GSTPAM News Bulletin June 2023

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRAINTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2022-23

Respected Members,

It is 6th year of the GST act is implemented. After implementation of GST, whole fraternity of IndirectTax Practitioners and Trade are facing various challenges with regard to implementation, transition,interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various noticesrelated to ITC mismatch and so on.

We all are aware about the practical di culties we are facing while applying the rules and proceduresof the GST law and the frequent amendments to the law especially due to frequent lockdown. Withthe view to update our fellow members on the latest development in law and to discuss the practicalissues arising there from, our association has been regularly conducting Intensive Study Course. This year the Intensive Study Course is designed to enable the members to study and discuss variousissues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybridmode Intensive Study Course for the year 2022-23 from Friday, 16-09-2022 onwards, uptoJune, 2023.

The Intensive Study Course is such an academic activity of our association which is designed tofacilitate the members to study and discuss various issues in group. At the intensive study Course,one of the members acts as a group leader and leads the discussion on issues of the relevant subject/topic and one of the seniors in the profession monitors the discussion. The meetings are generally arranged ON Hybrid mode on 1st, 3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m..There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday,16-09-2022 onwards, upto June, 2023. between 3.00 p.m. – 6.00 p.m. on hybride mode onthe subject “Issues in Assessment and Recovery proceedings under GST” The topic will belead by Group Leader CA Dharmen Shah and the Monitor of CA Ashit Shah.

The group strength is restricted to a limited number of members to facilitate better interaction withinthe group. The Intensive Study Course Fee is fixed at Rs. 1,650 – including GST for Members and Rs. 1,850 – including GST for Non members. You are requested to enroll at the earliest to avoid disappointment.

Member interested to act as group leader should inform by filling up the option in the Form of “Iwish to be a group leader for the subject” and are requested to contact the Convener on the mobilenumbers mentioned- on Cell No. 9552451930/ 98211 21433/9324541329

Note :

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulatedthrough mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meetingand to come prepared for the subject, which will be helpful for the discussion.

| Pravin Shinde Chairman |

Dilip Nathani Convenor 9821121433 |

Pravin Jadhav Convenor 9324541329 |

Manakchand Baheti Convenor 9552451930 |

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGESFOR THE F.Y. 2023 –

24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate yourContinuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updateson various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages,Webinars and online access to the website www.gstpam.org. The Life Members only need to renewthe subscription charges for the GST Review. The members can also avail the benefit of discount bypaying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of theManaging Committee. If the Renewal fees for a particular year are not paid, then the member is liableto pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability uponpayment of such additional courier charges.

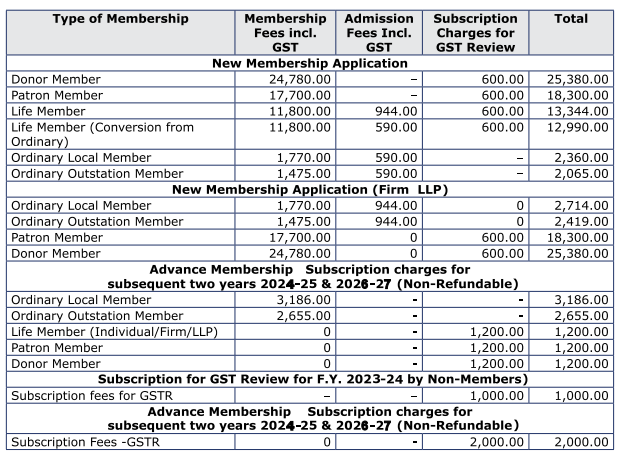

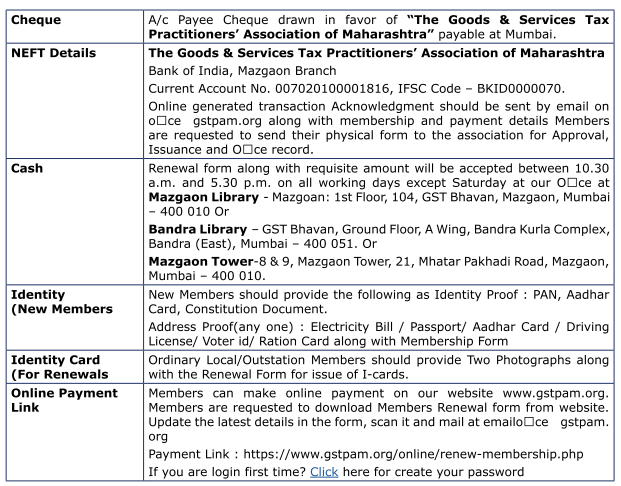

The details of Membership Subscription Fees are given below for your ready reference:

