GSTPAM News Bulletin July 2023

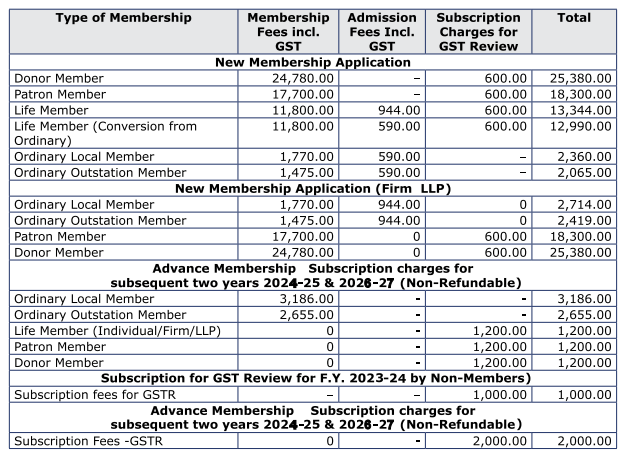

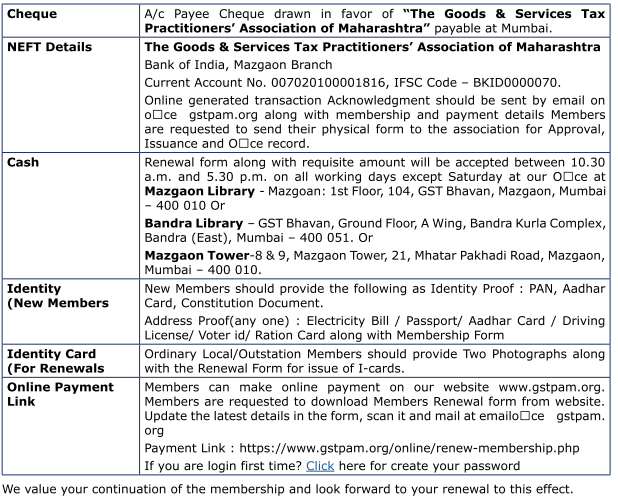

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2023 – 24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updateson various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages,Webinars and online access to the website www.gstpam.org. The Life Members only need to renewthe subscription charges for the GST Review. The members can also avail the benefit of discount bypaying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of theManaging Committee. If the Renewal fees for a particular year are not paid, then the member is liableto pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability uponpayment of such additional courier charges.

The details of Membership Subscription Fees are given below for your ready reference:

Dated:- 31.01.2023

Parth Badheka

Vinod Mhaske

Hon. Jt. Secretary

72nd ANNUAL GENERAL MEETING

NOTICE TO MEMBERS

NOTICE is hereby given to all the members of the Association that the 72 nd ANNUAL GENERAL MEETING of the Association will be held on Friday, 21st July, 2023 at 5.00 p.m. at the GSTPAM Association Library Hall, Room. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

AGENDA

- To read and confirm the minutes of the last Annual General Meeting held on 15 th July, 2022.

- To receive and adopt the Audited Statement of Accounts of the Association, ‘Sales Tax /GST Review’ and ‘Books and Bulletin’ for the year ended 31.03.2023 and the Balance Sheet as on that date and to receive and adopt the Annual Report of the Managing Committee for the year 2022-23(A copy of the report and accounts would be sent separately)

- To appoint an Auditor for the year ending 31.03.2024 and fix his honorarium.

- To receive the report of the Chief Election Officer and declare the result of the Election.

- To transact any other business that may be brought with the permission of the Chair.

Place: Mumbai

Dated– 21st April, 2023

Parth Badheka

Vinod Mhaske

Hon.Jt.Secretaries

NOTES:

- In case, if there is any change the same would be communicated to all the members.

- As per Article 13 of the Constitution of the GSTPAM, if the required quorum i.e. 40 members present in person is not there, the meeting shall stand adjourned and the adjourned meeting shall be held after lapse of half an hour from the appointed time at the same venue only to consider the items on the agenda circulated in the notice convening the meeting. Such adjourned meeting shall be deemed to be valid meeting with the members present forming the quorum and no other business than the one circulated shall be transacted at such adjourned meeting

- Any member desiring to seek any information on the Accounts may do so at least 3 days in advance in writing so as to enable the committee to reply to the same to the satisfaction of the member concerned.

- Resolution : Any member desiring to move any resolution, other than alterations in the Articles of the Constitution of The Goods & Services Tax Practitioners’ Association of Maharashtra, in the General Meeting, should send the same duly proposed by a member and seconded by another member so as to reach the office of Association, latest by 24th June,2023

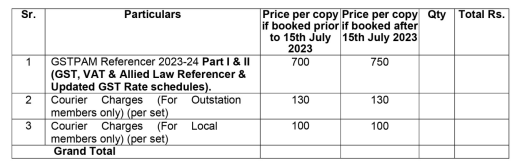

ORDER FORM FOR GSTPAM REFERENCER 2023-24

(Members are requested to take out the photocopy of the Order Form for booking)

For Office use only

![]()

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon,

Mumbai

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2023-24 as given below.

