Assessment under GST

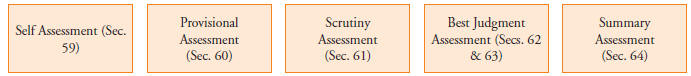

Assessment means determination of tax liability. In terms of Section 2(11) of the Act, '"assessment" means determination of tax liability under this Act and includes self-assessment, re-assessment, provisional assessment, summary assessment and best judgment assessment.'

The word 'assessment' can comprehend the whole procedure for ascertaining and imposing liability upon the taxpayer. It covers-

Section 59 refers to the assessment made by the taxable person himself while all other assessments are undertaken by tax authorities.

1. Self-Assessment (Section 59).

Self-assessment means an assessment by the tax payer himself and not an assessment by the Proper Officer. Similar to provisions under earlier Indirect tax laws, under GST, every registered taxable person shall assess the taxes payable by him on his own, and furnish a return for each tax period along with basis for calculation of the tax paid.

2. Provisional Assessment (Section 60)

Where a taxable person is unable to determine value of goods or services or both or determine the rate of tax applicable thereto, he may request the proper officer in writing/giving reasons for payment of tax on a provisional basis. Hence, except for inability to determine Value or Rate of Tax on goods, provisional assessment cannot be opted by the assessee for uncertainty about Place of supply or time of supply, whether intra-state or inter-state sale, whether supply or not etc. The taxable person has to execute a bond with such surety/security as per the rules framed in this regard. Proper officer has to pass the provisional assessment order within 90 days from the date of request.

Final Assessment-

The proper officer shall issue a notice, calling for information and records required for finalization of assessment and the proper officer shall, within a period not exceeding six months from the date of the communication of the order issued, pass the final assessment order after taking into account such information as may be required for finalizing the assessment. The finalization of assessment has to be completed, within a period of 6 months from the date of communication of provisional assessment order. However, on sufficient cause being shown and for reasons to be recorded in writing, this period can be extended by Joint/Additional Commissioner or by the Commissioner for such further period as mentioned below:

| |

Additional/Joint Commissioner |

Maximum 6 months |

| |

Commissioner |

Maximum 4 years |

If Tax Payable is more on final assessment-

If the amount of tax determined to be payable under final assessment order, is more than tax which is already paid along with return under section 39, the registered person shall be liable to pay interest on the shortfall, at the rates specified in Section 50(1) of the Act, from the first day after due date of payment of tax in respect of the said goods and/or services, till the date of actual payment, irrespective of whether such shortfall is paid before or after the issuance of order for final assessment.

If refund is due as a result of Final assessment-

Where the taxable person is entitled to a refund consequent to the order for final assessment, interest shall be paid on such refund at the rate specified in Section 56. Such refund is subject to doctrine of unjust enrichment.

3. Scrutiny of Returns (Section 61)

Section 61 confers discretionary power to a Proper Officer to scrutinize returns filed by registered persons to verify the correctness of the return. The officer will ask for explanations on any discrepancies noticed in the returns.

- During such scrutiny, discrepancies if any noticed has to be communicated by issuing notice to the registered person.

- The notice should also contain the details as to the quantified amount of tax, interest and any other amount payable in relation to such discrepancy.

- Registered person can respond to such notice wherein either explanations are furnished for discrepancy or in case where discrepancy is accepted, pay the tax, interest and any other amount and inform the same.

- In case the explanation is found acceptable, the registered person shall be informed accordingly and no further action shall be taken in this regard.

- In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the registered person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted, the proper officer may initiate appropriate action or proceed to determine the tax and other dues.

Hence, Section 61 is a pre-adjudication process wherein department identifies discrepancies on the basis of return and then takes further action on the basis of power granted under Section 65, Section 66, Section 67 and Sections 73 & 74 of CGST Act

4. Best Judgment Assessment (Section 62 & Section 63).

a) Assessment of non-filers (Section 62):

If a registered taxable person does not file his return even after getting a notice u/s 46, the proper officer may assess the tax liability to the best of his judgment, taking into account all the relevant material available on record, and issue an assessment order.