Dated:-31.01.2023

Parth Badheka

Vinod Mhaske

Hon. Jt. Secretary

INVITATION OF NOMINATIONS

| Election |

| Chief Election Officer |

| Shri. J. D. Rawal |

| Members: |

| Shri. Ramesh Gandhi |

| Shri. Pradip Kapadia |

| Shri. Ashvin Acharya |

| Shri. Shashank Dhond |

| Shri. Chirag Parekh |

| Shri. Vijay Sachiv |

| Invitee: |

| Shri. Sunil Khushalani |

(For the posts of office Bearers and Members of the Managing Committee for the year 2023-2024)

Pursuant to the appointment made by the Managing Committee as provided in Article 17(1) of the Constitution of the Association and in exercise of the powers conferred under Article 17(2), Nominations are hereby invited from the members of the Association, eligible to contest as per Article 17(3) of the Constitution, for the following posts for the year 2023-24:

- One President

- One Vice-President

- One Hon.Treasurer

- Two Hon. Jt. Secretaries

- Fifteen members of the Managing Committee

- The nomination forms for the above posts can be procured from the office of the Association or from the Library at Mazgaon and also available on GSTPAM website.

- The nomination Form should reach the office of the Association at Mazgaon Tower not later than 5.00 p.m. on Wednesday, 21.06.2023 as per article 17(2) of the Constitution. No Nomination Form will be accepted on the last day; i.e. on Wednesday, 21.06.2023 at Library at GST Bhavan, Mazgaon, Mumbai 400 010.

- As per article 17(2) of the Constitution, the last date of submission of duly filled up and signed nomination Forms is Wednesday, 21.06.2023 up to 5 p.m. Nomination Form can also be submitted through e-mail of the candidate to the specially created e-mail ID of the Association for the purpose of the election i.e. at: [email protected] and also can be filed physically at Mazgaon Library and Mazgaon Tower respectively as per the date mentioned in clause 2. The procedure of how to submit the online Nomination Form is prescribed at point No. (13) of this circular.

- Any member of the Association who is not in arrears of fees and whose delay in payment of fees has been condoned by the Managing Committee on or before the date of filing of his / her nomination Form, shall be eligible to file the nomination, subject to the provision of Article 17(3) of the Constitution which is reproduced herein below at point No. (12).

- The nomination should be proposed by one member and seconded by another member of the Association (other than the members of the Election Committee), who are not in arrears of fees and whose delay, if any, in payment of fees has been condoned by the Managing Committee on or before the date of filing of such Nomination Form, as per provision of Article 17 (4) of the Constitution. The further procedure for online submission of nomination form is explained in point No. (13) of this circular.

- No member shall contest for more than one post as per Article 17(5) of the Constitution.

- As per Article 17(6) of the Constitution, a contestant shall be entitled to withdraw his / her nomination if he / she so wishes on or before Saturday, 24.06.2023 up to 5.00 p.m. Intimation of Withdrawal Form may be done through the candidate’s e-mail ID which he / she had provided in his / her Nomination For m t o t h e As s oc i a t i on ‘ s n ew ly c r e a t e d I D f or t h e p u r p os e of e l e c t i on i . e. [email protected]. However, if any candidate wishes to withdraw his / her Nomination Form by submitting it physically he / she can do so by submitting the same at Mazgaon Library or at the Association’s Office at the address herein mentioned before by Friday, 23.06.2023 up to 5.00 p.m. Please note that physical withdrawal of Nomination Form shall be accepted at the Mazgaon Library only up to Friday, 23.06.2023 and thereafter on Saturday, 24.06.2023, the withdrawal Form shall be accepted only at Association’s Office at Mazgaon Tower up to 5.00 p.m.

- Election will be conducted as per Article 17 of the Constitution. Attention of the candidates is invited to Clause 15A inserted in Article 17, whereby a contestant, who desires recounting, shall ask in writing for recounting of votes within 15 minutes from the time of declaration of election results by the Chief Election Officer.

- Election at Mumbai shall be conducted between 11.00 a.m. and 5.00 p.m. on Friday, 21.07.2023 at the GSTPAM, Library, Room No. 104, 1st Floor GST Bhavan, Mazgaon, Mumbai-400 010.

- Election at District places shall take place on Monday, 17.07.2023 as per schedule given here in below.

- Nominations Forms Proposed / Seconded by any Member of the Election Committee shall be rendered the Nomination Form as invalid

- ELECTION RULES:Article 17 (3): Any member of the Association who is not in arrears of annual membership fees and/or of Additional Membership Fees of the Association on the date of filing of nomination and whose delay in paying such fee is condoned by the Managing Committee on or before the date of filing of nomination shall be eligible to file nomination for a post of the office bearer or a member of the managing committee.Provided that a Member of the Association shall be eligible to file the Nomination Form for following posts subject to the fulfilment of the criteria mentioned against each post in the Table given herein below:

Post

Eligibility Criteria for filing the Nomination Form

Managing Committee Member Eligible only if the Applicant has been a Member of the Association for at least two consecutive years (24 months from the date of admission) on the date of filing Nomination Form. Hon. Jt. Secretary or Hon. Treasurer Eligible only if the Applicant has been a Member of the Managing Committee for a period of at least two years. Vice-President Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. President Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. - Online Procedure to submit Election Nomination Form:Subject to Note No. (2) and (4) of this circular,the online nomination Form may be filled up and signed by the contestant, proposer and seconder and should be scanned and the same should be sent through the e-mail id of the contestant registered with GSTPAM office.

