BACKGROUND OF FOREIGN TRADE POLICY

Introduction

The Ministry of Commerce and Industry is authorised to formulate and announce policies for governance and development of exports and imports and the overall regulation of foreign trade. The Foreign Trade Policy 2015-20 (hereinafter referred to as "FTP 2015-20") was announced on 1st April 2015 under the provisions of the Foreign Trade (Development & Regulation) Act, 1992. The FTP subsequent to the mid-term review under went few revisions which were implemented from 5th December 2017. The Directorate General of Foreign Trade (DGFT) is the controlling and supervising authority for various provisions of FTP. The validity of FTP 2015-20 has been extended to 31st March 2021, amidst the COVID-19 pandemic.

Objectives

The foreword to FTP 2015-20 lays down its broad objectives which primarily include:

♦ Providing a framework for increasing exports of goods and services;

♦ Generation of employment;

♦ Increasing value addition in the country;

♦ Supporting both manufacturing and services sector;

♦ Improving ease of doing business.

Incentives under FTP

FTP 2015-20 introduced two new incentive schemes, namely Merchandise Exports from India Scheme (MEIS) and Services Exports from India Scheme (SEIS) with a view to replace multiple schemes which all had different conditions for eligibility and usage. Other incentive schemes such as Export Promotion Capital Goods (EPCG) scheme and Advance Authorisation scheme have been continued under FTP 2015-20.

In light of global events, the Cabinet has approved Scheme 'Remission of Duties and Taxes on Exported Products (RoDTEP)' to boost exports Scheme for enhancing Exports to International Markets. RoDTEP scheme is WTO compliant and will reimburse taxes/duties/levies at the central, state and local level, which are currently not being refunded. Items will be shifted in a phased manner from existing scheme MEIS to RoDTEP.

EXPORTS FROM INDIA SCHEMES

FTP 2015-20 contains two schemes under exports from India, namely,

♦ Merchandise Exports from India Scheme (MEIS), to be replaced by RoDTEP

♦ Service Exports from India Scheme (SEIS)

Nature of rewards

The rewards are in the form of duty credit scrips. These duty credit scrips as well as the goods imported/exported procured against such duty credit scrips are freely transferrable.

The duty credit scrips can be used for the following:

♦ Payment of Basic Customs Duty (BCD) and Additional Customs Duty (ACD) for import of inputs or goods, including capital goods (including BCD and ACD payable in case of default in export obligations);

♦ Payment of Central excise duties on domestic procurement of inputs or goods (where applicable);

Practically, with the implementation of GST, usage of scrips for payment of ACD and Central Excise Duty have lost relevance. Further, the duty credit scrips cannot be used for payment of IGST and GST compensation cess, if applicable.

The duty credit scrips are valid for a period of 24 months from the date of issue. The holder of duty credit scrips is allowed to sell such scrips in accordance with the procedure laid down in FTP 2015-20, thereby facilitating immediate monetisation.

The duty credit scrips are granted at the notified percentage of FOB value/Net Foreign Exchange (NFE) earnings earned by eligible exporters in case of MEIS/SEIS respectively. The rate of rewards can range from 2% to 7%.

Earlier, GST at the rate of 12% was applicable on sale of duty credit scrips. This rate was reduced to 5% with effect from 9th September 2017. However, vide Notification No. 35/2017-Central Tax (Rate) dated 13th October 2017, the sale of duty credit scrips has been exempted from GST.

Online transfer and issuance of scrips

♦ Issuance of physical duty credit scrips discontinued

The DGFT vide Trade Notice No. 3/2015-2020 dated 3rd April 2019 has discontinued issuance of physical copy of duty credit scrips for EDI ports. Instead, a facility to view and save soft copy of the duty credit scrips has been made available on the DGFT portal. This decision has been made applicable with effect from 10th April 2019.