It may be noted that issuance of notice under Section 46 is a pre-requisite for commencing proceedings under Section 62. However, where the registered person furnishes a "valid return" within thirty days of the service of the assessment order, the said assessment order shall be deemed to have been withdrawn but the liability for payment of interest or for payment of late fee shall continue. 'Valid return' is defined in Section 2(117) to mean a return filed under Section 39(1) of the Act on which self-assessed tax has been paid in full. In order to avail the facility of withdrawal of the assessment order passed, filing of a valid return is required, including payment of taxes declared therein.

b) Assessment of unregistered persons (Section 63):

This is concerning unregistered persons i.e., persons who are liable to obtain registration under Section 22 and have failed OR person whose registration was cancelled as per section 29(2) of the Act.

Similar to Section 62, the proper officer will issue notice specifying grounds of making assessment under this section and assess the tax liability of such persons to the best of his judgment. The registered person is allowed a time of 15 days to furnish his reply, if any. After considering the said explanation, the order has to be passed.

The proper officer has to pass an assessment order u/s 63 within a period of five years from the due date for filing the annual return u/s 44 for the year to which such unpaid tax relates to.

Provision of Section 63 are similar to Section 23(4) of the MVAT Act.

5. Summary assessment in certain special cases (Section 64).

Section 64 provides for "priority assessments" under GST. These assessments are done when the assessing officer comes across sufficient grounds to believe any delay in assessment completion can harm the interest of the revenue and will lead to loss of revenue. To protect the interest of the revenue, he can pass the summary assessment with the prior permission of the Additional/Joint Commissioner.

The summary assessment can be undertaken in case all of the following conditions are satisfied:

♦ The Proper Officer must have evidence that there may be a tax liability.

♦ The Proper Officer has obtained prior permission of Additional/Joint Commissioner to assess the tax liability summarily. The proper officer must have sufficient ground to believe that any delay in passing assessment order would result in loss of revenue.

Hence, summary assessment under this Section is not a substitute for assessment getting time barred but sort of "protective assessment".

The section allows the person who is assessed and is served the order so passed, to come forward and make an application to the Additional/Joint Commissioner, which will then be examined and if the Additional/Joint Commissioner is satisfied, the summary assessment order will be withdrawn. On receipt of application the proper officer has to pass the order of withdrawal or, rejection of the application. Every assessment order so withdrawn under sub-Section (2), must be followed by a notice under Section 73 or as the case may be 74.

Where the taxable person to whom the liability pertains is not ascertainable and such liability pertains to supply of goods (not applicable for supply of services), the person in charge of such goods shall be deemed to be the taxable person liable to be assessed and liable to pay tax and any other amount due under the case.

Various important forms in respect of assessment under GST as notified under Rules are under :

| Sr. No. |

Name of Form |

Description |

Reply or Action Sought |

Time Limit to reply |

Consequences of Non- response |

| 1 |

ASMT-02 |

Notice for Seeking Additional Information for provisional assessment under GST |

Reply in ASMT-03 along with documents |

Within 15 days from the date of service of this notice |

Application for provisional assessment may be rejected |

| 2 |

ASMT-06 |

Notice for seeking additional information for Final assessment under GST (for those who applied for provisional assessment) |

Reply in 15 days of receipt of the notice |

Within 15 days from the date of receipt of this notice |

ASMT-07 can be passed without considering the views of taxpayer being assessed |

| 3 |

ASMT-10 |

Scrutiny notice-Notice for intimating discrepancies in the GST return after scrutiny along with tax, interest and any other amount payable in relation to such discrepancy, if any |

Reply in ASMT-11 giving reasons for discrepancies in the GST returns |

Within the time prescribed in the show cause notice or a maximum time of thirty days from the date of service of notice or such deadline notified |

Proceed to assess the taxpayer based on information at hand - may lead to prosecution and penalty |

| 4 |

ASMT-13 |

Order of assessment under sub-section (1) of section 62 i.e. best judgment assessment in scenarios where the registered person fails to furnish return on own or even after issuing notice. |