- In case of any Covid-19 like wave or any force majeure, the election committee is authorized to change or modify any of the directions related to the such election & decision of the Election Committee shall be binding on all. Any such decision shall be informed to all the members through Email/Whatsapp/GSTPAM website/ GST Review etc.

- Outstation Election Centers:

| Sr. No | Election Centre at Outstation Place-as per Article 17A | Time |

| 1. | Dhule | 11.00 AM To 02.00 PM |

| 2. | Jalgaon | 11.00 AM To 02.00 PM |

| 3. | Kolhapur | 11.00 AM To 02.00 PM |

| 4. | Nagpur | 01.00 PM To 04.00 PM |

| 5. | Nashik | 02.00 PM To 05.00 PM |

| 6. | Pune | 11.00 AM To 02.00 PM |

| 7. | Aurangabad | 11.00 AM To 02.00 PM |

| 8. | Sangli | 11.00 AM To 02.00 PM |

| 9. | Solapur | 11.00 AM To 02.00 PM |

| 10. | Thane | 02.00 PM To 05.00 PM |

| 11. | Sindhudurg | 02.00 PM To 05.00 PM |

| 12. | Ratnagiri | 11.00 AM To 02.00 PM |

Note: The list of the above outstation election centers is based on the data available with the Association on the date of Notice, the same can change if updated data is made available to the election committee.

For and on behalf of the Election Committee-GSTPAM

Sd/-

Shri J. D. Rawal

72nd ANNUAL GENERAL MEETING

NOTICE TO MEMBERS

NOTICE is hereby given to all the members of the Association that the 72nd ANNUAL GENERAL MEETING of the Association will be held on Friday, 21st July, 2023 at 5.00 p.m. at the GSTPAM Association Library Hall, Room. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

AGENDA

- To read and confirm the minutes of the last Annual General Meeting held on 15th July, 2022.

- To receive and adopt the Audited Statement of Accounts of the Association, ‘Sales Tax /GST Review’ and ‘Books and Bulletin’ for the year ended 31.03.2023 and the Balance Sheet as on that date and to receive and adopt the Annual Report of the Managing Committee for the year 2022-23(A copy of the report and accounts would be sent separately)

- To appoint an Auditor for the year ending 31.03.2024 and fix his honorarium.

- To receive the report of the Chief Election Officer and declare the result of the Election.

- To transact any other business that may be brought with the permission of the Chair.

Place: Mumbai

Dated– 21st April, 2023

Parth Badheka

Vinod Mhaske

Hon.Jt.Secretaries

NOTES:

- In case, if there is any change the same would be communicated to all the members.

- As per Article 13 of the Constitution of the GSTPAM, if the required quorum i.e. 40 members present in person is not there, the meeting shall stand adjourned and the adjourned meeting shall be held after lapse of half an hour from the appointed time at the same venue only to consider the items on the agenda circulated in the notice convening the meeting. Such adjourned meeting shall be deemed to be valid meeting with the members present forming the quorum and no other business than the one circulated shall be transacted at such adjourned meeting

- Any member desiring to seek any information on the Accounts may do so at least 3 days in advance in writing so as to enable the committee to reply to the same to the satisfaction of the member concerned.

- Resolution : Any member desiring to move any resolution, other than alterations in the Articles of the Constitution of The Goods & Services Tax Practitioners’ Association of Maharashtra, in the General Meeting, should send the same duly proposed by a member and seconded by another member so as to reach the office of Association, latest by 24th June,2023

PRIZE DISTRIBUTION TO THE CHILDREN OF THE MEMBERS OF OUR ASSOCIATION WHO HAVE OBTAINED HIGHEST PERCENTAGE FOR THE ACADEMIC YEAR 2022-23

To recognize bright students of members some prizes have been instituted by our association out of specific funds received from our members. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

The following cash prizes are to be awarded to the children of the members of our association who have obtained highest percentage of marks at the following subject or examinations held in the academic year 2022-23.

- POURANA MEMORIAL PRIZE(For securing the highest percentage of marks at the B.Com. Examination)

- GALA & GALA PRIZE(For securing the highest percentage of marks in paper of Accountancy paper at the B. Com. Examination)

- SHRI VADILAL C. SHAH PRIZE(For securing highest percentage of marks at the H. S. C. Examination)

- M/S.CHHAJED & DOSHI PRIZE(For securing highest percentage of marks at the S.S.C. Examination.)