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer &Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give arequest on their letter head along with the order form. Tax Practitioner’s Associationscan place order in bulk quantity by making request on their letterhead signed by theAssociation’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery ofthe Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order……………………………………………………………………………………………………………………………………………………………………………………

of………………………………………………………………………………………….(Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No……………..dated……….drawn on……….. Bank………………………….Branch, Mumbai

Signature…………………..

Membership Number………………..

Address………………………………..

………………………………………….

………………………………………….

Name………………………

Office Tel No………………………..

Residence Tel No………………………..

E-mail:………………………………..

Mobile No………………………………

PROVISIONAL RECEIPT

Received with thanks payment

of……………………………………….from………………………………….vide Cash /Card

/Cheque /NEFT/Demand Draft No.on……………………………………Date………………………drawn

on …………………Bank…………………….Branch, Mumbai.

Signature………………………..

Date……………………………..

Name of staff of GSTPAM……………………………..

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office atTower or at Mazgaon library along with requisite payment.

- For Direct Deposit / NEFT payment – Bank of India, Mazgaon – Account No.007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should besent by email: [email protected] along with duly filled form.

- Please mention your name and membership number on the reverse side of the Cheque/Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque/ DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION

OF MAHARASHTRA.

GST, MVAT & ALLIED LAW UPDATESCompiled by |

|

|

Notification under Central Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 10/2023- Central Tax (Rate) | 10/05/2023 | Seeks to implement e-invoicing for the taxpayers having aggregate turnover exceeding Rs. 5 Cr from 01 st August 2023. |

| 11/2023- Central Tax (Rate) | 24/05/2023 | Seeks to extend the due date for furnishing FORM GSTR-1 for April, 2023 for registered persons whose principal place of business is in the State of Manipur. |

| 12/2023- Central Tax (Rate) | 24/05/2023 | Seeks to extend the due date for furnishing FORM GSTR-3B for April, 2023 for registered persons whose principal place of business is in the State of Manipur. |

| 13/2023- Central Tax (Rate) | 24/05/2023 | Seeks to extend the due date for furnishing FORM GSTR-7 for April, 2023 for registered persons whose principal place of business is in the State of Manipur. |

| 14/2023- Central Tax (Rate) | 19/06/2023 | Seeks to extend the due date for furnishing FORM GSTR-1 for April and May, 2023 for registered persons whose principal place of business is in the State of Manipur |

| 15/2023- Central Tax (Rate) | 19/06/2023 | Seeks to extend the due date for furnishing FORM GSTR-3B for April and May, 2023 for registered persons whose principal place of business is in the State of Manipur. |

| 16/2023- Central Tax (Rate) | 19/06/2023 | Seeks to extend the due date for furnishing FORM GSTR-7 for April and May, 2023 for registered persons whose principal place of business is in the State of Manipur. |

| 17/2023- Central Tax (Rate) | 27/06/2023 | Extension of due date for filing of return in FORM GSTR-3B for the month of May 2023 for the persons registered in the districts of Kutch, Jamnagar, Morbi, Patan and Banaskantha in the state of Gujarat upto 30th June 2023. |

|

Instructions / Guidelines |

||

| Instructions | Date of Issue | Subject |

| Instruction No. 02/2023- GST | 26/05/2023 | Standard Operating Procedure for Scrutiny of Returns for FY 2019-20 onwards |

| Instruction No. 03/2023- GST | 14/06/2023 | Guidelines for processing of applications for registration. |

|

Trade Circular MVAT Act 2005 |

||

|

Notification/ Circular No. |

Date of Issue | Subject |

| 10T of 2023 | 03.05.2023 | Generation and Quoting of document reference number (RFN) on communication / document pertaining to search and inspection received by the officer of the State Goods & Services Tax Deparment – reg. |

|

Notification MVAT Act 2005 |

||

|

Notification/ Circular No. |

Date of Issue | Subject |

| SGST/e-way bill/ 01/ 01/ 2023-24 | 19.05.2023 | Waiving off requirement of e-way bill for motor vehicles for road testing where goods are transported for reasons ‘other than by way of supply’ under sub rule (5) of rule 138A of MGST Rules , 2017 reg. |

| Notification No. GST-1023/C.R.21, E.O. No.192 Dtd. 24.05.2023 | 24.05.2023 | Smt. Rajashree Girish Nadgauda has been appointed as member of Advance Ruling authority in the place of Mr. T R Ramnani. |

| Notification No. 06/2023- State Tax Dt.24.05.2023 | 24.05.2023 | Amnesty Scheme for deemed withdrawal of assessment orders issued under section 62 |

| Notification No. 02/2023-State Tax Dt.24.05.2023 | 24.05.2023 | Amnesty for GSTR – 4 non filers |