♦ Mandatory recording transfer of scrips online

- The DGFT vide Trade Notice No. 42/2015- 2020 has made it mandatory to record every transfer of duty credit scrips from 14th January 2019 (for Electronic Data Interchange ports) on the DGFT website.

- The transfer process for scrips is similar to the process followed earlier where terms and conditions were negotiated between the buyer and seller, and only the process to record the transfer is modified.

Late cuts

Any delayed application for any financial benefit under FTP 2015-20 may be considered after imposing a late cut i.e., a deduction from the eligible reward, as under:

| Delay of |

Late cut |

| Up to 6 months |

2% |

| More than 6 months but up to a year |

5% |

| More than a year but up to 2 years |

10% |

Amidst the pandemic, the timelines and due dates have been extended to ease the applicants. In light of this, late cut would be applicable from the extended timelines.

The Merchandise Exports from India Scheme

♦ Objective

The objective of Merchandise Exports from

India Scheme (MEIS) is to offset infrastructural inefficiencies and associated costs involved in export of goods, which are manufactured in India. The focus of MEIS is on goods having high export intensity, employment potential which can thereby result in enhancing India's export competitiveness.

♦ Entitlement under MEIS

The list of goods on the export of which incentives under MEIS can be claimed is contained in Appendix 3B to FTP 2015-20 (as extended).

The said appendix also provides the rate of rewards applicable on each eligible product. The rate of reward under MEIS ranges from 2% to 7%.

The rewards under MEIS should be calculated on the basis of:

| |

Realised FOB value of the exports in free foreign exchange; or |

|

| |

FOB value of exports as given in the shipping bill in free foreign exchange |

whichever is lower.

♦ Ineligible categories

The following exports are ineligible for duty credit scrips entitlement under MEIS:

- Supplies made from DTA units to SEZ units;

- Export of imported goods covered under paragraph 2.46 of FTP 2015-20;

- Exports through transshipment, meaning thereby exports that are originating in third country but transshipped through India;

- Deemed Exports;

- SEZ/EOU/EHTP/BTP/FTWZ products exported through DTA units;

- Export products which are subject to Minimum export price or export duty;

- Exports made by units in FTWZ.

♦ Time limit

MEIS application has to be filed on or before:

- 12 months from the Let Export (LEO) date, or

- Three months from the date of

♦ Uploading of Electronic Data Interchange (EDI) shipping bills onto the DGFT server by Customs

♦ Printing/release of shipping bills for non-EDI shipping bills. whichever is later, in respect of shipments for which claim is being filed.

♦ Key procedural aspects

- The application for claiming rewards is to be filed online, using digital signature, in Form ANF 3A.

- For export of goods through courier or foreign post office using e-commerce, application has to be filed in Form ANF 3D.

- In case of EDI shipping bills, a single application can be filed containing shipping bills of different EDI ports.

- One application under MEIS can contain a maximum of 50 shipping bills.

Service Exports from India Scheme

♦ Objective

The objective of Service Exports from India Scheme (SEIS) is to encourage and maximize export of notified services from India.

♦ Entitlement under SEIS

- The list of notified services and their respective rate of rewards is contained in Appendix 3D to FTP 2015-20. The rate of reward under SEIS ranges from 2% to 7%.

♦ Key eligibility criteria

- Service providers of notified services, located in India are eligible under SEIS. It is pertinent to note that software and information technology enabled services, which form a major part of India's services export, are not covered under SEIS.

- The eligible categories for availing SEIS are as follows:

■ Mode 1 - Cross border trade

Supply of a service from India to any other country

■ Mode 2 - Consumption abroad

Supply of service from India to service consumers of any other country in India

- Eligible service providers should have minimum NFE earnings in the year of rendering service as follows:

| Service provider |

Minimum NFE earnings in USD |

| Individual and sole proprietor |

10,000 |

| Others |

15,000 |

- The service provider should have active Importer-Exporter Code (IEC) at the time of rendering such services for which rewards are claimed.