This order is to be issued within a period of 5 years from the date of furnishing of the annual return for the financial year to which the tax not paid relates |

In case the defaulting taxpayer furnishes a valid return within 30 days from passing of order in FORM GST ASMT-13, the said assessment order shall be deemed to have been withdrawn. |

However, if the said return is not furnished within 30 days, then proper officer may initiate recovery proceedings |

| 5 |

ASMT-14 |

Show Cause Notice for assessment under section 63- reasons for conducting the assessment on the best judgment basis |

Reply in written form and appear before the GST authority issuing the notice |

Within 15 days of notice |

Assessment order in ASMT-15, may not be favouring the assessee |

Audit under GST

Audit under GST- An Overview.

Under earlier laws, reconciliations between the tax records and audited statements of accounts were generally sought for at the time of assessment, audit or investigation by the Revenue authorities. There was no statutory requirement to furnish such reconciliation statements under the earlier laws.

Therefore, while the information provided by the taxpayer would be accepted at its face value as self assessment, there have to be certain checks and balances put in place to ensure that no tax leakages take place due to inadequate knowledge of tax laws, negligence in maintaining records, human or technical errors and fraud. Hence audit under GST implies a stricter compliance.

What is Audit?

Audit under GST is the examination of records maintained by the taxable person to verify the correctness of information declared, taxes paid and to assess the compliance with the provisions of GST. Audit is defined u/s 2(13) to mean examination of records, returns and other documents maintained or furnished by the registered person under the Act or rules made thereunder or under any law for time being in force to verify correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess compliance with the provisions of Act/rules made thereunder.

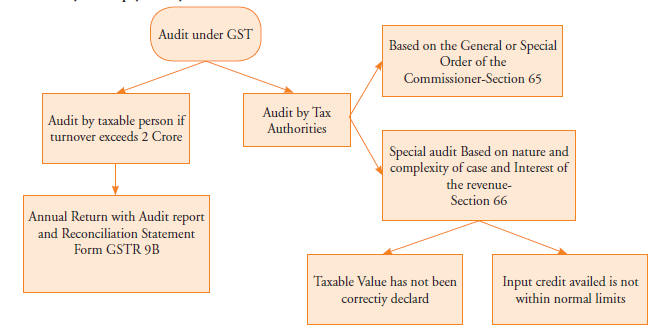

Audit can be by the taxpayer or by the tax authorities as follows:

1. Audit by Taxable Person:

Under Section 35(5) of the Act, every registered taxable person whose turnover during a financial year exceeds the prescribed limit. The corresponding Sub-rule (3) of rule 80 of CGST/SGST Rules, 2017 (hereinafter referred to as "the rules") prescribes such threshold limit as two crore for the purpose of section 35(5) of the Act. Accordingly, assessee shall get his books of account audited and submit to the proper officer a copy of the audited statement of accounts, the reconciliation statement and such other documents in the form and manner as may be prescribed in this behalf.

However, as an exception, proviso has been inserted in sub-rule (3) of Rule 80 vide Notification 16/2020-CT dated 23.03.2020 wherein Turnover limit for Furnishing Reconciliation Statement in Form 9C has been increased to 5 crore for Financial Year 2018-19.Accordingly taxpayer having turnover upto 5 Crore in Financial Year 2018-19 shall not be required to furnish 9C .

Every taxable person who is required to get his accounts audited shall furnish, electronically, the annual return along with the audited copy of the annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the year with the audited annual financial statement, and such other particulars as may be prescribed.

Annual Return has to be furnished in Form GSTR 9 along with Reconciliation statement by 31st December of the next Financial Year. Due date of Furnishing Audit report in Form 9C for FY 2018-19 has been extended till 30th June, 2020

2. Audit by Tax Authorities:

a. Tax Authorities (Section 65):

Tax Authorities authorized to conduct audit-

Section 65 authorizes conduct of audit by the proper officer or the Commissioner of the transactions of the registered persons only. The Commissioner may issue a general order or a specific order, to authorize officers to conduct such audit. As per the draft Assessment and Audit Rules, the period of audit under sub-section (1) of section 65 shall be a financial year (or part thereof) or multiples thereof. Hence, its not a mandatory Audit but applicable only in cases where the appropriate authorities authorize the same by issue of order. The criteria for audit are not prescribed under the Act but are left to the discretion of the authorities.