- LATE SMT. BHANUBEN H. VORA PRIZE(For securing highest percentage of marks at the M.Com. Examination)

- MR. BHARAT D. VASANI PRIZE

(For passing C.A. Final Exam)

The members are therefore requested to send the Scan copies of the Mark sheet stating the percentage of marks obtained by their children at the Examination or subject as stated above on or before 1st July, 2023 on following email ID [email protected]

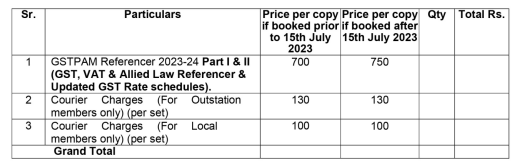

ORDER FORM FOR GSTPAM REFERENCER 2023-24

(Members are requested to take out the photocopy of the Order Form for

booking)

For Office use only

![]()

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon,

MumbaiSr.

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2023-24 as given below.

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer &Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give arequest on their letter head along with the order form. Tax Practitioner’s Associationscan place order in bulk quantity by making request on their letterhead signed by theAssociation’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery ofthe Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of………………………………………………………………………………………….(Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No……………..dated……….drawn on……….. Bank………………………….Branch, Mumbai

Signature…………………..

Membership Number………………..

Address……………………………………………………………………………………………………………………….Name………………………………………………………

Office Tel No………………………..

Residence Tel No………………………..

E-mail:………………………………..

Mobile No………………………………

PROVISIONAL RECEIPT

Received with thanks payment

of……………………………………….from………………………………….vide Cash /Card

/Cheque /NEFT/Demand Draft No.on……………………………………Date………………………drawn

on …………………Bank…………………….Branch, Mumbai.

Signature………………………..

Date……………………………..

Name of staff of GSTPAM……………………………..

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office atTower or at Mazgaon library along with requisite payment.

- For Direct Deposit / NEFT payment – Bank of India, Mazgaon – Account No.007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should besent by email: [email protected] along with duly filled form.

- Please mention your name and membership number on the reverse side of the Cheque/Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque/ DD should be drawn in the name of “THE GOODS AND SERVICES TAXPRACTITIONERS’ ASSOCIATION

OF MAHARASHTRA.

Quick Start Guide to e-invoicingCompiled by |

|

Purpose of this document

This document aims to provide the practical and important information relating to einvoice in a concise manner for use by taxpayers in their day-to-day activities. It does not purport to cover the entire gamut / legal provisions relating to e-invoicing or the process of generating e-invoice. Detailed user manual, presentations and videos for step-by-step guidance on how to generate e-invoice are available on the e-invoice portal.

Background

Notification No. 10/2023-Central Tax dated 10-05-2023 has been issued to reduce the threshold limit of aggregate turnover for applicability of e-invoicing to 5 crores w.e.f. 1st August 2023

Starting 1st August 2023, taxpayers having aggregate turnover of 5 crores or more in any of the financial years from 2017-18 to 2022-23 shall be required to report the details of their B2B invoices and B2B debit / credit notes on the e-invoicing portal and generate an Invoice Reference Number (IRN).

What is e-invoicing?

It is not a separate system of invoicing. It is merely the process of reporting your invoice details (prepared through your billing system) on the Invoice Registration Portal (IRP) and obtaining an Invoice Reference Number (IRN) and QR code from the portal. This IRN along with the QR code is to be printed on your invoice. An invoice containing the IRN and QR code is referred to as an “e-invoice”.

Necessary changes to the accounting / billing software / ERP will be made by the concerned service provider whereby your software will generate IRN and QR code using the e-invoice portal. In most cases, the software undertakes this task at the backend and the taxpayer is only required to verify the details before generating IRN.

Exemption from e-invoicing

Following persons are exempt from applicability of e-invoicing provisions even if theirturnover exceeds the threshold limit:

- SEZ units

- Insurers

- Banking companies or financial institutions including NBFC

- Goods Transport Agency (GTA) supplying services in relation to transportation of goods by road in a goods carriage

- Suppliers of passenger transportation service

- Suppliers of services by way of admission to exhibition of cinematograph films in multiplex screens

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR service providers)

In terms of the FAQs as well as Circular No. 186/18/2022-GST dated 27th December 2023,it has been clarified that the exemption from e-invoicing is with respect to the entity and not with respect to the transaction, which means that a banking company involved in banking services as well as sale of goods (such a bullion) is not required to issue e-invoice in respect of any supply made by it. Similarly, a taxpayer engaged in the business of June- 2023 GSTPAM NEWS BULLETIN 18 supply of any goods or services along with supply of GTA services is not required to issuee-invoice in respect of any supply made by it.