♦ Time limit

- The SEIS application should be filed within 12 months from the end of the relevant financial year. This time limit has been extended for applications pertaining to FY 18-19.

♦ Key procedural aspects

The service provider should hold:

- IEC

- DGFT digital signature

- Registration-Cum-Membership Certificate (RCMC)

- CA certification

- SEIS application should be filed online.

- Prescribed documents should be submitted manually.

- In case of ambiguity in estimating the eligibility of services qualifying under Appendix 3D, reference must be made to Services Sectoral Classification List prescribed by the WTO which is aligned to Central Product Classification ('CPC') code.

REMISSION OF DUTIES AND TAXES ON EXPORTED PRODUCTS

Introduction

To match the global norm and facilitate global trade, the Finance Ministry announce a scheme which is intended at replacing the existing MEIS. RoDTEP is aiming to refund the taxes and duties which are currently un-refunded or are embedded in the cost. The Government looks to formulate such scheme. The cabinet approved this scheme in March 2020.

Current Situation

The Government is in process of obtaining information from the export sectors to determine and recommend the rate and value under scheme. Sector based committees have been established to collect such information. Export promotion council, trade bodies and associations are required to collate data from members of the industry/firm/exporters with respect to un-rebated duties, taxes and levies used in the manufacture of export products in prescribe format.

Three forms (R1,R2,R3) have been issued which are to be filled separately for each export product by each manufacturing/exporting unit, which is to be certified by a Chartered Accountant/Cost Accountant. Data being used as base pertains to the period between Jan. to June 2019. Industry bodies are to compile such information and send it to the DGFT with their recommendation report.

EXPORT PROMOTION CAPITAL GOODS SCHEME

Objective

The objective of Export Promotion Capital Goods (EPCG) scheme is to facilitate import of capital goods for producing quality goods and services to enhance India's export competitiveness.

Incentives

Under the EPCG scheme, import of capital goods for pre-production, production and post-production is exempt from basic customs duty, IGST and GST compensation cess. The benefit of exemption from IGST and GST compensation cess is available till 31st March 2020 which has been extended to 31st March 2021 vide Public Notice No. 1/2015-20 dated 7 April 2020. In certain cases, procurement of capital goods from indigenous sources is also allowed.

Coverage

♦ EPCG scheme covers manufacturer exporters with or without supporting manufacturers, merchant exporters tied to supporting manufacturers and service providers.

♦ The scheme also covers a service provider who is designated/certified as a Common Service Provider (CSP) by the DGFT, Department of Commerce or State Industrial Infrastructural Corporation in a Town of Export Excellence subject to provisions of Foreign Trade Policy/Handbook of Procedures, subject to certain conditions.

Export obligation

The imports under EPCG scheme is subject to an export obligation (EO) equivalent to 6 times of duty saved on capital goods. This EO should be fulfilled within 6 years from the date of issue of authorization under EPCG scheme. Following key conditions should apply for fulfilment of EO:

♦ EO should be fulfilled by the authorisation holder through export of goods which are manufactured by him or his supporting manufacturer/services rendered by him, for which the EPCG authorisation has been granted.

♦ In case of indigenous sourcing of capital goods, specific EO would be 25% less than the normal EO stipulated.

♦ Shipments under Advance Authorisation, DFIA, Drawback scheme or reward schemes under

Chapter 3 of FTP would also count for fulfilment of EO under EPCG scheme.

♦ Export shall be physical export. However, certain deemed exports are also counted towards fulfilment of EO.

♦ Royalty payments received by the authorisation holder in freely convertible currency and foreign exchange received for R&D services would also be counted for discharge under EPCG.

♦ Payment received in rupee terms for such services as notified in Appendix 3E of FTP 2015- 2020 would also be counted towards discharge of EO under the EPCG scheme.

♦ Relevant to note that block wise extension has been granted for fulfilment of EO

Key procedural aspects

♦ Application, along with the prescribed documentation, has to be filed by the registered office or a branch office or manufacturing unit of an eligible exporter with the Regional Authority (RA) in Form ANF 5A.