| Notification No. 03/2023-State Tax Dt.24.05.2023 | 24.05.2023 | Extention of time limit for application for revocation of cancellation of registration |

| Notification No. 07/2023-State Tax Dt.24.05.2023 | 24.05.2023 | Rationalisation of Late fees for GSTR 9 and Amnesty to GSTR – 9 non filers |

| Notification No. 08/2023-State Tax Dt.24.05.2023 | 24.05.2023 | Amnesty to GSTR -10 non filers |

| Notification No. 09/2023-State Tax Dt.24.05.2023 | 24.05.2023 | Extention of limitation under section 168A of CGST Act |

| Notification No. 10/2023-State Tax Dt.06.06.2023 | 12.06.2023 | Seeks to implement e-invoicing for the taxpayers having aggregate turnover exceeding Rs 5 Cores from 1st August 2023 |

| 05/2023-State Tax (Rate) | 13.06.2023 | Seeks to amend Notification No 11/2017 – State Tax (Rate) dated 29th June 2017 |

| No. GST-1023/C.R. 17/Taxation-1 Dt.09.06.2023 | 14.06.2023 | Notification issued under sec 72(2) of the MGST Act, 2017 |

INCOME TAX UPDATESBy Adv. Ajay Talreja |

|

Chotanagpur Petroleum Agency Vs PCIT (ITAT Kolkata)

ITAT Kolkata held that addition of sales reversal entry alleging the same as unexplained expenditure is unjustified and unsustainable in law.

Facts- Case of the assessee was selected for scrutiny through CASS followed by serving of notices u/s 143(2) & 142(1) of the Act and the reason for selection for the scrutiny was cash deposit during demonetization period. The details called for were filed by the assessee and the assessment was completed after making minor disallowances of bonus, gift & presentation charges, motor car expenses and addition was made for income from oil tanker and income assessed at Rs. 13,36,141/-. Prima facie no addition was made on the issue of cash deposit during demonetization period. Subsequently, ld. Pr. CIT called for the assessment records and issued show cause notice u/s 263 of the Act. Pr. CIT was not satisfied with these submissions and he held the order of ld. AO dated 04.12.2019 as erroneous and prejudicial to the interests of the Revenue and also directed ld. AO to pass a fresh assessment order. Being aggrieved, the present appeal is filed.

Conclusion- Held that it is merely a sales reversal entry and not a case of unexplained expenditure. Complete documentary evidences in support of these transactions have been filed and we are satisfied that it is not a case of unexplained expenditure. Even otherwise all these details of cash sales including the cash book have examined by ld. AO in detail while carrying out the assessment proceedings for the reason for which the case selected for scrutiny i.e. cash deposit during demonetization period, therefore, ld. Pr. CIT erred in referring to other issue which was not required to be dealt by ld. AO and thus, wrongly invoked jurisdiction u/s 263 of the Act.

Ramesh Chandna Vs ACIT (ITAT Delhi)

ITAT Delhi held that cost of new property for the purpose of exemption under section 54 has to be assumed to be value of interests and share in the new construction, as per the collaboration agreement and the sale deed terms Facts- During the year, assessee has showed capital gains from the sale of a 50% share in a property which was inherited by him along with his brother Mr Naresh Chandna, in 50% share each. Assessee claimed that, both the brothers had sold their shares to a builder for Rs. 4,53,75,000/- each. The brother of the assessee has received Rs. 4,53,75,000/- for his 50% share. On the basis of the sale deed executed for 67.5% of the plot, the AO considered it to be the transfer of 67.5% of the property for Rs. 5,50,00,000/-, which was the sales consideration mentioned in the sale deed. AO observed that the assessee was getting only a 32.5% share in the new property. Thus, for Section 54 of the Act, the AO considered that the brothers together have sold 67.5% of the property to the builder for 5,50,00,000/-. Thus, the cost of new property for Section 54 of the Act, was taken at Rs. 2,64,81,481/- and the same was considered to be an investment in new property. The cost of acquisition was considered to be 99,250/- and taking share consideration payable to the assessee at 4,53,75,000/- and reducing the cost of acquisition Rs. 99,99,250/-, the AO arrived at capital gains of Rs. 3,53,75,750/- and after reducing investment made in new property calculated as above at Rs. 2,64,81,481/- arrived at a taxable capital gain of 88,94,269/-. CIT(A) has confirmed the addition.

Conclusion-

Thus, for the purpose of Section 54 of the Act, mere value of 32.5% ownership rights on the proportionate basis of share consideration of Rs. 5,50,00,000/- is not correct and the cost of new property has to be assumed to be Rs. Rs. 3,57,50,000/- being the value of interests and share of the assessee in the new construction, as per the collaboration agreement and the sale deed terms.

Taxation and tax deducted at source (TDS) on winnings from Online Games:- Section 115BBJ and 194BA A.

