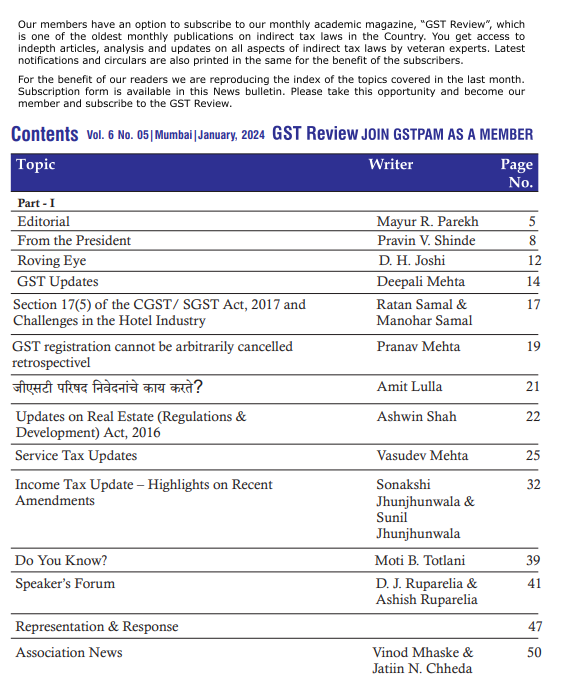

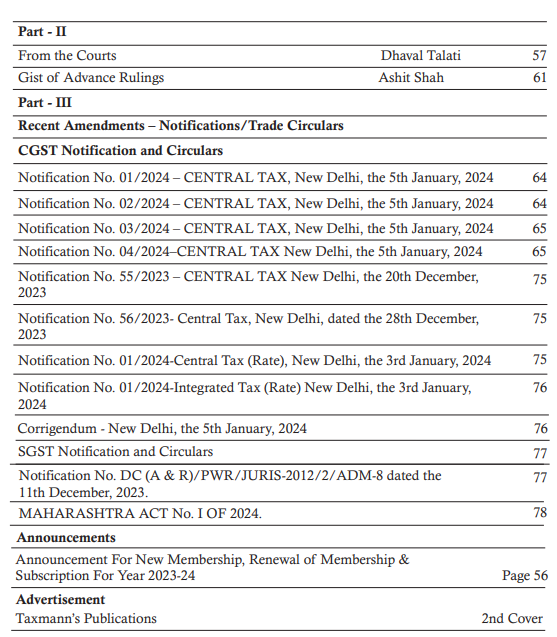

GSTPAM News Bulletin February 2024

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2023-24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GSTReview, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscriptioncharges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference

| Type of Membership | Membership Fees incl. GST | Admission Fees Incl.GST | Subscription Charges for GSTReview | Total |

| New Membership Application | ||||

| Donor Member | 24,780.00 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,365.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

New Membership Application (Firm/LLP)

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,174.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

Advance Membership/ Subscription charges for subsequent two years 2024-25& 2025-26 (Non-Refundable)

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,665.00 | – | – | 2,665.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1200.00 | 1,200.00 |

| Patron Member | 0 | – | 1200.00 | 1,200.00 |

| Donor Member | 0 | – | 1200.00 | 1,200.00 |

Subscription for GST Review for F.Y. 2023-24 by Non-Members

| Subscription fees for GSTR | – | – | 1000.00 | 1,000.00 |

Advance Membership / Subscription charges for subsequent two years 2024-25& 2025-26 (Non-Refundable)

| Subscription Fees -GSTR | 0 | 2000.00 2,000.00 |

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra”payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra

Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070. Online generated transaction Acknowledgement should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at

Mazgaon Library – Mazgoan: 1stFloor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Mazgaon Tower-8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity

(New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) | Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I- cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org.Members are requested to download Members Renewal form from website. Update the latest details in the form, scan it and mail at email [email protected]

Payment Link : https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 21.07.2023

Vinod Mhaske

Jatin Chheda

Hon. Jt.Secretary

|

Guidance Cell Email ID for queries Members can send their queries at [email protected] |

ORDER FORM FOR GSTPAM REFERENCER 2023-24

(Members are requested to take out the photocopy of the Order Form for booking)

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon,

Mumbai

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2023-24 as given below.

| Sr. | Particulars | Price per copy if booked prior to 15th July 2023 | Price per copy if booked afterto 15th July 2023 | Qty | Total RS. |

| 1 | GSTPAM Referencer 2023-24 Part I & II(GST, VAT & Allied Law Referencer & Updated GST Rate schedules). | 700 | 750 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 130 | 130 | ||

| 3 | Courier Charges (For Local members only) (per set) | 100 | 100 |

Note :

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer & Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of………………………………………………………………………… (Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No. ………….……dated……….……. drawn on……………………………………………… Bank Branch, Mumbai.

Signature …………………………….

Membership Number…………………… Address.…………………………………

Name ……………………………………… ………………………………………

Office Tel No…………………………………… Residence Tel No………………………………

E-mail: …………………………………………. Mobile No.…………………………………………….

PROVISIONAL RECEIPT

Received with thanks payment of. ………………… from…………………………………..vide Cash /Card /Cheque /NEFT/Demand Draft No. …………………………. Date ………………. drawn on…………………………………………………Bank…………………………….. Branch, Mumbai.

Signature ……………………………

Date…………………………………. Name of staff of GSTPAM……………………

Note:

- * Please fill in all the details in the above form and send the same to the GSTPAM’s office at Tower or at Mazgaon library along with requisite payment. For Direct Deposit / NEFT payment –

- * Bank of India, Mazgaon – Account No. 007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should be sent by email: [email protected] along with duly filled form.

- * Please mention your name and membership number on the reverse side of the Cheque / Demand Draft.

- * The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- * The Cheque / DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

48th RESIDENTIAL REFRESHER COURSE

Hotel Novotel, At Visakhapatnam

Thursday 29th February, 2024 to Sunday 3rd March,2024

The Residential Refresher Course Committee is pleased to announce its 48th Residential Refresher Course (RRC) on GST at Visakhapatnam, the port city and Industrial Centre in the State of Andhra Pradesh on the Bay of Bengal. The City is famous for its Port, Beautiful Beaches, caves, ancient Buddhist sites and the eastern ghats as well as wild life sanctuaries. It is also know as Vizag and nick named as the “City of Destiny” and the “Jewel of the East Course”.

The object of RRC is to share the essence of professional experience and expertise of the faculties they have gained over the years and where members can study in afresh at mosphere and rejuvenate.

The topics selected for RRC will cover an in-depth and practical understanding of GST Law and the challenges faced in the GST Era. In addition, the Delegates can seek views from seniors on issues they face regarding the interpretation of the law and practical difficulties. These topics are of immense importance and will help professionals/Delegates handling Indirect Tax Matters.

Along with studies, we have planned to visit various tourist places such as local sightseeing in Visakhapatnam which Includes Submarine Museum, Air Craft Museum, Kailasagiri. Simhachalam Temple, Beautifull beaches and many more.

Dates: Thursday 29th February, 2024 to Sunday 3rd March, 2024.