All such taxpayers whose turnover exceeds the threshold limit for e-invoicing ( 5 crores w.e.f. 01/08/2023) but who are exempt from issuing e-invoice are mandated to mention the following declaration on their tax invoice:

‘I/We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than the aggregate turnover notified under sub-rule (4) of rule 48, we are not required to prepare an invoice in terms of the provisions of the said sub-rule’.

Important points to remember relating to e-invoice:

- E-invoicing is applicable to invoices, debit notes and credit notes issued to registered persons (commonly known as B2B transactions). It is not applicable to B2C invoices, debit notes and credit notes as of now.

- E-invoicing is applicable to export of goods or services or both.

- As per rule 48(5) of the CGST Rules, any invoice to which the provisions of einvoicing apply, and which does not contain IRN shall not be considered as an invoice. Legal consequences of supplying goods and/or services without issuing an invoice as well as ineligibility of ITC in the hands of the recipient shall follow.

- Provisions relating to preparation of invoice in triplicate for supply of goods and in duplicate for supply of services are not applicable to an e-invoice.

- Ideally, e-invoice must be generated immediately after preparing the manual invoice and before issuing it to the customer. While the e-invoicing portal presently allows to generate IRN for old invoices without any time limit, such time limit may be put in place in the near future.

- Only a unique invoice number is accepted by the e-invoice system, which means that an invoice number cannot be reported more than once on the e-invoice portal.

- IRN, once generated, cannot be modified or deleted. However, if IRN is generated with wrong information, it can be cancelled within 24 hours of its generation. Oncecancelled, the same document (with same document number) cannot be reported again for generation of IRN. Therefore, in case of a mistake/ incorrect or wrong entry in the e-invoice, the only available option is to cancel that invoice / IRN within 24 hours and report a new document (with new number) and generate a fresh IRN.

- As per the e-invoice process document on NIC hosted on https://einvoice1.gst.gov.in/Documents/eInvoice_process.pdf, IRN can be cancelled if there is no active e-way bill for the invoice. Hence, where e-way bill is not generated or it is generated and later cancelled, then the IRN can be cancelled.

- In case your accounting / billing software does not have the provision for generating IRN, you may use the bulk generation facility made available on the e-invoice portal. In this method, a JSON file generated using the Excel based offline tool is to be uploaded on the e-invoice portal.

- On fulfilment of prescribed conditions, the obligation to prepare and issue e-invoice lies with the concerned taxpayer. As a facilitation measure, the e-invoice portal automatically enables e-invoicing for taxpayers who have crossed the prescribed turnover as per the data available on the GST portal. In case any taxpayer who is to issue e-invoice but is not enabled on the e-invoice portal, a facility hasbeen provided whereby they can make an online declaration regarding turnover and request for enabling on the portal for the required GSTIN.

- E-invoicing portal can be accessed using the link: https://einvoice1.gst.gov.in/.

- E-invoicing enablement status of a taxpayer can be checked by entering the GSTIN using the followinglink: https://einvoice1.gst.gov.in/Others/EinvEnabled

- NIC has issued a list of GSTINs who are issuing e-invoices. The same can be downloaded from https://einvoice1.gst.gov.in/Others/GSTINsGeneratingIRN

- Detailed FAQs have been hosted on the e-invoice portal which can be accessed using the following links:

- Legal / procedure related FAQs: https://www.gstn.org.in/einvoice-faqs

- Technology / Portal / APIs related FAQs : https://einvoice1.gst.gov.in/Others/Faqs

INCOME TAX UPDATESBy Adv. Ajay Talreja |

|

Proceedings initiated & orders passed in the name of dead person is invalid

Parmanand Jamnadas Kapadia (Legal Heir Mr. Harit P. Kapadia) Vs ITO (ITAT Mumbai)

Admittedly notice under section 148 has been issued and also the orders of the tax authorities have been passed in the name of the assessee, who has died in 2013 itself. It is settled proposition of law that proceedings initiated and orders passed in the name of the dead person is not valid. However, it appears that the AO was not aware of the fact of death of the assessee and the copy of death certificate is furnished for the first time before us. Hence, we feel it proper to restore all the issues to the file of the Assessing Officer for examining the veracity of the documents and also for taking appropriate decision in the light of discussions made supra. Accordingly, we set aside the order passed by the learned CIT(A) and restore all the issues to the file of theAssessing Officer for taking appropriate decision in the light of discussions made supra.