Introduction:- India’s nascent gaming industry has a remarkable rise in recent years, quickly propelling it into one of the biggest global markets for gaming. India’s massive youth population is fueling this expansion, along with higher disposable incomes, new gaming genres, and an increase in tablet and smartphone users making gaming easily accessible. The Indian gaming market to $5 billion in 2025, growing at a Compound annual growth rate of 28-30%. The quantity of gamers in the nation is supposed to expand from 420 million in 2022 to 450 million by 2023, and it is likely to hit 500 million by 2025. Considering the above growth in the number of users on the online gaming industry and simultaneously increase in the amount involved, the Government of India vide its Budget 2023 made multiple amendments in relation to the taxation of the winnings from the online games and deduction of the TDS on such winnings under the Income Tax Act (the Act). Through this article,it is tried to summarize provisions of the taxation on the winnings from the online gaming and manner of the computation of such winnings for the purpose of deduction of TDS on such winnings.

B. Amendments w.e.f. Finance Act 2023

Under the Income Tax Act, online games are defined as a game that is offered on the internet and is accessible by a user through a computer resource including any telecommunication device. Considering the growing market and public interest of the online games, Government vide Budget 2023 introduced section 115BBJ under the Act to provide 30% tax on the winnings from the online games. The above section also provides that the calculation of the net winnings for the purpose of the taxation will be prescribed. Further, to provide for the effective collection of the tax on the net winnings from online games, Government introduced section 194BA under the Act.

Section 194BA of the Act provide that if any person receives any income by way of winning from any online game during the financial year then the person responsible for paying such income shall deduct TDS from the net winnings at the end of the financial year. However, in a case where a user withdraws the amount during the financial year then the tax shall be deducted at the time of such withdrawal from the net winnings.

Also, in case where the net winnings are partly in cash, partly in kind, or wholly in kind and the cash is not sufficient to meet the tax liability of deduction from net winning, then the person responsible for paying such income shall ensure that before releasing the winnings the tax has been paid in respect of the net winnings.

Tax Rate u/s 115BBJ and TDS rate has been kept at 30% from the net winnings of the user account. Further, no threshold has been provided on the amount after which such deduction required. Thus, TDS would be required to be deducted on the entire net winnings.

However, CBDT vide its circular no. 05/2023 dated 22nd May 2023 has provided some relief for the by non- deduction of TDS for the persons playing with very insignificant amount and withdraw small amount after fulfillment of certain conditions. The above relaxation has been discussed in the later part of the article.

C. Calculation of Net Winnings from Online Games:- Government vide its notification no. 28/2023 dated 22 May 2023, introduced rule 133 under Income Tax Rules (the Rule) to provide the mechanism of calculation of the net winnings. While computing the net winnings following terms have been defined which will be used in formula for computation.

- Taxable deposit means any amount deposited in the user account which is not a non-taxable deposit. Further, as per circular No. 5 of 2023 dated 22 May 2023 issued by CBDT, any incentives/bonus which is withdrawable, will form part of taxable deposit.

- Non-taxable deposit means the amount deposited by the user in his user account and which is not taxable. As per circular No. 5 of 2023 dated 22 May 2023 issued by CBDT, any incentives/bonus which is not withdrawable, will not form part of Non-taxable deposit.

- Withdrawal means any amount withdrawn by the user from any user account. As per circular No. 5 of 2023 dated 22 May 2023 issued by CBDT, that transfer from one user account to another user account, maintained with the same online gaming intermediary, of the same user shall not be considered as withdrawal. As per Rule 133 of the Rules, Net winnings from online games shall be calculated using the following

formula:

Net winnings during the previous year = (A+D)-(B+C)

Where; A= Aggregate amount withdrawn from the user account during the financial year;

B= Aggregate amount of non-taxable deposit made in the user account by the assessee during the financial year.

C= Opening balance of the user account at the beginning of the financial year (Excluding Incentive/Bonus Which is Non-Withdrawable)

D= Closing balance of the user account at the end of the financial year (Excluding Incentive/Bonus Which is Non-Withdrawable)

Guidelines for removal of difficulties u/s 194BA of the Income-tax Act, 1961:

Recently, CBDT vide its circular No. 5 of 2023 dated 22 May 2023, provide with the guidelines for the removal of difficulties in respect of the deduction of TDS u/s 194BA of the Act to provide the following clarifications:-- Calculation of the amount of net winnings in case of maintaince of multiple user accounts:-

- While calculating the amount of net winnings, every account of the user registered with an online gaming intermediary by whatever name called shall be included.

- Transfer of the any amount from one from one user account to another user account, maintained with the same online gaming intermediary, of the same user shall not be considered as withdrawal or deposit, as the case may be.