Venue: Hotel Novotel Varun Beach

Dr NTR Beach Rd, Krishna Nagar, Visakhapatnam, Andhra Pradesh 530002 The RRC includes 3 Nights–4 Days accommodation on double occupancy basis and the course material. The Package will start from Lunch on 29th February, 2024 and end with breakfast on 3rd March, 2024.The Paper at the RRC are as under:

| Paper | Topics | Paper Writer | Chairman |

| Paper 1 | Cross Border Transactions – Export,Import, Bond Transfer, Out to Out Transactions | CA Deepali Mehta | Eminent Faculty |

| Paper 2 | Interest, Penalties and offences under GST | CA Aloke Singh | Eminent Faculty |

| Paper 3 | Insights and How to deal with various Parameters ofASMT-10 | Adv. Amol Mane | Eminent Faculty |

| Brains’ Trust Session | Eminent Faculties |

The enrollment Fees are as under:

| Enrollment Fees | Amount | GST18% | Total | |

| DELEGATE FEES FOR MEMBERS | ||||

| 1 | Fees Paid on or Before 14/12/2023 | Rs.19,500/- | Rs.3,510/- | Rs.23,010/- |

| 2 | Fees Paid After 15/12/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Child rates (With Extra Bed)*Age 6-12 years Sharing room with parents | Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

| DELEGATE FEES FOR NON- MEMBERS | ||||

| 1 | Fees Paid on or Before 14/12/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Fees Paid After 15/12/2023 | Rs.22,500/- | Rs.4,050/- | Rs.26,550/- |

| 2 | Child rates (With Extra Bed)*Age 6-12 years Sharing room with parents | Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

Notes:-

- In case of cancellation, the refund will be at the discretion of the RRC Committee, the same shall be refunded after completion of event.

- Hotel Check-in Time is 02.00 PM, and Check out Time is 12.00 PM. Early Check-In and Late Checkout will be subject to availability.

- Delegates joining late or leaving early in RRC should inform the Convenor / Office Bearers well in advance.

- All delegates are requested to carry their AADHAR, Driving License, Election Card, and Passport for Photo & Address identification (Any Two) for Train or Air Travel. In addition, members are requested to send a Xerox copy of his/her photo ID with address proof along with Enrollment Form.

- Delegates are advised to carry their medical kit with them.

- Room Service and items other than provided for in the Hotel package will have to be paid Directly in Cash separately by the Delegates to the hotel.

- Tea/Coffeemakers are placed for consumption in all the rooms.

- Delegates are strictly requested to deposit room keys at the reception counter on leaving.

- Please carry our water bottles during Sightseeing Program.

- Members are requested to keep their Identity Cards Compulsory during all Sightseeing programs.

- Allotment of Room shall be at the sole discretion of the RRC Committee only. Any changes required in the program will be at the sole discretion of the RRC Committee.

- We request all Delegates to get themselves fully vaccinated as per the directions of the Government of India and carry their copies of their final certificates as issued.

- Members who enroll for RRC have to renew their Membership for the year 2023-24 before registering for the event; otherwise, they will be treated as Non-Member.

We Wish You All Good Luck in Study at RRC

The Goods & Services Tax Practitioners’ Association of Maharashtra

| Pravin V. Shinde | Sachin Gandhi | Dilip Nathani | Premal Gandhi & Ajay Talreja |

| President | Chairman | Convenor | Jt. Convenor |

| 9821482020 | 9821121433 | 9324383636/ 9820013469 |

Suggested Train Details from Mumbai to Visakhapatnam on 28th February, 2024

| From | To | TrainNumber | NAME | DepartureTime | ArrivalTime |

| LTTMumbai | Visakhapatnam | 18520 | Visakhapatnam Express | 6:55(Wednesday) | 10:40(Thursday) |

Train Details from Visakhapatnam to Mumbai on 3rd March, 2024.

| From | To | TrainNumber | NAME | DepartureTime | ArrivalTime |

| Visakhapatnam | LTT Mumbai | 22847 | Vskp Ltt S F | 8:20 AM(Sunday) | 1:00 PM(Monday) |

| Visakhapatnam | LTT Mumbai | 18519 | Vskp Ltt Express | 11:20 PM(Sunday) | 4:15 AM(Tue) |

Suggested Flight Details from Mumbai to Visakhapatnam on 29th February, 2024.

| From | To | Flight Number | AirlineName | DepartureTime | ArrivalTime |

| Mumbai | Visakhapatnam | 6E 5107, 6E 581(Via Chennai) | Indigo Airlines | 7:00 | 11:45 |

| Mumbai | Visakhapatnam | 6E 5246, 6E 879( Via Hyderabad) | Indigo Airlines | 8:00 | 11:50 |

| Mumbai | Visakhapatnam | 6E 5352, 6E 6336(Via Bengaluru) | Indigo Airlines | 6:05 | 13:55 |

| Mumbai | Visakhapatnam | 6E 5296, 6E 6336(Via Bengaluru) | Indigo Airlines | 7:30 | 13:55 |

Suggested Flight Details from Visakhapatnam to Mumbai on 3rdMarch, 2024.

| From | To | Flight Number | AirlineName | DepartureTime | ArrivalTime |

| Visakhapatnam | Mumbai | AI 654 | Air India | 15:50 | 18:05 |

| Visakhapatnam | Mumbai | 6E 5247 | Indigo | 15:10 | 17:15 |

| Visakhapatnam | Mumbai | I5 1529, I5 1782(Via Bengaluru) | Air Asia | 11:00 | 15:50 |

| Visakhapatnam | Mumbai | 6E 5309, 6E 5255(Via Bengaluru) | Indigo | 14:35 | 19:50 |

ENROLMENT FORM for

48th RESIDENTIAL REFRESHER COURSE Hotel Novotel, At Visakhapatnam

Thursday 29th February, 2024 to Sunday 3rd March, 2024

To,

The Convenor,

Residential Refresher Course Committee,

The Goods and Services Tax Practitioners’ Association of Maharashtra,

8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road,

Mazgaon, Mumbai-400 010.

Dear Sir,

Kindly enroll me /us as the delegate(s) for the 48 th RRC to be held Hotel Novotel, at Visakhapatnam between Thursday 29th February, 2024 to Sunday 3rd March, 2024. My relevant details are as under

* NAME ……………………………………………………………………………………… (Age:…….yrs.)

* ADDRESS……………………………………………………………………………

* GSTIN…………………………..………….…..………………………………………………………………..

* GSTPAM Membership No……………….…………………………………………………………………….

* Telephone (O)………………………………®……………………………………………………………………..

* Email:…………………………………………………………………………………………………………………………….

* Mobile……………………………………………………………………………………………………………………………

* Food preference Veg Non-veg

* Whether Jain food is required Yes No

* If joining with family, please fill in the following details:

- Name of Spouse:……………………………………………… (Age………………………… yrs.)

- Name of Child/Children: (i) ……………………………………(Age……………………… yrs.)(ii) ……………………………………(Age………………….. yrs.)

* My preference of Room Partner (in case of not accompanied by a family member)

………….………………………………………………………………………………………………….

(Signature)

Delegate Fees:

The fees include 3 Nights – 4 Days accommodation with the course material. The enrollment Fees are as under:

| Enrollment Fees | Amount | GST18% | Total | |

| DELEGATE FEES FOR MEMBERS | ||||

| 1 | Fees Paid on or Before 14/12/2023 | Rs.19,500/- | Rs.3,510/- | Rs.23,010/- |

| 2 | Fees Paid After 15/12/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 3 | Child rates (With Extra Bed)*Age 6-12 years Sharing room with parents | Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

| DELEGATE FEES FOR NON- MEMBERS | ||||

| 1 | Fees Paid on or Before 14/12/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Fees Paid After 15/12/2023 | Rs.22,500/- | Rs.4,050/- | Rs.26,550/- |

| 3 | Child rates (With Extra Bed)*Age 6-12 years Sharing room with parents | Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

Member means a member of The Goods and Services Tax Practitioners’ Association of Maharashtra along with his/her Spouse and Children only. A member who enrolls for RRC has to renew the Membership for 2023-2024 before enrolling for the event.