♦ A nexus certificate from an Independent Chartered Engineer should also be submitted. Any anticipated reasonable wastage at the time of installation of capital goods should also be certified in the nexus certificate.

♦ Within 6 months from the date of completion of import, the authorisation holder should furnish a certificate to the RA, confirming the installation of capital goods. Such certificate should be obtained from the jurisdictional Customs authority or an independent Chartered Engineer, at the option of the authorisation holder.

♦ Before clearance of goods through Customs, authorisation holder shall execute a bank guarantee/Letter of Undertaking with Customs Authorities.

Closure of authorisation licence

The closure of authorisation licence under EPCG scheme will be as follows:

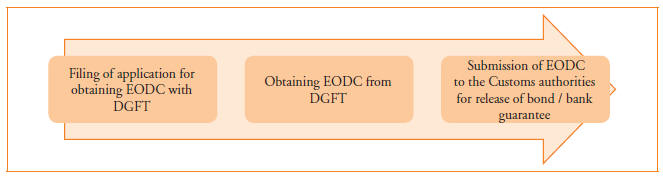

♦ Obtaining Export Obligation Discharge Certificate (EODC) in case of fulfilment of EO.

On fulfilment of EO under EPCG or advance authorisation, as the case may be, the authorisation holder should obtain EODC from DGFT and submit the same with Customs authorities for release of any bond/bank guarantee submitted.

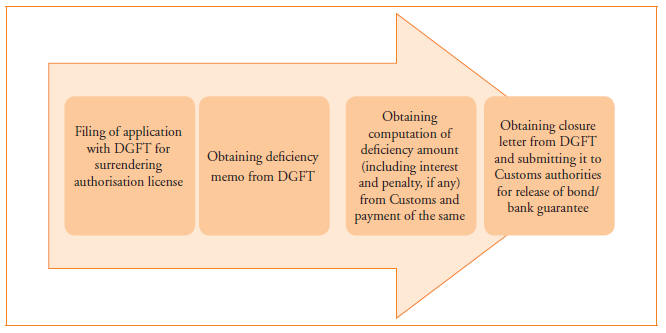

♦ Surrender of authorisation licence in case of inability to fulfil the EO.

In a scenario where an authorisation holder is unable to fulfil the EO, the applicant should apply for surrender of licence by paying the amount of applicable duty, along with the applicable interest and penalty, if any. The procedure in this regard is as under:

ADVANCE AUTHORISATION

Introduction

Advance authorisation is issued to allow duty free import of input, which is physically incorporated in an export product. A normal wastage allowance is provided for. Further, an allowance may also be made for fuel, oil, catalyst which is consumed/utilised in the process of production of export product.

Benefits available

Imports under advance authorisation are exempted from payment of the following:

♦ Basic Customs Duty;

♦ Additional Customs Duty, Education Cess, Anti- dumping Duty, Countervailing Duty, Safeguard Duty, Transition Product Specific Safeguard Duty, wherever applicable;

♦ Imports against supplies covered under para 7.02 (c), (d) and (g) of FTP 2015-2020 will not be exempted from payment of anti-dumping duty, countervailing duty, safeguard duty and transition product specific safeguard duty, if any;

♦ Imports under advance authorisation for physical exports are exempt from whole of integrated tax and compensation cess leviable under sub-sections (7) and (9) respectively, of section 3 of Customs Tariff Act, 1975. This exemption is valid till 31st March 2020 (extended to March 2021).

♦ Advance authorization is issued for inputs in relation to the resultant product, on the following basis:

♦ Notified Standard Input Output Norms (SION)

♦ Self-declaration by the applicant in accordance with para 4.07 of Handbook of Procedures of FTP 2015-2020.

♦ Applicant specific prior fixation of norms by the Norms Committee.

♦ Self-ratification scheme in accordance with para 4.07A of FTP 2015-2020.