- It may be possible that one deductor (one TAN) is having multiple platforms and it is not technologically feasible for him to integrate multiple user accounts across platforms then he may, at his option, calculate tax required to be deducted for the purposes of section 194BA of the Act for each platform separately. But even in that case all the user accounts under one user in one platform need to be considered for the purposes of calculating net winnings in the formulas provided in Rule 133. However, in this scenario transfer from one user account to another user account under same online gaming intermediary across platforms shall be considered as withdrawal or deposit for the purposes of calculation of net winnings under Rule 133.

- Amount which is borrowed by an user and then credited to his or her account will be considered as non- taxable deposit since the amount is already from the taxed income and not chargeable to the tax.

- Bonus, referral bonus, incentives etc. given by the online game intermediary to the user will be considered as taxable deposit. Thus any deposit in the form of bonus, referral bonus, incentives etc. would form part of net winnings and tax under section 194BA of the Act is liable to be deducted at the time of withdrawal as well as at the end of the financial year.

- Bonus, referral bonus, incentives etc. are provided in the form of money equivalent too like coins, coupons, vouchers, counters etc. In such a situation the equivalence in money of such deposit shall be considered as taxable deposit and would accordingly form part of balance in user account. However, where incentives/bonus which is credited in user account only for the purposes of playing and they cannot be withdrawn or used for any other purposes, then such deposit shall be ignored for calculation of net winnings. They shall not be included in non- taxable deposit and they shall also not be included in opening balance or closing balance of user account. It may be possible later that these incentive / bonus are recharacterised and they are allowed to be withdrawn, they would be treated as taxable deposit at the time when they are recharacterised. Thus, they will become part of net winnings in the year of recharacterisation.

- Transfer of an amount from one user account to another user account, maintained with the same online gaming intermediary, of the same user shall not be considered as withdrawal or deposit, as the case may be. However, when the amount is withdrawn from the user account to any other account, it shall be considered as withdrawal. It has been clarified that w.r.t deductor, any account of user which is not registered with the online game intermediary (for which he is a deductor) is an account which is not a user account and any transfer from user account to such account is a withdrawal.

- It has been clarified that no need to deduct the TDS u/s 194BA of the Act, in case of the insignificant withdrawal on the satisfaction of the below conditions:- net winnings comprised in the amount withdrawn does not exceed Rs 100 in a month; tax not deducted on account of this concession is deducted at a time when the net winnings comprised in withdrawal exceeds Rs 100 in the same month or subsequent month or if there is no such withdrawal, at the end of the financial year; and the deductor undertakes responsibility of paying the difference if the balance in the user account at the time of tax deduction under section 194BA of the Act is not sufficient to discharge the tax deduction liability calculated in accordance with Rule 133.

- Where the wininnigs are in the kind, the valuation of such winings will be done on fair market value of the winnings in kind except in following cases:’ The online game intermediary has purchased the winnings before providing it to the user. ln that case the purchase price shall be the value for winnings. The online game intermediary manufactures such items given as winnings. ln that case, the price that it charges to its customers for such items shall be the value for such winnings. It is further clarified that GST will not be included for the purposes of valuation of winnings for TDS under section 194BA of the Act.

- It may be noted that this mechanism of deduction of TDS under section 194BA read with rule 133 has been provided by the CBDT in May while the provisions are applicable w.e.f. 01 April 2023. Thus there may be possibility that there would be shortfall for such deduction on the winnings. In this regard, the CBDT clarified that where there is any shortfall in deduction of tax due to time lag in issuance of Rule 133 or this Circular, for the month of April, 2023 that shortfall may be deposited with the tax deduction for the month of May 2023 by 7th June 2023. In that case there will not be any penal consequences.

- Calculation of the amount of net winnings in case of maintaince of multiple user accounts:-

Expenses Incurred for Gifts to Customers by Company during Festivals Allowable u/s 37 of Income Tax Act:

ITAT

The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has held that the expenses incurred for gifts to customers by company during festivals would be allowable under Section 37 of the Income Tax Act, 1961. The assessee IREO Waterfront Pvt. Ltd., had incurred expenses on account of omega watches and silver articles given for Diwali gifts given as gift.The AO had disallowed the same as not meant for business purposes of the assessee by stating that the assessee failed to produce the details of persons along with reasons and confirmations to whom the expensive gifts were distributed. It was not in dispute that the aforesaid gifts were given by the assessee to its land aggregators who were identifying and brokering the land deals on behalf of the assessee company and to brokers who were affecting bulk sales for the assessee company, on the occasion of Diwali.

The assessee stated that no details were ever called for by the AO regarding this expenditure and the assessee came to know of this only from the assessment order. It was not in dispute that the assessee was in the real estate business wherein purchase of land and sale of projects was the most critical and commercially important activity and hence it was very important for the assessee to keep land aggregators and brokers in good humor.