Details of Payment

Cheque/ D.D.No……..………………… Bank……………………..…………………………..……. Branch…………….……… Dated……………………… NEFT details ….………………………………….

Bank details of GSTPAM are as under:

Bank:- Bank of India

Name:- The Goods & Services Tax Practitioners’ Association of Maharashtra

Branch:- Mazgaon, Mumbai

A/c No. :- 007020100001816 – Current A/c

IFSC Code :- BKID0000070

Notes:-

- Acknowledgment generated through online transactions should be emailed to [email protected] along with Enrollment Form and payment details.

- Online Payment Link: https://www.gstpam.org/online/event-registration.php

- Please issue the Cheque in favour of ‘‘The Goods & Services Tax Practitioners’ Association of Maharashtra’’ (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- Please tick/fill in the appropriate boxes.

- All delegates are requested to attach a xerox copy of his / her photo ID with addressproof.

- Booking for RRC will be accepted and confirmed only on payment of full delegate fees.

- Please attach your Travels details with the enrollment form and email to [email protected]

CIRCULAR FOR 41ST BATCH OF GST BEGINNERS COACHING CLASS FOR THE YEAR 2023-24

Dear Members,

We are happy to announce that “41st Batch of GST Beginners Coaching Classes” will commence on 15th January, 2024 in Hybrid mode.

Details of Coaching Class are as under

Virtual : Zoom Platform

Enrollment Fee : Rs.1950/- (Incl GST) for all participants

Salient Features of the Coaching Class:

- The object of the Coaching Class is to train and groom the new entrants or would be entrants in Indirect Taxes Practice particularly in GST in a very professional manner. Our well known seniors not only teach what is written in the books but also share the essence of their professional experience which they have gained over the years. This can be of enormous help and use to the new entrants. Here, students not only get knowledge but also wisdom by interacting with the seniors.

- Our expert faculties will provide notes on the respective topics.

- It has been now more than 6 years of implementation of GST, the classes will help the member and students to solve their doubt.

- The classes would be conducted, having “Twenty Four” Coaching Sessions. Also, the participants would be given case studies for the practical experience.

The “Coaching Class” of our Association is one of the best places where the subject of GST can be learnt in a very professional manner. Our Coaching Classes are so popular that apart from new entrants, many members who are not new, but whose craving for perpetual learning is very strong, enroll every year. You are, therefore, requested to enroll yourself or send your juniors and/or staff members without fail and enroll them at the earliest to avoid disappointment.

The enrollment form can be obtained from the Mazgaon Library or can be downloaded from GSTPAM’s website at www.gstpam.org

Thanking you,

Yours faithfully,

| Pravin V. Shinde | Jatin Chheda | Haresh Chhugani | Vivekanand Rao, Chaitanya Vaidya & |

| Ashwin Shivnani | |||

| President | Chairman | Convenor | Joint Convenors |

For further details, please visit www.gstpam.org or contact:

Mr. Jatin Chheda, Chairman & Hon. Jt. Secretary (Mob. No.: 9821669090)

Mr. Haresh Chhugani, Convenor ( Mob. No. 9820268035)

Mr. Ashwin Shivnani, Jt. Convenor ( Mob. No. 9819897488)

Mr. Vivekanand Rao, Jt. Convenor ( Mob. No. 9820036040)

Mr. Chaitanya Vaidya, Jt. Convenor ( Mob. No. 9511291003)

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

ENROLMENT FORM FOR

41st Batch of GST Beginners Coaching Classes

| Virtual | :– | Zoom Platform |

| Enrolment Fee | : | Rs. 1,950/- (Inclusive 18% GST) for all participants. |

| Date | : | Monday, 15th January, 2024, onwards |

Name of the participant

…………………………………………………………………………………………………………….

GSTPAM Membership Number……………………..

GSTTIN of Member……………………………………

Address

……………………………………………………………………………………………………………………..

Telephone: (O)………………..…………….. ® ………………………..

E-mail …………………………………………… Mobile No. ………………………..

Amount: Rs. ……………………………………. Cheque No. …………………………

Bank……………………………………………… Branch ……..…………………..

Dated………………………

Participant Details:

E-mail …………………………………………… Mobile No.…………………………

Whats app No. …………………………………….

Signature …………………….

Notes:

- Cheque/D.D. should be drawn in favour of the “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai.

- The enrollment form along with Cheque / DD/ Cash should be submitted at Room No. 104, GST Bhavan , Mazgoan, Mumbai 400 010.

- Payment Link : https://www.gstpam.org/online/event-registration.php

- NEFT detail – Bank of India, Mazgaon Branch – Account No. 007020100001816, IFSC Code – BKID0000070

- Acknowledgement generated through online transaction should be emailed [email protected] along with Enrolment Form and payment details

- Participant’s Email id & Mobile No. shall be used for schedule communication

- Kindly carry the receipt of payment to attend the Coaching Class.

- The Association reserves the right to change and alter the schedule if required.

41st Batch of GST Beginners Coaching Classes

| Sr.No. | Day & Date | Session | Time | Topics | Speakers |

| 1 | Monday, 15/01/2024 | 2.00 To 2.30 | Innauguration Session | ||

| 1 | 2.30 To 4.00 | General concept of GST and legacy laws | Adv. Dinesh Tambde | ||

| 2 | 4.15 To 5.45 | Important Definitions under GST | Adv. Dinesh Tambde | ||

| 2 | Wednesday, 17/01/2024 | 3 | 2.30 To 4.00 | Over view of Registration under GST Act | CA Aalok Mehta |

| 4 | 4.15 To 5.45 | Levy and Scope of Supply under GST Act (including Exemptions under goods and Exemptions under services) | Adv. Parth Badheka | ||

| 3 | Thursday, 18/01/2024 | 5 | 2.30 To 4.00 | Time of Supply under GST | CA Hiral L. Shah |

| 6 | 4.15 To 5.45 | Value of Supply under GST | CA Raj Khona | ||

| 4 | Monday 22/01/2024 | 7 | 2.30 To 4.00 | Place of Supply of Goods under GST | Adv. Manohar Samal |

| 8 | 4.15 To 5.45 | Place of Supply of Services under GST | CA Aditya Khandelwal | ||

| 5 | Wednesday 24/01/2024 | 9 | 2.30 To 4.00 | Composite Supply and Mixed Supply | CA Aditya Seema Pradip |

| 10 | 4.15 To 5.45 | Input Tax Credit | CA Aditya Surte | ||

| 6 | Monday 29/01/2024 | 11 | 2.30 To 4.00 | Tax on Reverse Charge Mechanism basis | Mr. Balram Begari |

| 12 | 4.15 To 5.45 | Composition Schemes (Including Taxation on Insurance Companies, Travels Agents and Forex Agents) |