Eligibility

The following are the eligible categories for obtaining advance authorization:

♦ Manufacturer exporter or merchant exporter tied to a supporting manufacturer;

♦ Pharmaceutical products manufactured through non-infringing process (in accordance with para 4.18 of Handbook of Procedures of FTP 2015- 2020) - only for manufacturer exporter;

♦ Physical exports, including exports to SEZ;

♦ Intermediate supply;

♦ Supply of goods to categories mentioned in paragraph 7.02 (b), (c), (e), (f), (g) and (h) of FTP 2015-2020.

♦ Supply of 'stores' on board a foreign going vessel/aircraft, subject to condition that there is specific Standard Input Output Norms in respect of item supplied.

Actual user conditions for advance authorisation

♦ Before clearance of goods through Customs, authorisation holder shall execute a bank guarantee/Letter of Undertaking with Customs Authorities.

♦ Material imported under advance authorization should not be transferred even after completion of export obligation.

♦ In case where input tax credit facility on inputs has been availed for exported goods, even after completion of export obligation, the goods imported against such Advance Authorisation should be utilized only in the manufacture of dutiable goods whether within the same factory or outside (by a supporting manufacturer).

♦ Waste/scrap arising out of manufacturing process, as allowable, can be disposed off on payment of applicable duty even before fulfilment of export obligation.

♦ Under Advance Authorisation, a minimum value addition (VA) of 15% is required.

VA = (A-B)/B × 100

where,

A = FOB value of export realized/FOR value of supply received;

B = CIF value of inputs covered under the Advance Authorisation and value of any other inputs on which benefit of drawback is claimed or intended to be claimed

Closure of authorisation license

The procedure for closure of advance authorisation license is similar to closure of EPCG license.

Pre-import condition

♦ The Government vide Notification No. 79/2017-Customs dated 13th October 2017 introduced the exemption from IGST and GST compensation cess under the Advance Authorisation scheme. However, such exemption was subject to a 'pre-import' condition. The said notification did not define the meaning of such 'pre-import' condition. However, based on the notices received by exporters from authorities it was clear that they sought to deny the benefit of IGST and GST Compensation cess benefits on imports made consequent to exports and required exporters to provide a one-to-one co-relation between the imports and exports.

♦ Such a requirement resulted in genuine hardship on most exporters who undertook imports, manufacturing and exports in a continuous cycle and it would also mean that the exemption of the above notification would not be admissible when goods manufactured were exported in anticipation of license/authorisation, because such would be a case of export having been made first and duty free import against the Authorisation having been made subsequently.

♦ The DGFT vide Notification No. 53/2015-20 dated 10th January, 2019 removed the pre- import condition prospectively, thereby allowing license holders to avail benefits of duty free imports under Advance Authorisation even when such imports are made after exports.

♦ Later, in a major relief to exporters, the Hon'ble Gujarat High Court in Maxim Tubes Company Pvt Ltd. v. Union of India quashed the pre- import condition as being ultra vires the schemed of the FTP 2015-20. Therefore, now the pre-import condition should stand quashed with retrospective effect from 13th October 2017 i.e., the date on which it was initially introduced.

EXPORT ORIENTED UNIT SCHEME

Introduction

Units setup to export their entire production of goods and services (except permissible sale in DTA) maybe set up under the Export Oriented Unit (EOU) Scheme. Trading units are not covered under these schemes. Objectives of this scheme is to promote exports, enhance foreign exchange earnings, and attract investment for export production and employment generation.

Key aspects of EOU Scheme

♦ Initially under the GST regime, upfront duty exemption available on procurement of imported goods by EOU prior to GST regime was restricted to Basic Custom Duties (BCD) till 12th October 2017. With effect from 13th October 2017, this exemption was also extended to Integrated GST and Compensation Cess till 31st March 2018. The Government has extended the validity of this exemption by issuing periodic notifications in this regard. As on date, the exemption from IGST and Compensation Cess under EOU scheme is valid till 31st March 2020.