Section 194H TDS not deductible on Turnover Discount by Distributor to dealers

ITO Vs Marda Associates (ITAT Kolkata)

CIT (A) held that A.0. misunderstood that the benefit/ incentive/additional margin passed on by the appellant through credit notes was in the nature of commission. He further, misunderstood that discount/ additional margin could be given only on the invoice and not post invoice. It is submitted that the commission is paid after completion of the task/service. However, the same was paid because of the sales scheme announced on earlier occasion i.e. prior to completion of task/ service. Thus, the same was in the nature of turnover discount and, hence, not liable for deduction of TDS u/s 194H. The A.O. has also prejudiced his mind from the fact that Levi Strauss (India) Pvt. Ltd. deducted TDS u/s 194H and the appellant claimed credit of the said TDS by declaring the said incentive income as “income from incentive”. It is submitted that the appellant has already placed on record letter from Levi Strauss (India) Pvt Ltd (PB 14) wherein it has confirmed that the credit notes issued were not in the nature of commission and, inadvertently. TDS was deducted on such credit notes. Further, the appellant just in order to avail the credit of TDS declared the credit notes as income. CIT (A) further observed that In the instant case goods were invoiced by the appellant to the retailers leading to transfer of ownership in goods (with complete risk and rewards). The appellant, thereafter, did not have any right or control over the goods sold to the retailers. The retailers held the good on their own behalf and not on behalf of the appellant. Thus, they did not act as agents of the appellant. This is the acid test for deciding the nature of relationship. CIT (A) held that In view of the above facts & circumstances of the case, A.0. was not justified in making the disallowance on account of target incentive u/s 40(a) (ia) of the I.T. Act, 1961. ITAT held that the ld. CIT(A) rightly observed that the payment of incentive are made to the various parties by the assessee leading to transfer of ownership in the goods (with complete risk and rewards) the assessee in such a situation did not have any right or control over the goods sold to the retailers, as the retailers held the goods on their own behalf and not on behalf of the assessee and therefore they did not act as an agents of the assessee as such no TDS is deductible u/s 194H of the Act as it is not applicable in the case of assessee. Thus we confirmed the order passed by the ld. CIT(A) and there is no need to interfere with the findings given by the ld. CIT(A), therefore, the grounds taken by the revenue are dismissed.

Finance Advisor cannot be prosecuted for TDS Payment defaults of Company

S.M. Jain @ Shetan Mal Jain Vs State of Jharkhand (Jharkhand High Court) Prosecution case against this petitioner who was serving as Adviser Finance and other officers of HEC is that TDS deductions were not remitted to Income Tax Department on time. The main ground taken by the petitioner is that he is neither an employee of HEC, Ltd., nor he is responsible for collection of tax, on behalf of the HEC, from any contractors, employees or others. He was a retainer and not a regular employee and not responsible for deducting tax from any one. It is also hiscase that he is not responsible for depositing any amount as tax on behalf of the HEC, Ltd. It has been submitted that the complaint petition clearly suggests that the petitioner is merely an advisor. It is submitted that the petitioner is an independent consultant hired by HEC, Ltd., on contractual retainer-ship basis, for the purpose of improving the system of finance and costing. It has been further submitted that in terms of the Income Tax Act, this petitioner can never be held responsible for the alleged offence committed by the company or its employees. He submits that on the aforesaid facts no offence under the provision of I.P.C is made out against the petitioner. it is an admitted fact that the petitioner is not an employee of HEC, Ltd. The petitioner being not the employee of HEC, never had any control over the affairs of the company including the liability of deducting tax from the employees or the contractor and 4 depositing the same with the department. The petitioner neither falls within the definition of “Assessee”, “Principal Officer” nor an “Employee”. He was also not part and parcel of the management of HEC. The complaint also does not specify any overt act against the petitioner nor it has a single sentence to the effect that the petitioner is responsible for any of the acts which can attract any penal consequences nor it mentions that he was responsible for the daily affairs of the company. This Court finds that there is no material to summon the petitioner in the instant case by the Court below. Accordingly, the order taking cognizance dated 05.10.2001 passed in Complaint Case No. 41 of 2001 under Sections 276B read with 278B of Income Tax Act and Sections 409, 34 of IPC is quashed and set aside.

Income Tax on Non-Resident Indians who sell House Property in INDIA

Tax Deduction at Source (TDS) Applicability TDS shall be deducted and deposited to Government by the buyer of property at the rate of 20% for Long Term Capital Gains. Surcharge and Cess shall also be levied

For Short Term Capital gains, TDS shall be deducted and deposited to Government by the buyer of property at Income Tax Slab rates of the Seller. Surcharge and Cess shall also be levied on the applicable Tax rate.

TDS on purchase of Property from NRI is required to be deducted irrespective of the Transaction Value of the Property. Even if the value of property is less than Rs. 50 Lakhs – this TDS is required to be deducted.

The buyer should have a TAN No for deduction of TDS. TAN No is not required in case the property is purchased from a Resident Indian but it is mandatory in case the property is purchased from a Non Resident Indian.