Adv. Milind Bhonde | ||

| 7 | Wednesday 31/01/2024 | 13 | 2.30 To 4.00 | TDS / TCS & E-Commerce | Adv. Tanmay Mody |

| 14 | 4.15 To 5.45 | Type of Invoices, E Invoice, Credit / Debit Notes and Maintainance of Accounts | Mr. Swapnil Munot | ||

| 8 | Friday 02/02/2024 | 15 | 2.30 To 4.00 | Imports of goods and Import of services | CA R.Subramanian |

| 16 | 4.15 To 5.45 | E-Way Bill, Confiscation and detention of goods | Adv. Rahul C. Thakar | ||

| 9 | Monday 05/02/2024 | 17 | 2.30 To 4.00 | Zero Rated Supply (Export and SEZ) and other refunds | Miss. Devanshi Shah |

| 18 | 4.15 To 5.45 | Returns and Payment of tax and interest | CA Girish Kulkarni | ||

| 10 | Wednesday 07/02/2024 | 19 | 2.30 To 4.00 | Finalisation of Accounts | Shri. Sunil Joshi |

| 20 | 4.15 To 5.45 | Annual Return and Reconciliation (Form 9 & 9C) | GSTP Haresh Chhugani | ||

| 11 | Friday 09/02/2024 | 21 | 2.30 To 4.00 | Assessments, Business Audit, Penalties,Demand and Recovery of dues | CA Ashit Shah |

| 22 | 4.15 To 5.45 | Penal and Prosecution Provisions under GST | Adv. Ishan Patkar | ||

| 12 | Monday 12/02/2024 | 23 | 2.30 To 4.00 | Appeals and Advance Ruling | Adv. Pravin L. Jadhav |

| 24 | 4.15 To 5.45 | Overview of GST Website | GSTP Sachin Gandhi | ||

| 13 | Saturday 16/03/2024 | 25 | Moot Court |

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

Respected Members,

It is 7th year of the GST act is implemented. After implementation of GST, whole fraternity of Indirect Tax Practitioners and Trade are facing various challenges with regard to implementation, transition, interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various notices related to ITC mismatch and so on.

We all are aware about the practical difficulties we are facing while applying the rules and procedures of the GST law and the frequent amendments to the law especially due to frequent lockdown. With the view to update our fellow members on the latest development in law and to discuss the practical issues arising there from, our association has been regularly conducting Intensive Study Course. This year the Intensive Study Course is designed to enable the members to study and discuss various issues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybrid mode Intensive Study Course for the year 2023-24 from Friday, 15-12-2023 onwards.

The Intensive Study Course is such an academic activity of our association which is designed to facilitate the members to study and discuss various issues in group. At the intensive study Course, one of the members acts as a group leader and leads the discussion on issues of the relevant subject / topic and one of the seniors in the profession monitors the discussion. The meetings are generally arranged ON Hybrid mode on 1st, 3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m. There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday, 15-12-2023 between 3.30 p.m. & 6.00 p.m. on hybrid mode on the subject “Issues and Intricacies in GSTR 9 / 9C along with implications on Notices by GST Department”. The topic will be lead by Group Leader CA Dharmen Shah and the Monitor of CA Mayur Parekh.

The group strength is restricted to a limited number of members to facilitate better interaction within the group. The Intensive Study Course Fee is fixed at Rs. 1,650/- including GST for Members and Rs. 1,850/- including GST for Non members. You are requested to enroll at the earliest to avoid disappointment. Kindly use photocopy of the Enrolment form printed here in below. Also write your email address and mobile number for better communication.

Member interested to act as group leader should inform by filling up the option in the Form of “I wish to be a group leader for the subject” and are requested to contact the Convener on the mobile numbers mentioned- on Cell No. 9224386682/9821441740 / 9892512345/9870008752

Note :

- The First Meeting of the ISC is proposed to be a HYBRID meeting. The members joining the ISC are requested to fill the attached form for selection of Only Physical Mode or Only Virtual Mode. The Physical mode will be continued only if majority participants opt for the Physical Mode. (Else only Virtual meetings shall be held no Hybrid Meeting shall be held)

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulated through mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meeting and to come prepared for the subject, which will be helpful for the discussion.

| Pranav Kapadia

Chairman |

Hiral Shah

Convenor |

Sanjay Gajra

Jt.Convenor |

Sujoy Mehta

Jt.Convenor |

Bhavin Mehta

Jt.Convenor |

| 9224386682 | 9821441740 | 9892512345 | 9870008752 |

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA ENROLMENT FORM FOR INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

To,

Convener,

Intensive Study Course

The GSTPAM, Mazgaon, Mumbai – 400 010.

Dear Sir,

Please enroll me as a participant for the Intensive Study Course for the year 2023-24. The Registration fees of Rs.1,650/- (for members) / and Rs.1,850/- (for non-members) 18% Including GST is enclosed herewith by Cash /DD / Cheque No. _______________dated ______________ drawn on______________________________

Particulars of Member/Participant :

Name: _____________________________________________

Educational Qualification: ______________________________

Address for Communication: _____________________________

Telephone No. Office : ______________________________________ Res. _______________________

Email ID : ______________________ Mob. No. _______________________

GSTPAM Membership No: ______________________________________________

GSTIN (if Applicable): _________________________________________________

I also wish to be a group leader for the subject of ___________________________________________ and suitable available date will be : _________________________________________

I would like to attend the Meeting (Please Tick only one option)

Only Physical Mode

Only Virtual ModeThe Physical mode will be continued only if majority participants opt for the Physical Mode

Signature ________________

Note :-

- Please issue the Cheque in favour of ”The Goods & Services Tax Practitioners’ Association of Maharashtra” (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- For NEFT payment – Bank of India, Mazgaon- Account No. 007020100001816, IFSC – BKID0000070. Acknowledgement generated through online transaction should be emailed on [email protected] along with Enrolment Form and payment details.

- Online Payment Link: https://www.gstpam.org/online/event-registration.php

- Outstation members are requested to make payment online payment.

- The enrollment form along with payment proof should be submitted at Room No. 104, Vikrikar Bhavan, Mazgaon, Mumbai – 400010.

- Kindly carry the receipt of payment to attend the Lecture.

- The Association reserves the right to change and alter the schedule if required.

| GIST OF TRIBUNAL JUDGEMENTS (VAT)

Compiled by CA Rupa Gami |

|

1. J. K. Surface Coatings Pvt. Ltd. in Vat S.A. Nos. 04 to 07 of 2019 dated 03.04.2023

The appellant is a works contractor in the business of anti-corrosive coatings on offshore platforms. Such transactions on offshore platforms are in the course of export and not liable to tax under MVAT Act. Since the appellant had not paid 10% as pre-deposit as per Section 26(6B) the appeals were held by the Tribunal as not valid. (Petitioner represented by Adv. C. B. Thakar)

2. M/s Mehul Trading Company in Vat S.A. No. 255 of 2018 decided on 12.04.2023

Set off claim was disallowed for the period 2005-06. Having regard to the Circular dated 23.08.2019, the matter was remanded to ponder over the appellant’s claim for grant of set off in the light of guidelines laid down inn para 5 of the said Circular.

(Petitioner represented by Adv. C.B. Thakar)

3. M/s BASP Chemicals Products Ltd. in Miscellaneous Application Nos. 55, 56, 57, 58, 59 and 60 of 2019 dated 24.04.2023

Applications are filed for six periods from 2006-07 to 2011-12 for condonation of delay. When the appellant wanted to file Second Appeals before the Tribunal, the Registrar declined to accept the same by giving reference to the amendment dated 15.04.2017 and instructed the applicant to pay 10% by way of pre- deposit. The appellant then sent the application by Registered Post and which was received by the Tribunal in time. The issue now being of 10% pre-deposit, and the amendment having been upheld by the Bombay High Court in United Projects, the Miscellaneous Application was dismissed as the appellant had declined to make mandatory pre-deposit amount.