♦ Erstwhile procedure of availment of upfront duty exemption on imported goods through Procurement Certificate (PC) has been discontinued. Under GST, upfront exemption can be availed by 100% EOUs by following the procedure prescribed under Rule 5 of the Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017.

♦ Erstwhile procedures of availment of upfront duty exemption on indigenous goods through CT-3 Certificate has been discontinued. Under GST, upfront exemption on indigenous procurement from DTA can be availed by 100% EOUs by following the procedures as prescribed under Notification No. 14/14/2017-GST dated 6th November, 2017. Such supplies to EOU will be considered as Deemed Exports, and accordingly, DTA supplier or EOU can claim refund of tax paid on such supplies.

♦ Administrative Control over EOUs located in non-port cities has been restored back to the Jurisdictional Custom Offices in place of jurisdictional Commissioner of Central Excise under erstwhile regime.

♦ Excise/Custom supervision and control on sealing of export containers has been done away with, instead self-sealing procedure shall be followed subject to certain conditions.

♦ Supplies from one EOU to another would be treated like any other supplies under GST law and would be subject to payment of applicable GST.

₹Procurement of services on payment of applicable taxes is continued under GST. No upfront exemption was available under erstwhile regime as well.

SPECIAL ECONOMIC ZONES

Introduction

Special Economic Zones are governed under the provisions of The Special Economic Zones Act, 2005 ("the Act"). As per Section 51(1) of the Act, the Act shall have effect notwithstanding anything inconsistent in any other law for the time being in force. Further, a Free Trade and Warehousing Zone (FTWZ) is also a SEZ and is governed by the Act. The SEZ unit shall be a positive Net Foreign exchange Earner. Net Foreign Exchange Earning (NFE) shall be calculated cumulatively for a period of five years from the commencement of production. The validity of Letter of Approval allowing the units to operate in an SEZ has been extended to 31 Dec. 2020.

Supply of goods and services to SEZ from outside India

Under Section 26 of the Act, a SEZ unit and a developer is exempt from all duties of Customs on goods imported into, or services provided in a SEZ, provided that such import is to carry on authorised operations. Further, the Government vide Notification No. 64/2017-Customs dated 5th July 2017 has exempted all goods imported by a SEZ unit or a SEZ developer in the SEZ for authorised operations, from the levy of IGST. Similar exemption from IGST has been provided on import of services vide Notification No. 18/2017-Integrated Tax (Rate) dated 5th July 2017.

Supply of goods and services to SEZ from DTA

Supply of goods, or providing services to SEZ unit or developer from Domestic Tariff Area (DTA) are deemed to be exports under Section 2(m)(ii) the Act. Further, Under section 16(1)(b) of IGST Act, 2017, supply of goods or services or both to a SEZ developer or unit is a zero-rated supply. Further, under Rule 89 of the CGST Rules, 2017 for supplies by a registered person located in DTA to a SEZ unit, the registered person would have an option to make such supplies on payment of IGST and claim refund of the same by filing FORM GST RFD-01.

The Ministry of Commerce and Industry vide letter dated 2nd January 2018 has reiterated a uniform list of 66 services as default authorised services for SEZ operations. Any SEZ unit or developer, procuring any other service, would be required to obtain approval from Unit Approval Committees to enjoy the benefit of zero-rating for such services.

Supply of goods and services from SEZ to outside India

Supply of goods or providing services, out of India, from a SEZ would be governed by the provisions of the IGST Act, 2017. The taxability of such supply would be based on fulfilment of conditions for zero-rated supply under the IGST Act, 2017.

Supply of goods and services from SEZ to DTA

The supply of goods and services by a SEZ to DTA would be governed by the provisions of the IGST Act, 2017 and the Customs Act, 1962. Accordingly, such a supply would be chargeable to Customs duty and IGST as applicable.

❑❑