The tax authorities may conduct audit at the place of business of the taxable person and/or in their office. However, the taxable person should be informed at least 15 days prior to conduct of audit.

Duty of Taxable Person-

The taxable person is required to:

(a) Facilitate the verification of accounts/records available or requisitioned by the authorities,

(b) Provide such information as the authorities may require for the conduct of the audit, and

(c) Render assistance for timely completion of the audit.

Concluding Audit-

Time Limit - The audit shall be completed within a period of three months from the date of "commencement of audit." Where the Commissioner is satisfied that audit in respect of such registered person cannot be completed within three months, he may, for the reasons to be recorded in writing, extend the period by a further period not exceeding six months.

Here, "commencement of audit" shall mean-

♦ The date on which the records and other documents, called for by the tax authorities, are made available by the registered person or

♦ The actual institution of audit at the place of business,

whichever is later.

The proper officer must without delay inform the taxable person about his findings along with reasons for findings within 30 days from date of completion of Audit. In cases where tax liability is identified during the audit or input tax credit wrongly availed or utilized by the auditee, the procedure laid down under Section 73 or 74 is to be followed by way of issuance of show cause notice. Hence, Audit by itself cannot automatically result in demand unless followed by show cause notice.

b. Circumstances for Special audit (Section 66):

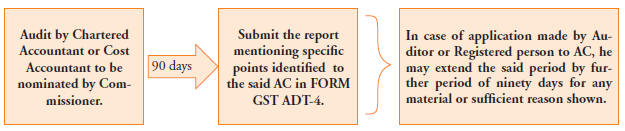

Section 66 of the Act provides a facility to the department wherein an officer not below the rank of Assistant Commissioner may avail the services of a Chartered Accountant or Cost Accountant to conduct a detailed examination of specific areas of operations of a registered person.

A special audit can be instituted in limited circumstances where during scrutiny, investigation, etc. it comes to the notice of any officer not below the rank of Assistant Commissioner, having regard to nature and complexity of the case and the interest of revenue that

- the value has not been correctly declared, or

- the credit availed is not within the normal limits.

Special Audit is in addition to any other audit-

- Special Audit can be ordered even if accounts of the taxable person have been audited under any other provision of this Act or any other law for the time being in force or otherwise.

- Once an Assistant Commissioner is of an opinion on that audit is needed on the above two aspects, after commencement and before completion of any scrutiny, enquiry, investigation or any other proceedings under the Act, may direct a registered person to get his books of account audited by an expert.

- The Assistant Commissioner needs to obtain prior permission of the Commissioner to issue such direction to the taxable person.

Opportunity of hearing to Taxable Person-

While the report in respect of the special audit under this section is to be submitted directly to the Assistant Commissioner. However the taxable person shall be given an opportunity of being heard in respect of any material gathered on the basis of special audit which is proposed to be used in any proceedings under this Act or rules made thereunder.

Expenses of Special Audit-

The expenses of the examination and audit of records including the remuneration of such chartered accountant or cost accountant, shall be determined and paid by the Commissioner and such determination shall be final.

Action taken consequent to conclusion of both the audits mentioned above -

Where the audit conducted under section 65 or section 66 results in detection of tax not paid or short paid or erroneously refunded, or input tax credit wrongly availed or utilized, the proper officer may initiate action and issue show cause notice under following provisions of the law-

♦ Section 73 (Provisions relating to demand and recovery of tax by any reason other than fraud or any willful-misstatement or suppression of facts) or

♦ Section 74(Provisions relating to demand and recovery of tax by any reason of fraud or any wilful-misstatement or suppression of facts).

❑❑