(Petitioner represented by Adv. N.V.Tapare)

4. M/s Amber Distelleries Ltd. in Vat S.A. No. 384 of 2019 dated 25.04.2023

Branch transfers were disallowed by reading incorrectly the terms of the agreement with the handling agent. It was explained that the handling agents were appointed to look after handling of goods during transportation and the consideration was paid to them for handling of goods. No consideration was received from the handling agent and there was no sale made to the handling agent. That the handling agent was appointed as depot in charge to look after stock and other compliances. The goods were transferred on F Form to Delhi office and sale took place in Delhi in the invoices of the appellant. The relevant portion of the agreement on the basis of which branch transfers were disallowed read as “Once the consignment of Delhi Depot leaves from the first party’s plant, all and any type of liability/risk will be of the Second Party”. IT was explained that as per section 26 of the Sale of goods Act risk prima facie passes with the property. And relying on the Mysore High Court judgement in the case of M/s Multanmal Chempalal, Bellary (AIR 1970 Mys 106), which held that “Prima facie the risk passes only with property, but the section authorises a contract to the contrary under which the risk passes even before the title to the property passes. So it is permissible for contracting parties to enter into an agreement that although property does not pass, the risk passes and they may fix the point of time when it so passes.” The Tribunal set aside the first appeal order and remanded the matter to first appellate authority for verification of F Form.

(Petitioner represented by Adv C.B. Thakar)

5. M/s Vertive Energy Pvt. Ltd. in Miscellaneous Application Nos. 25 and 26 of 2023 dated 28.04.2023

There was delay of 127 days in filing of appeal due to the fact that the order which was given to the junior employee for giving report was transferred to another department and the work remained unattended. At the end of the year, while looking into pending matters, it came to be known that the work remained pending. The following decisions were relied where there was negligence on the part of the employee/ consultant.

- Crescent Valves Mfg. Co. Ltd. (Miscellaneous Application No.59 of 1994 dated 11/1996)

- Dex Vin Polymers (Miscellaneous Application No. 187 of 2014 (Vat Appeal No.565 of 2013 decided on 24.03.2014)

The applicant also relied on the apex court decision in the case of Mst. Katiji (66 STC 228(SC)) to contend that the delay condonation is to be considered liberally so as to serve the cause of justice. Also, Section 5 of the Limitation Act empowers the court to condone delay and admit appeal on sufficient cause being shown for delay. In the case reported in 1988 SC 897 G.Ramegauda vs. Special Land Acquisition Officer, the Supreme Court has held that “The expression in section 5 of the Limitation Act must receive construction so as to advance substantial justice and generally delays in preferring appeals are required to be condoned in the interest of justice where no gross negligence or deliberate action or lack of bonafides is imputed to the party seeking condonation of delay.” In Mh.L.J.1992 page 272 Sorerao Sadashiv Patli vs Goderambai Laxmansinngh Gaharwar, it has been observed that “The primary function of the court is to adjudicate the dispute between the contesting parties and to advance substantial justice. Rule of limitation is not made to harm valuable right of parties. The discretion to condone the delay should be exercised to advance substantial justice. The court is required to adopt liberal approach in the matter of interpretation to phrase “sufficient cause”.

The delay was condoned at a nominal cost of Rs. 5000/-. (Petitioner represented by Adv. C.B. Thakar)

No matter what is the environment around you, it is always possible to maintain brand of integrity.

– Dr. APJ Abdul Kalam

INCOME TAX UPDATES

Compiled By By Adv. Ajay Talreja |

|

Co-op Societies Eligible for Section 80P Deduction on Interest from Co-op Banks

Navrang Basant Co-operative Housing Society Limited Vs ITO (ITAT Mumbai)

Introduction:

In a recent case before the Income Tax Appellate Tribunal (ITAT) in Mumbai, the issue of interest income deduction under Section 80P of the Income Tax Act for a cooperative housing society was under consideration. The case revolved around whether cooperative societies were eligible for this deduction.

- Background of the ITAT Case:The case was brought before the ITAT by the Navrang Basant Co-operative Housing Society Limited, the appellant. The appeal challenged an appellate order issued by the National Faceless Appeal Centre in Delhi, relating to the assessment year 2017-18.

- Grounds Raised by the Assessee: The key grounds of appeal raised by the appellant were as follows: i. Disagreement with the Commissioner of Income Tax (Appeals) for not allowing a deduction under Section 80P(2)(d) concerning interest earned from cooperative banks.

- Clarification that the deduction was claimed under Section 80P(2)(d) and not Section 80P(4).

- Citing the decision of the CIT(A) for the assessment year 2015-16 in the appellant’s own case, as well as decisions from the jurisdictional Tribunal where deduction under Section 80P(2)(d) was allowed for interest income from cooperative banks.

- Deduction Claim and Assessment: The appellant, a cooperative housing society, had filed its return of income for the assessment year 2017-18, declaring a total income of nil. In the return, the appellant claimed a deduction under Section 80P amounting to Rs.1,589,385. The deduction was specifically under Section 80P(2)(d). The return was subsequently selected for scrutiny. During the assessment proceedings, the Assessing Officer observed that the appellant had received interest income of Rs.1,589,385 from a cooperative bank. The appellant had claimed this as a deduction under Section 80P(2)(d). However, the Assessing Officer questioned the eligibility of this deduction under Section 80P.

- Denial of Deduction: The Assessing Officer’s view was that the interest income received by the appellant from cooperative banks was not eligible for deduction under Section 80P because cooperative banks did not qualify as cooperative societies. Consequently, the assessment order was issued, denying the deduction under Section 80P(2)(d) and assessing the total income at Rs.1,589,385.

- Appeal to CIT(A) and Decision: The appellant appealed to the Commissioner of Income Tax (Appeals) (CIT(A)), and the appeal was ultimately dismissed. The decision was based on a ruling by the Supreme Court in the case of Mavilayi Service Co-operative Bank Ltd. vs. CIT, which was issued on January 12, 2021.

- Appeal to ITAT: Discontented with the CIT(A)’s order, the appellant filed an appeal with the ITAT.

- ITAT’s Decision and Rationale: The ITAT considered the appellant’s claim and the legal provisions. It was established that the appellant, as a cooperative housing society, did not fall under the category of cooperative banks, and, therefore, Section 80P(4) did not apply to them. This section specifically denies deductions to cooperative banks. The ITAT relied on a recent judgment by the Supreme Court, the Kerala State Co-Operative Agricultural & Rural Development Bank Ltd. vs. Assessing Officer [2023] 154 taxmann.com 305 (SC) [14-09-2023], which clarified that deductions under Section 80P are not denied to cooperative societies like housing societies, only to cooperative banks.

As a result, the ITAT reversed the CIT(A)’s decision and allowed the deduction for interest income claimed by the cooperative housing society under Section 80P(2)(d). 6. Conclusion: In the ITAT case, Navrang Basant Co- operative Housing Society Limited successfully argued that interest income received from cooperative banks by a cooperative housing society is eligible for deduction under Section 80P(2)(d) of the Income Tax Act. The ITAT’s decision was based on the clarification provided by the Supreme Court in a similar case. This ruling provides clarity on the eligibility of cooperative societies for this deduction, highlighting the importance of legal definitions in tax matters.

Income Tax on Joint Development Agreements under Section 45(5A)

Joint Development Agreements (JDAs) have gained significant prominence in the real estate industry. These agreements, which involve collaboration between landowners and builders, enable the development of properties without transferring ownership. In this article, we will delve into the intricate world of income tax implications concerning JDAs, particularly under Section 45(5A) of the Income Tax Act

A Joint Development Agreement typically follows a structured process, involving various stakeholders and aspects. Here’s a breakdown of the key components:

Landowner-Builders Collaboration: The landowner, often the owner of an undeveloped plot, enters into an agreement with a builder. The landowner provides the land, while the builder undertakes to construct apartments or flats on the property.