Important Note :- The seller can file an application in Form 13 with the Income Tax Department and request them to compute his Capital Gains. The Income Tax Department will collect information from seller and will compute the Capital Gains of the seller and will issue a certificate for Nil/ Lower deduction of TDS depending on the capital gains arising on the sale of property. The seller is required to give this certificate to the buyer and the buyer will deduct the TDS as per the rates mentioned in the income tax certificate. How to save Capital Gains Tax?

NRI can claim exemption under section 54 & 54EC on Long Term Capital Gains. Exemption under Section 54 – Investment in One or Two residential houses, as the case may be in India. – Purchase of Residential House within 1 year before or 2 years after date of Transfer or Construction of House Property within 3 years from the date of Transfer. To claim exemption you have to invest only Capital Gains amount and not the entire Sale amount.

Important Note:- Exemption is withdrawn if you sell new property within 3 years from the date of purchase. – If you are unable to purchase house property until the date of filing of Income Tax Return you can deposit your gains in Capital Gains account scheme and claim exemption from Capital Gains in Income Tax Return. If the amount deposited in Capital Gains Account Scheme is not utilized for Purchase of construction of House property within stipulated time of 2 years / 3 years as the case may be then unutilized amount is charged as Capital Gains in the year in which specified period expires.

In the event of Death of an Individual, the unutilized amount is not chargeable to tax in the hands of Legal Heir of the deceased individual as it is not income.

Exemption under Section 54EC – Investment in Bonds of National Highway Authority of India (NHAI) / Rural Electrification Corporation (REC) or any other notified Bonds. – Investment in Bonds to be made within 6 months from the date of transfer to claim exemption u/s 54EC. To claim exemption you have to invest only Capital Gains amount and not entire Sale amount. A person cannot invest more than Rs. 50 lakhs in these 54EC bonds in total. The bonds bought with the capital gains amount should be held for at least 5 years. If a person sell the bonds before the end of 5 years, then the exemption granted under Section 54EC will be withdrawn and have to pay LTCG tax on the original capital gains amount.

Manual final assessment order without containing DIN is unsustainable in law

Teleperformance Global Services Private Limited Vs ACIT (ITAT Mumbai)

ITAT Mumbai held that issuance of manual final assessment order without containing DIN (Document Identification Number) is deemed to have never been issued. Accordingly, the impugned order is unsustainable in law. Facts- The assessee is engaged in the business of providing IT-enabled services. The assessee filed the ROI for AY 2017-18 declaring NIL income as per the normal provisions of the Act and book profits of Rs.1,38,16,45,117 u/s. 115JB of the Income Tax Act,1961. The return was originally processed u/s. 143(1) where the income under the normal provisions was assessed at Rs.77,37,83,380 and the income u/s. 115JB was retained at the same as in the return of income. Subsequently, the return was selected for scrutiny under CASS and the statutory notices are duly served on the assessee. Since the assessee had international transactions with its Associated Enterprise (AE) a reference was made to the Transfer Pricing Officer in order to determine the arm’s length price of the international transactions. The TPO made a TP adjustment of Rs.7,90,77,518. AO passed a draft assessment in which the assessing officer retained the disallowances made u/s. 143(1) Rs.6,05,18,177 and besides the TP adjustment, the assessing officer further made a disallowance of Rs.70,87,66,411 towards depreciation on goodwill and also disallowed the unabsorbed depreciation of Rs.1,45,93,19,199. The assessed income as per the draft assessment order was Rs.2,30,76,81,305. Aggrieved the assessee filed its objections before the DRP. The DRP gave partial relief towards the adjustment made in the intimation under Section 143(1) and upheld the TP adjustment and other disallowances made by the assessing officer. The assessing officer passed the manual final assessment order in which the income was assessed at Rs.2,25,88,39,614 as per the directions of the DRP. Conclusion- In assessee’s case there is no dispute about the fact that the impugned order u/s. 143(3) r.w.s.144C(13) of the Act has been issued manually. It is also noticed that the DIN for the order is generated through separate intimation. The argument of the ld DR that the intimation dated 02.09.2022 is part of the order and that there is no violation cannot be accepted as generating the DIN by separate intimation is allowed to be done to regularise the manual order (Para 5 of the circular) provided the manual order is issued in accordance with the procedure as contained in Para 3. On perusal of the order u/s. 143(3) r.w.s.144C(13), it is noted that the order neither contains the DIN in the body of the order, nor contains the fact in the specific format as stated in Para 3 that the communication is issued manually without a DIN after obtaining the necessary approvals. Therefore we are of considered view that the impugned order is not in conformity with Para 2 and Para 3 of the CBDT circular.