The two-member Bench of Saktijit Dey, (Judicial Member) and M. Balaganesh, (Accountant Member) observed that It was customary to incur these expenses on various auspicious.The two-member Bench of Saktijit Dey, (Judicial Member) and M. Balaganesh, (Accountant Member) observed that It was customary to incur these expenses on various auspicious occasions especially festivals like Diwali to be given to brokers, persons who work on behalf of the assessee company, customers and suppliers of the assessee, in order to keep them in good humor. It was also a fact that by incurrence of these expenditures at the proper time like Diwali occasion would certainly strengthen the relationship of the assessee with the persons who work for the Assessee Company, customers and suppliers which in turn would enable the company to have continued relationship with the parties. The tribunal Bench deleted the disallowance on account of gifts holding that the said expenditure was for the purpose of business as per the principle of commercial expediency.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled by |

|

Income Tax Circulars

|

Circular No |

Date of Issue |

Subject |

| 09/2023 | 28/06/2023 | Order under section 119 of the Income-tax Act, 1961 for extension of time limits for submission of certain TDS/TCS Statements |

| 10/2023 | 30/06/2023 | Circular to remove difficulty in implementation of changes relating to tax Collection at Source (TCS) on Liberalised Remittance Scheme (LRS) on purchase of overseas tour program package. |

| 11/2023 | 06/07/2023 | Corrigenda to Circular No.1 0 of 2023 dated 30th June, 2023 |

Income Tax Notifications

|

Notification No |

Date of Issue |

Subject |

| 37/2023 | 12/06/2023 | Income- tax (9th Amendment)Rule,2023 notified, substituting sub-rule (2) in rule 44E, of the Income Tax Rules, 1962. |

| 38/2023 | 12/06/2023 | E-Advance Rulings (Amendment) Scheme, 2023, notified. |

| 39/2023 | 12/06/2023 | Cost Inflation Index for the FY 2023-24 notified as 348 by making amendment in relevant notification dated 05.06.2017. |

| 40/2023 | 14/06/2023 | The CBDT issues directions specifying powers and functions of various Income tax authorities for conducting e-appeal proceedings, specified under the e-Appeals Scheme vide notification no. 33 of 2023. |

| 41/2023 | 14/06/2023 | The CBDT makes amendments in the notification no. S.O. 359 dated 30.03.1988. |

| 42/2023 | 15/06/2023 | The Central Government, in consultation with the Chief Justice of the High Court of Jharkhand, designates the Courts in the State of Jharkhand, as Special Courts for the areas mentioned in this notification, for the purposes of section 280A(1) of the Income-tax Act, 1961 and section 84 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. |

| 43/2023 | 21/06/2023 | Income- tax (10th Amendment)Rule,2023 notified, making substitution in some rules and sub-rules in the Income tax Rules, 1962. |

| 44/2023 | 23/06/2023 | The Central Government approves ‘M/s Patanjali Yog Peeth Nyas, Delhi (PAN: AABTP0560H) for its university unit ‘University of Patanjali’, Haridwar’ under the category of ‘University, College or Other Institution’ for research in ‘Social Science or Statistical Research’ for the purposes of section 35(1)(iii) of the Income-tax Act, 1961 read with rules 5C and 5E of the Income-tax Rules, 1962.This Notification shall be applicable for Assessment Years 2024-2025 to 2028-2029. |

| 45/2023 | 23/06/2023 | Income- tax (11th Amendment)Rule,2023 notified, substituting some rules and sub-rules in the Income tax Rules, 1962. |

| 46/2023 | 26/06/2023 | The Central Government notifies that where the variation between the arm’s length price determined under section 92C the price at which the international transaction or specified domestic transaction has actually been undertaken does not exceed 1% of the latter in respect of wholesale trading and 3% of the latter in all other cases, the price at which the international transaction or specified domestic transaction has actually been undertaken shall be deemed to be the arm’s length price for assessment year 2023-2024. |

DGFT & CUSTOMS UPDATEBy CA. Ashit K. Shah |

|

- Notifications issued under Customs Tariff:

Notifications No

Remark

Date

39/2023

–

CustomsReduction in the import duty on refined sunflower oil and refined soyabean oil from 17.5 per cent to 12.5 per cent w.e.f. 15-06-2023 by amending N. No. 48/2021 – Customs, dated 13-10-2021. 14-06-2023 40/2023 41/2023

42/2023

Customs

Increase in the standard tariff rate of Liquefied Petroleum Gas (LPG) falling under tariff items 2711 19 10, 2711 19 20, and 2711 19 90 of the First Schedule to the Customs Tariff Act, 1975, to 15% w.e.f. 01-07-2023. Basic Custom Duty (BCD) on LPG is prescribed @ 5% w.e.f. 01-07-2023 by amending N. No. 50/2017 – Customs dated 30.06.2017

Agriculture Infrastructure and Development Cess (AIDC) rate of 15% for Liquefied Petroleum Gas (LPG) on imports w.e.f. 01-07-2023.