Builder’s Responsibilities: In addition to construction, the builder assumes responsibility for various crucial activities, including marketing the property, obtaining legal permissions, and registering the flats in the names of prospective buyers. This includes overseeing the entire development process.

Compensation Arrangement: In return for their land, the landowner is entitled to compensation in the form of a predetermined number of flats or a share of the revenue generated from selling the flats. The specific terms of this compensation are typically outlined in the JDA.

How to calculate capital gains: Determining the capital gains associated with Joint Development Agreements requires a comprehensive assessment of four essential elements:

- Full Value of Consideration: This component encompasses the total value of the consideration received by the landowner. It typically comprises the stamp duty value of the flats received and any cash payments that the landowner receives in the year in which the certificate of completion is issued. This represents the total benefit that the landowner gains from the JDA.

- Cost of Acquisition: The cost of acquisition is a crucial factor in calculating capital gains. It involves the indexed cost of acquisition, which is computed by multiplying the stamp duty value at the time of transfer by the Cost Inflation Index (CII) of the year in which the transfer took place. The result is then divided by the CII of either the first year in which the land was held or 01.04.2001, whichever is later.

- Year of Transfer: The year of transfer signifies the specific year in which the land was transferred from the landowner to the builder as part of the JDA.

- Year of Taxability: This is the year when the certificate of completion is issued, and the gains from the JDA become subject to taxation.

Example- Mr X purchased a plot of land – 1995- Rs 500000

F.MV of Land as on 01.04.2001 – Rs 1000000 Mr X transferred land to builder in 2017 – SDV of property – Rs 2500000

Year of completion -2022-23 SDV of one flat -Rs 5000000

Computation of capital gain- Full value of consideration in year 2022-23 2 Flats + 2500000 5000000*2+2500000 Rs 1,25,00,000

Less: Index cost of acquisition 2500000*272/100 ( CII 2017-18/CII 2001-02 = 6800000

Long Term Capital Gain Rs 5700000

Transfer of assets of partnership to retiring partners is taxable u/s. 45(4) of Income Tax Act

ITO Vs Satish Babu Kethineedi (ITAT Hyderabad)

ITAT Hyderabad held that transfer of assets of the partnership to the retiring partners would amount to the transfer of the capital assets in the nature of capital gains and business profits which is chargeable to tax under section 45(4) of the Income Tax Act. Facts- The case of the assessee was selected for scrutiny and during the assessment proceedings, it was found that the assessee along with Sri Nihar Ranjan Pradhan has incorporated a company by name M/s. Digital Campus Services Private Limited and got allotted shares of the company which was in lieu of introduction of the ERP package in the ratio of 60:40 and accordingly, the assessee received shares worth Rs.8,92,98,000 /which attract provisions of section 45 of the Act. As the assessee did not admit the income from capital gains or otherwise in the return filed for A.Y. 2012-13, assessment was reopened u/s 147 of the Act and notice u/s 148 of the Act was issued. AO completed the assessment by making an addition of Rs.8,92,98,000/- towards undisclosed income, thereby determining the total income at Rs.8,95,38,000/-. CIT(A) partly allowed the appeal of the assessee. Being aggrieved, revenue has preferred the present appeal.

Conclusion-

Supreme Court in the case of CIT Vs. Mansukh Dyeing and Printing Mills has held that when the asset of the partnership is transferred to a retiring partner the partnership which is assessible to tax ceases to have a right or its right in the property stands extinguished in favour of the partner to whom it is transferred. If so read it will further the object and the purpose and intent of amendment of section 45. Once, that be the case, we will have to hold that the transfer of assets of the partnership to the retiring partners would amount to the transfer of the capital assets in the nature of capital gains and business profits which is chargeable to tax under section 45(4) of the I.T. Act. Held that the totality of the circumstances and the judgment of the Hon’ble Supreme Court cited (supra), we are of the opinion that the ld.CIT(A) had wrongly granted the relief to the assessee and therefore, we set aside the order passed by the ld.CIT(A) and restore the order passed by the Assessing Officer. Accordingly, the appeal of the Revenue is allowed.

Payments to Micro & Small Enterprises under MSME – Section 43B

Introduction: Delve into the significant amendments in Section 43B concerning payments to Micro & Small Enterprises (MSME) under the MSME Act. Applicable from April 2024, these changes impact the due dates, eligibility for deductions, and compensatory interest. The content includes a detailed flowchart presentation simplifying the comprehension of Section 43B for enhanced clarity.

Payments To Micro & Small Enterprises Under Income Tax Act – Section 43B

- Applicable from 1st April 2024, so applicable for any sum payable as on last day of FY 2023-24.

- Applicable to only Micro Enterprise (Investment < 1 Cr, Turnover < 50 Cr) or Small Enterprise (Investment < 10 Cr, Turnover < 50 Cr) as per MSME Act & not Medium & Large enterprises.

- Applicable to only supplier manufacturers or service provider, so purchase from traders would be outside the purview of these amendments.

- Micro and small enterprises are also advised to mention a note on the invoice issued by them indicating that they are registered as micro or small enterprise under MSME Development Act, 2006.

- Payment should be made within 15 days from the date of acceptance or deemed acceptance (delivery date) of the goods or services by a buyer.

- If a buyer is entering into an agreement with MSME supplier, the due date of payment cannot exceed 45 days from the date of acceptance or deemed acceptance of the goods or services by a buyer.

- If buyer fails to make payment within the dates mentioned as above then the sum payable will be ineligible for the deduction under income tax act.

- If compensatory interest paid to MSME for delayed payments it is also disallowed under income tax act.

- In case any defect in goods or deficiency in service is noticed, then an objection in writing should be made within 15 days. Date of removable of objection by the vendor should also be kept in record as counting of due date will start from this date.

- Status of the supplier has to be checked on the date of transaction.

- If the supplier on the date of transaction is not holding the registration/memorandum and is not covered under the MSMED Act, it can’t claim benefits with subsequent registration

- In case goods supplied before 31st March, 2024 & payment is made after 1st April 2024 but within the time limit specified above then still deduction is allowed for FY 2023-24.

ITAT Allows section 54 Deduction for property registered in spouse’s name.

Simran Bagga Vs ACIT (ITAT Delhi)

Introduction: In a significant verdict, the Income Tax Appellate Tribunal (ITAT) Delhi, in the case of Simran Bagga Vs ACIT, has ruled on the eligibility of income tax deduction under section 54. The dispute arose when Simran Bagga, a non-resident individual residing in the UAE, claimed a deduction of INR 93,46,404 under section 54 for a property registered in her spouse’s name. The Assessing Officer (AO) disallowed the claim, leading to an appeal before the ITAT. Detailed Analysis: Simran Bagga filed a revised return for A.Y. 2020-21, declaring a total income of Rs. 2,11,190 after claiming the deduction under section 54. The property in question, located in New Delhi, was sold for Rs. 1,30,00,000, and the Assessee invested Rs. 1,00,00,000 in a new residential house in Hyderabad. Notably, the new property was registered in the name of her spouse, Mr. Ajay Suri

During the assessment, the AO disallowed the deduction, arguing that the property was not registered in Simran Bagga’s name, and the payment was made from a joint account. The Assessee contended that the deduction should not be restricted solely because the property was not registered in her name. The case reached the ITAT. The ITAT considered the documentary evidence, including HDFC bank statements and payment receipts, establishing that the investment was made from the sale proceeds of the Delhi property. The Assessee explained that due to travel restrictions amid the COVID-19 pandemic, the property was registered in Mr. Ajay Suri’s name for convenience. The ITAT referred to precedents and High Court judgments, emphasizing that the crucial factor is the utilization of sale proceeds for the new investment. The Tribunal held that the Assessee is eligible for the deduction under section 54F, considering the investment made within the stipulated time.

