-CT waives the late fee paid under section 47 of the said Act, by the following classes of taxpayers:-

(i) The registered persons whose return in FORM GSTR-3B of the Central Goods and Services Tax Rules, 2017 for the month of October, 2017, was submitted but not filed on the common portal, after generation of the application reference number;

(ii) The registered persons who have filed the return in FORM GSTR-4 of the Central Goods and Services Tax Rules, 2017 for the period October to December, 2017 by the due date but late fee was erroneously levied on the common portal;

(iii) The Input Service Distributors who have paid the late fee for filing or submission of the return in FORM GSTR-6 of the Central Goods and Services Tax Rules, 2017 for any tax period between the 1st day of January, 2018 and the 23rd day of January, 2018.

2) Notification No. 4/2018-CT as amended by Notification No. 75/2018-CT waives late fee payable for late filing of GSTR-1:

(i) If GSTR-1 is a NIL return, it is ₹ 10/-.

(ii) Full waiver of late fee for failure to furnish GSTR-1 for the months of July, 2017 to September, 2018 but files between 22-12-2018 to 31-3-2019.

3) Notification No. 76/2018-CT waives the late fee payable under section 47 of the CGST Act:

(i) in excess of ₹ 25/- for every day for GSTR-3B for the months from July, 2017 onwards. If it is NIL return, it is ₹ 10/-.

(ii) Full waiver of late fee for failure to furnish GSTR-3B for the months of July, 2017 to September, 2018 but files between 22-12-2018 to 31-3-2019.

4) Notification No. 73/2017-Central Tax, dated 29-12-2017 as amended by Notification No. 77/2018-Central Tax, dated 31-12-2018 waives late fee for failure to furnish GSTR-4 for the quarters from July, 2017 to September, 2018 but furnishes between the period from 22-12-2018 to 31-3-2019.

5) Late fee is waived in all cases where return in FORM GSTR-3B is not filed within due date for the months of July, August and September, 2017. Where such late fee was paid, it will be re-credited to their Electronic Cash Ledger under "Tax" head instead of "Fee" head so as to enable them to use that amount for discharge of their future tax liabilities.

6) Notifications 75, 76 & 77-CT 2018 - Late fees shall be waived for July 2017 - Sept. 2018, if return (R1, R3B or R4 ) is filed between 22/12/2018 to 31/03/2019.

7) Notification 41/2019-CT - Late fees waived for filling GSTR 6 for Districts mentioned in Table & for J & K for July 2019, if filed on or before 20.09.2019

8) Notification 48/2019-CT - Late fees waived for filing GSTR 7 for J & K for July & Aug 2019, if filed on or before 10.10.2019, Late fees waived for filling GSTR 3B for J & K for July & Aug 2019, if filed on or before 20.10.2019

9) Notification 04/2020-CT - Late fees waived for filing GSTR 1 for all RTP for July 2019 - Nov 2019, who have failed to furnish by due date & if files between 19.12.2019 to 17.01.2020

10) Due dates for any time limit for completion or compliance of any action, returns etc

. time limit for any compliance falling between 20.03.2020 to 29.06.2020 extended till 30th June 2020

. but, such extension of time shall not be applicable for the compliances of the provisions of the said Act, as mentioned below - (a) Chapter IV; (b) sub-section (3) of section 10, sections 25, 27, 31, 37, 47, 50, 69, 90, 122, 129; (c) section 39, except sub-sections (3), (4) and (5); (d) section 68, in so far as e-way bill is concerned; and (e) rules made under the provisions specified at clauses (a) to (d) above; - Notfn 35/2020-CT.

❑❑