30-06-2023 15/2023 18/2023-

Customs

Circular

Mandatory additional qualifiers in import/export declarations in respect of certain products w.e.f. 01.07.2023 07-06-2023 30-06-2023

17/2023 –

Customs

Circular

Simplified regulatory framework for e-commerce exports of Jewellery through Courier mode. 15-06-2023 10/2023 –

DGFT

Amendment in Import Policy Condition 6 (Pet Coke) under Chapter 27 of Schedule –I (Import Policy) of ITC (HS) 2022 to allow import of Needle Pet Coke for making graphite anode material for Li-Ion battery as feedstock / raw material, and Low Sulphur Pet Coke by integrated steel plants only for blending with the coking coal in recovery type coke ovens equipped with desulphurization plant, subject to terms and conditions set out by MOEF & CC. 02-06-2023 11/2023 –

DGFT

Amendment in Import Policy and Policy Condition of Copra under ITC (HS) Code 12030000 of Chapter 12 of ITC (HS), 2022, Schedule-I, is revised from “State Trading Enterprise” to “Restricted”. 14-06-2023 12/2023 –

DGFT

Amendment in Paragraph 10.08 (ix) in the Foreign Trade Policy 2023 to amend the Policy for General Authorisation for Export of Chemicals and related Equipments (GAEC). Export of Chemicals (excluding Software and Technology) for export to specified countries as listed in Paragraph 10.16 of Handbook of Procedure is allowed on the basis of a onetime General Authorization for Export of Chemicals and related equipment (GAEC) issued by DGFT with one time validity of 5 years subject to the post export reporting of all the exports done under the authorisation.

19-06-2023 15/2023 –

DGFT

Amendment in import policy of Cigarette lighters (Pocket Lighters, gas fuelled, non-refillable) covered under CTH 96131000 & 96132000 of Chapter 96 of Schedule –I (Import Policy) of ITC (HS) 2022 is revised from “Free” to “Prohibited”. However, import shall be free if CIF value is INR 20 or above per lighter. 29-06-2023

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

Provisions relating to recording (acquisition or disposal) of Moveable and Immoveable Property of a Charitable Trust under the Maharashtra Public Trust Act, 1950.

Maintenance of a Register:

The Maharashtra Public Trust 1950 section 22B makes it mandatory in the case of a public trust,

- which is deemed to have been registered under this Act under section 28, or

- which has been registered under this Act before the date of the coming into force of the Bombay Public Trusts (Amendment) Act, 1955 (hereinafter referred to as the said date) on an application made under section 18, or

- in respect of which an application for registration has been made under section 18 and such application was pending on the said date,

the trustee of such public trust shall within three months from the said date make an application in writing for registration

of the property of the public trust in the name of such trust and shall state in the application the name of the public trust.

This effectively means that the Trustees shall ensure that the application for registration is made with 3 months on their behalf and submitted to Deputy Charity Commissioner or Assistant Charity Commissioner and the same is recorded in the register as mentioned in Section 17 i.e Schedule 1. Till the time the immoveable property is registered as above the same cannot be either let out or can be alienated/sold.

Details to be mentioned in the register:

Under Section 36B a Public Trust must maintain a register of Movable & Immovable Trust:

- A public trust shall prepare and maintain a register of all movable and immovable properties (not being property of a trifling value) of such trust in such form or forms giving all such information.

- Such register shall show the jewels, gold, silver, precious stones, vessels and utensils and all other movable property belonging to the trust with their description, weight and estimated value.

- Such register shall be prepared within three months from the expiry of the accounting year after the commencement of the Bombay Public Trusts (Amendment) Act, 1970.

- Such register shall be signed by all the trustees or by any person duly authorised by trustees in this behalf after verifying its correctness and shall be made available to the auditor for the purpose of auditing if the accounts are required to be audited under the

provisions of this Act. If the accounts are not required to be audited, the trustees shall file a copy of such register duly signed and verified.provisions of this Act. If the accounts are not required to be audited, the trustees shall file a copy of such register duly signed and verified. - The auditor shall mention in the audit report whether such register is properly maintained or not.

- Every year within three months from the finalising the accounts, the trustee or any person authorised by him shall update the register and if there are changes, they same shall be applied and approved as above.

Alienation of Immoveable Property of the Trust

Under Section 36 of the Trustees can seek permission by way of an application from the Charity Commissioner for Alienation of the Immoveable Property of the Trust. Furthermore, notwithstanding anything contained in the Trust Deed;

- no sale, exchange or gift of any immovable property, and

- no lease for a period exceeding ten years in the case of agricultural land or for a period exceeding three years in the case of non-agricultural land or a building belonging to a public trust, shall be valid without the previous sanction of the Charity Commissioner.

- © if the Charity Commissioner is satisfied that in the interest of any public trust any immovable property thereof should be disposed of, he may, on application, authorise any trustee to dispose of the property.

The important point to be noted is that the Charity Commissioner is not allowed to sanction any lease period exceeding 30 years under the Act.