Conclusion: The ITAT Delhi’s ruling in Simran Bagga Vs ACIT sets a precedent affirming that income tax deductions under section 54F can be claimed even if the new property is registered in the name of the spouse. The decision aligns with purposive construction, interpreting tax laws liberally in favor of taxpayers. This victory reinforces the importance of documenting the direct connection between sale proceeds and new investments to substantiate claims. Taxpayers can find assurance in the ITAT’s approach, promoting fair interpretation and application of tax laws.

One best book is equal to hundred good friends, but one good friend is equal to a library.

– Dr. APJ Abdul Kalam

DGFT & CUSTOMS UPDATE

By CA. Ashit K. Shah |

|

1. Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

| 01/2024 – Customs | Imposition of Export Duty on molasses resulting from extracting or refining of sugar and covered under HSN 1703. Molasses is a by-product of sugar cane used raw material for manufacture of Alcohol. This notification shall th came into force from 18th January, 2024. | 15 -01 -2024 |

| 02/2024 – Customs | Extend the existing concessional import duties on specified edible oils up to and inclusive of the 31st March 2025 by amending existing N. No. 48 & 49/2021 – Customs, dated 13-10-2021 | 15 -01 -2024 |

| 04/2024 – Customs | Exempt certain entries from Social Welfare Surcharge (SWS) viz. Spent Catalyst and ash containing precious metal falling under chapter 7112 and Coins of precious metals falling under chapter 7118. | 22 -01 -2024 |

| 05/2024 – Customs | Agriculture Infrastructure and Development Cess (AIDC) on items falling under tariff headings 7112, 7113, and 7118. The new rates are set at 4.35% for spent catalyst or ash containing precious metals (7112), 5% for gold or silver findings (7113), and 5% for coins of precious metals (7118). The notification clarifies that “gold or silver findings” refers to small components used in jewelry, such as hooks, clasps, and pins. | 22 -01 -2024 |

| 06/2024 – Customs | Extend the validity of exemptions lapsing on 31st march 2024 up to 30th September, 2024 covered under chapter heading 3208, 3815, 3901 or 3920, 70, 7204, 7225, 84, 85, 8507 60 and 8507 60 00 by amending N. No. 50/2017 | 29 -01 -2024 |

| 09/2024 – Customs | Basic Custom Duty rate specified parts/sub-parts of cellular mobile phone has been amended.– Customs | 30 -01 -2024 |

| 01/2024 – Customs (ADD) | Anit Dumping Duty (ADD) on “Meta Phenylene Diamine”, falling under tariff item 2921 5120 and 2921 5190, is continue to levy, originating in, or exported from China PR and imported into India, for a period of 5 years from the date of Notification, which will be payable in Indian Currency | 15 -01 -2024 |

2. Notifications under DGFT:

| Notifications No | Remark | Date |

| 56/2023 | Import policy of used IT Assets viz. laptops, desktops, monitors, printers from SEZ to DTA has been notified with certain conditions under para 2.31 of the Foreign Trade Policy, 2023 | 01 -01 -2024 |

| 55/2023 | Import policy of Screws covered under HSN 73181110, 73181190, 73181200, 73181300, 73181400, 73181500 and 73181900 is revised from “Free” to “Prohibited”. However, import shall be “Free” if CIF value is INR 129 or above per kg | 03 -01 -2024 |

| 57/2023 | Import policy of Silver covered under Chapter 71 of Schedule I is amended. Import of semi-manufactured silver paste, sheets, plates, strips, tubes, electrodes, wires, silver brazing alloys (in any form), by electrical, electronics and engineering industries including glasses and solar industries as input for their own manufacturing process on “actual user” basis shall be “Free”. Import of given items for R & D purpose by Government or Government Recognized Institutions shall also be “Free”. Import for any other purpose shall be through specified agencies as per earlier provisions. | 15 -01 -2024 |

| 58/2023 | Import policy of “Glufosinate Technical” under ITC (HS) code 38089390 is revised from “Free” to “Prohibited”. However, import shall be free if CIF value is INR 1,289 or above per Kg. This will be effective from 25-01-2024 | 23 -01 -2024 |

By your stumbling, the world is perfected

– Sri Aurobindo

LIGHT THE LAMP OF FINANCIAL FREEDOM

Compiled By By Mr. Tushar P. Joshi |

|

Don’t Keep Your Money lying idle in the Bank Deposits.

Everybody knows that India is a country of Savers. The fact that actual recession has never hit us is an evident for the same. Saving is in our blood unlike the people in Western Country. The people in West more likely live on plastic money. They believe in spending whatever they have today and are hardly bothered about provisions for future .That is the reason the number of Rich people in Mumbai and India is more than that in any of the Western nations. It is from school that our parents and teachers start teaching us about savings. I always had the strategy of keeping aside ₹ 20/- out of the ₹100/- I received every Monday during my childhood. This habit stays with us till the end and t at is the reason our savings accounts are flooded with a lots of money. Yes we do invest, but the money which we do not know what to do with, is always idle in savings account. If not savings we make a fixed deposit out of it which is the easiest way. But do we really calculate whether we are doing the right thing or no? Or we are just doing it because it is almost become a tradition from our four father.

Well, let us see what happens if we keep our money lying idle in the saving account. Firstly the rate of interest we earn is very less. It is not more than 6% to 7%. Yes I have seen banks marketing about 8% but this is not the absolute returns we earn. We are also liable for the TDS. If our money is lying idle in savings account. This means a person whose money is lying idle in savings account is earning negative returns.

Let us talk about fixed deposits. The current rates for short term fixed deposits are 8% which is firstly liable for 10% TDS and then if you come in the 20-30% tax bracket. The actual returns we get are not more than 5%. Are you shocked? Don’t believe it? Well just discuss with your accountant or banker once and ask him to show you the calculation of real rate you earn on fixed deposits,. A recent survey says 90% of India’s wealth is lying in bank deposits. WHY WOULD YOU PARK YOUR MONEY IN SUCH AN INSTURMENT WHERE YOUR MONEY IS DEGRADING?

Durations Instrument Name

1 – 6 Months Liquid funds and liquid plus funds.

6-12 Months Income Funds and Bonds funds

18-36 Months Income, Bond and MIP plans

More than 5-6 years Equity and Real Estate.

You may invest in the selective fund options/ avenues as per your need.

Man needs difficulties in life because they are necessary to enjoy the success.

– Dr. APJ Abdul Kalam

”Wishing our members a very HAPPY BIRTHDAY!!”

|

Members Name |

Date of Birth |

| Chheda Harilal Devji | 10 – February |

| Dhunisingani Lakhmichand Purshottamdas | 10 – February |

| Shah Jignesh Kishorkumar | 10 – February |

| Saboo Kamlesh Ramprasad | 10 – February |

| Rathod Bhavesh Somchand | 10 – February |

| Wankhade Santosh Devrao | 10 – February |

| Ahuja Amar Murli | 10 – February |

| Joshi Tushar Praful | 11 – February |

| ChavankeSandeep Chandrakantl | 11 – February |

| Jadhav Mahesh Bhagwan | 11 – February |

| Soni Mahendrakumar Murarilal | 11 – February |

| Dedhia Hasmukh K. | 12 – February |

| Hindivali Prakash Shivappa. | 12 – February |

| Shah Hemal Pravinchandra | 12 – February |

| Hussain Mazhar Musharraf | 12 – February |

| Dedaniya Jigar Ratilal | 12 – February |

| Shah Rajesh Chimanlal | 13 – February |

| Bhatt Rameshkumar Shashivadan | 13 – February |

| Kulkarni Atul Vasant | 13 – February |

| Ruparelia Ashish Damodardas | 13 – February |

| Doshi Praful J. | 14 – February |

| Menon Subhash | 14 – February |

| Mundada Pravinkumar S. | 14 – February |

| Parihar Jayant Bastimal | 14 – February |

| Surte Pramod Prabhakar | 15 – February |

| Shaikh Shakeel Ahmed | 15 – February |

| Vaishampayan Mukund Manohar | 15 February |

| Gangaramani Mukesh Vasdev | 15 February |

| Bajaj Harsh Nandlal | 15 February |

| Chandak Piyush Premsukh | 15 February |

| Savani A G | 16 February |

| Sawant Shantaram R. | 16 February |

| Nakade Manoj Ramnath | 16 February |

| Suryavanshi Arjun Pandurang | 16 February |

| Jaitapkar Yogesh Dipak | 16 – February |

| Porania Mansi Bharat | 16 – February |

| Chouhan Govind K | 17 – February |

| Desai Neelesh M. | 17 – February |

| Agrawal Ravi. | 17 – February |

| Poojari Poojashree Gopal | 17 – February |

| Arkal Sagar Nagesh | 17 – February |

| Chaudhary Avachal Ganeshbhai | 18 – February |

| Agrawal Pankaj Shyamsunder | 18 – February |

| Dedhia Manisha K | 18 – February |

| Taparia Jitendra Shankarlal | 18 – February |

| Gadhia Vijay Chandulal | 19 – February |

| Jain Vijaykumar Sarupchand | 19 – February |

| Doshi Biren Himatlal | 19 – February |

| Shah Vipul Jitendra | 19 – February |

| Dungarwal Rahul P | 19 – February |

| Gandhi Jasmit Hiralal | 21 – February |

| Shah Vipul Manaharlal | 21 – February |

| Joshi Kiran Kantilal | 21 – February |

| Vasa Ketan Manharlal | 22 – February |

| Chande Ankit Kishor | 22 – February |

| Bapat Sanket Deepak | 22 – February |

| Dixit Dilip Shriniwas | 23 – February |

| Varde Vishwas Jaywant | 23 – February |

| Kothadiya Sanjeev Sharao | 23 – February |

| Chitre Kiritkumar Vasant | 23 – February |

| Thakkar Pradip Kalidas | 23 – February |

| Darji Mittal Ramesh | 23 – February |

| Beriwala Neha | 23 – February |

| Bhutada Ramratan Kashiram | 24 – February |

| Wagh Sunilkumar Madhukar | 24 – February |

| Joseph Jeberson Samuel | 24 – February |

| Baldi Pawan Satynarayan | 24 – February |

| Kasare Atesh Ashok | 24 – February |

| Mir Jawedali Yaqubali | 24- February |

| Khan Gulam Mujtaba Muslim | 24- February |

| Jhaveri Sanjiv Piyush | 25- February |

| Mahaldar Arun Hardeo | 25- February |

| Kharat Anil Dhondiram | 25- February |

| Dudani Sanjeev Anand | 25- February |

| Panchal Umang Vasantlal | 25- February |

| Nagla Pawankumar Madhusudan | 25- February |

| Bardia Saket | 25- February |

| Solanki Jagdish Ratanlal | 25- February |

| Khandelwal Sanket Sunil | 25- February |

| Daga Rajendra K | 26- February |

| Vora Mahendra K. | 26- February |

| Desai Rajesh N | 26- February |

| Magar Subodh J | 26- February |

| Chandidas Ajaykumar Avinash | 26- February |

| Jain Popatalal Seshmal | 27- February |

| Darji Bharat Kasturbhai | 27- February |

| Chachra Gulab Inderlal | 27- February |

| Nachanekar Mahesh Suryakant | 27- February |

| Adavadkar Milind P | 28- February |

| Assawa Shiwbhagwan Chaturbhuj | 28- February |

| Lingsur Ramakrishna Raghavendra | 28- February |

| Manek Nilesh Bharat | 28- February |

| Gaikwad Anand Murlidhar | 28- February |

| Palan Bhavesh S. | 28- February |

| Makani Adeeb Ayaz | 28- February |

| Mungekar Vinayaka Madhukar | 29- February |

| Upadhye Z. J. | 01- March |

| Bodake M. B. | 01- March |

| Parte Shobhana Bhalchandra | 01- March |

| Sheth Chetan Narendrakumar | 01- March |

| Pednekar Rajesh Kashinath | 01- March |

| Pawar Samir Vishnu | 01- March |

| Chauhan Somesh H | 01- March |

| Karangutkar Siddhesh Anil | 1- March |

| Shaha Vrindavan G | 2- March |

| Nachankar Ritesh Ravindra | 2- March |

| Jain Vijay Mangilal | 2- March |

| Srivastav Vinod C | 3- March |

| Kanapade Sudesh Vishnu | 3- March |

| Pawar Jyoti Sanjay | 3- March |

| Mehta Sujoy Pankaj | 3- March |

| Shetty M D | 4- March |

| Kolpe Raosaheb Dhondiba | 4- March |

| Khandwala Mihir H. | 4- March |

| Parmar Vishal Parasmal | 4- March |

| Jambhekar Shweta Vinayak | 4- March |

| Bhuptani Bhavesh Chandrakant | 5- March |

| Matekar Dadasaheb B | 5- March |

| Kale Subhash Laxman | 5- March |

| Mistry Sandeep Bhagwanji | 5- March |

| Hinduja Ajeet Singh Ranjeet Singh | 5- March |

| Chhajed Kamlesh Sayarchand | 5- March |

| Shukla Satish Devnarayan | 5- March |

| Patil Virendrakumar K | 5- March |

| Tonge Pratik Dilip | 5- March |

| Vatnani Jai Moti | 6- March |

| Nagal Lata Leeladhar | 6- March |

| Eriya Ilsha P. Joseph | 6- March |

| Udani Roopa | 6- March |

| Surte Shirish P | 7- March |

| Patil Subhash Daga | 7- March |

| Deshpande Atul Vishwanath | 7- March |

| Magar Nishikant Bapusaheb | 7- March |

| Ransinga Amol Vitthal | 7- March |

| Sheth Dinesh N | 8- March |

| Jhunjhunwala Prakash Gourisankar | 8- March |

| Mundada Gopal Ramvilas | 09- March |

| Bhanushali Rajendra N. | 09- March |

| Gurav Pramod Anant | 09- March |

| Bhanushali Mahendra B. | 09- March |

| Patil Komal Kailas | 09- March |

| Rathi Dilip Narayandas | 09- March |

| Karpe Venayack Baburao | 09- March |

| Chulawala Manish Bhupendra | 09- March |

| Patil Rhushikesh Chandrakant | 09- March |

Learning does not make one learned: there are those who have knowledge and those who have understanding. The first requires memory and the second philosophy.

– Alexandre Dumas

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 375/- |

| 5 | Referencer 2023-24 | 750/- |

| 6 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 7 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 8 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 9 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 10 | 47th RRC Book | 250/- |

| 11 | Charitable Trusts | 300/- |

| 12 | Mega Full Day Seminar Booklet 09.02.2024 | 150/- |

Payment Link for Publication on sales : https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2023-24

Pradip Kapadia Chairman |

Aloke R. Singh Convenor |

Ashish Ruparelia Jt. Convenor |