The Charity Commissioner may revoke the sanction given under clause (a) or clause (b) as above on the premise that such sanction was obtained by fraud or misrepresentation made to him or by concealing from the Charity Commissioner, facts material for the purpose of giving sanction; However, No order under this section shall be passed without giving an show cause opportunity to the person in whose favour such sanction has been granted.

If, in the opinion of the Charity Commissioner, the trustee has failed to take effective steps within the period specified in Act, or it is not possible to recover the property with reasonable effort or expense, the Charity Commissioner may assess any advantage received by the trustee and direct him to pay compensation to the trust equivalent to the advantage so assessed.

However, in exceptional and extraordinary situations, where the approval was not obtained and revocation of the same may result in hardship to the Trust, a large body of persons or a bonafide purchaser for value, the Charity Commissioner may ex-post facto Sanction also if he is satisfied that:

- there was an emergent situation which warranted such transfer,

- there was compelling necessity for the said transfer,

- the transfer was necessary in the interest of trust,

- the property was transferred for consideration which was not less than prevalent market value of the property so transferred to be certified by the expert.

- there was reasonable effort on the part of trustees to secure the best price,

- the trustee action during the course of the entire transaction were bonafide and they have not derived any benefit either pecuniary or otherwise out of the said transaction and,

- the transfer was effected by executing a registered instrument if a documents is required to be registered under the law for the time being force

We thank you for the opportunity provided to us and if you have any concern regarding the above, you may send your comments on [email protected]

HEALTH INSURANCEBy Mr. Tushar P. Joshi |

|

Mediclaim is one of the most important insurance investments that an individual should make in his/her life. If you haven’t or think otherwise, this article will tell you why you must have a mediclaim policy.

I often come across people who are only interested in investing or putting money in things that will have returns- monetary returns. Then there are some who feel that certain things happen only after certain age or time in life and hence they postpones things like health cover or mediclaim and life Insurance and instead run after products that give better immediate returns.

My simple question to them is, even if we assume that one may not develop a critical illness based on their family history or age or good lifestyle or whatever (which is actually unpredictable), still what will they do if they had a sudden bout of weakness due to stress and exhaustion and suppose have to be hospitalized? Or what if they have an accident and break a leg or have to be in the hospital for a day or two? Will they always have instant cash available to settle the medical bills at the hospital? Some may, some may not, and in today’s day and age the expenses of hospitalization do not take time to shoot up each passing day. Hence it is important for you to have a mediclaim policy.

Mediclaim policies in India or Health cover provides a facility by which you can either have a cashless treatment done in the specified hospitals or if the hospitalization is an emergency, you will be reimbursed for the expenses, provided you intimate the insurer within the stipulated time frame. All those feeling the need ‘NOT’ to have a Mediclaim just because it is ‘NOT’ needed or doesn’t give “Monetary Returns”, I request them to please change their minds and think clearly for once. I Agree Mediclaim Policy does not give you monetary returns, but the cushion they give you in case you do need hospitalization, is worth every penny of the premium paid.

Also, if you are young and have started off in life with your career, chances are you won’t be able to afford any steep medical expenses, which might rise from a sudden hospitalization. Also if at this point you think that why do I need a mediclaim policy?

Forget preferences, all of sudden will you have that kind of cash with you always? You may even incur more expenses than that. This is where mediclaim comes in. Mediclaim policies or Health Insurance will save you from these sudden shocks in life.

You MUST understand that, while medicalim won’t give you any monetary returns, it will prove to be your biggest investment when the need arises, that is in times of medical emergencies. They will cover for your hospitalization expenses, surgery if required, etc. If you can spare about Rs.12000/- in a year you can get a Mediclaim policy in India for sum assured of Rs.10 Lakh for age 30 yrs. Is it too much of your yearly income? Rs.12,000 a year is about 1000/- a month or Rs.33 a day. So please get yourself a good mediclaim. Some mediclaim policies can also cover you for specific critical illness like, diabetes, Kidney failure, heart disease, cancer etc., which will reimburse you even for diagnosis of the disease and also have a medical cover for hospitalization expenses. However this comes at an extra premium and you must take them if you can afford them.

If you will think you cannot afford that Rs. 12,000/- a year, then cut down some of your expenses and get yourself a medical cover today. Even if your monthly salary is Rs. 12,000, assume, you did not get one month’s salary and ‘Invest’ that money in a good mediclaim policy. Choose a plan as per your age, requirement, dependants etc. Assess how much can you afford in terms of premium and don’t stretch too much by getting a high sum insured, but considering today’s scenario, at least get health insurance cover of Rs. 5 Lakhs to start with and later on take a critical illness cover as well.

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 750/- |

| 5 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 6 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 7 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 8 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 9 | 47th RRC Book | 250/- |

Payment Link for Publication on sale : https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2022-23

Ashit C. Shah Chairman |

Sunil D. Joshi Jt. Convenor |

Aloke R. Singh Jt. Convenor |