Disallowance u/s 36(1)(iii) unjustified as investments made out of interest free funds

DCIT Vs Sylvannus Builders and Developers Ltd (ITAT Ahmedabad)

ITAT Ahmedabad held that when interest free funds are available with the assessee, it can be said that investments are made out of interest free funds and hence disallowance under section 36(1)(iii) of the IncomeTax Act not justifiable. Facts- The respondent assessee is a Private Limited Company engaged in the business of Real Estate Developers and Construction. For A.Y. 2016-17, the assessee filed its Return of Income on 28.09.2015 declaring a total income of Rs. 3,11,94,560/-. The case was selected for scrutiny and assessment was completed u/s. 143(3) wherein the Assessing Officer held that the assessee in principal accepted Percentage Completion Method (PCM) and returned profit of Rs. 3,11,94,560/- whereas AO estimated the profit at 31% under Profit Margin Method (PMM) as per earlier A.Y. 2015-16 and accordingly made an addition of Rs. 2,76,69,223/-. AO also made disallowance of interest u/s. 36(1)(iii) of the Act amounting to Rs. 1,06,64,058/- and thereby demanded taxthereon. Aggrieved against the same, the assessee filed an appeal before Commissioner of Income Tax (Appeals) who deleted the additions. Being aggrieved, revenue has preferred the present appeal. Conclusion- We have given our thoughtful consideration and perused the materials available on record. The Ld. CIT(A) deleted the addition on the ground that the A.O. without rejection of books of accounts u/s. 145 of the Act, but estimated the income based on Profit Margin Method. It is settled principle of law that when the interest free funds available with the assessee were far in excess of investments, it can be said that the investments are made out interest free funds, then the disallowance made u/s. 36(1)(iii) by the A.O. is not justifiable.

Section 80G Registration cancellation- ITAT allows one more opportunity on principles of natural

justice

Dr. Shivajirao Jondhale Research Foundation Vs CIT (ITAT Mumbai)

ITAT observed that the ld. CIT(E) has issued e-notice to the assessee for the purpose of uploading informations/details pertaining to the date of commencement of the activity, date of expiry of provisional registration, details of any other law applicable for achievement of objectives and the proof of compliance of said law, proof of identity of main trustees/directors, year-wise list of donations receipt, note on activities carried out along with the supporting evidences, etc. was sought for by the ld. CIT(E). The ld. CIT(E) is said to have rejected the registration of 80G for the reason that the assessee has not complied with the said notices and that the assessee has not been registered u/s. 12AB r.w.s. 12A(1)(ac)(i)/12A(1)(ac)(iii) of the Act nor was it approved u/s.10(23C) read with clause (i)/(iii) of first proviso to the said section and that the assessee’s case was not covered under the exclusions provided u/s. 80G(5)(i) of the Act. The ld. CIT(E) has also stated that the assessee is not a regimental fund nor a non-public fund established by the armed forces of the union for the welfare of the past and the present members of such forces or dependents. The ld. CIT(E) rejected the assessee’s registration u/s. 80G on the said grounds. We are of the considered opinion that the assessee is to be given one more opportunity to present the details sought for by the ld. CIT(E) as on the principles of natural justice. We remand this issue back to the file of the ld. CIT(E) for denova consideration on merits of the assessee’s submission.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled by CA. Aloke R. Singh |

|

Income Tax Circulars

| Circular

No |

Date of Issue | Subject |

| 05/2023 | 05/05/2023 | Guidelines for removal of difficulties under sub-section (3) of section 194BA of the Income-tax Act, 1961 |

| 06/2023 | 24/05/2023 | Clarification regarding provisions relating to charitable and religious trusts |

| 07/2023 | 31/05/2023 | Condonation of delay in filing refund claim and claim of carry forward of losses under Section 119(2)(b) of the Income-tax Act,1961. |

| 08/2023 | 31/05/2023 | Revision of exceptions to monetary limits for filing appeals deferred under provisions of Section 158AB |

Income Tax Notifications

| Notification No | Date of Issue | Subject |

| 25/2023 | 10/05/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the Food Safety and Standards Authority of India’, New Delhi (PAN AAAGF0023K), an Authority established by the Ministry of Health and Family Welfare, Government

of India, in respect of the income arising to the Authority, as specified in this notification. |

| 26/2023 | 10/05/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Pune Metropolitan Region Development Authority’ (PAN AAALP1603L), an Authority constituted by the state government of Maharashtra, in respect of the income arising to that Authority, as specified in this notification. |

| 27/2023 | 16/05/2023 | The Central Government notifies that the Scheme namely the Mahila Samman Savings Certificate, 2023, made in exercise of the powers conferred by section 3A of the Government Savings Promotion Act, 1873 and notified vide notification number G.S.R. 237(E) dated the 31st March, 2023, shall be a Scheme framed for the purposes of section 194A(3)(i)(c) of the Income-tax Act, 1961. |

| 28/2023 | 22/05/2023 | Income-tax (5th Amendment) Rules, 2023 notified, inserting new rule

133 for prescribing calculation of net winnings for online games, notification of form 16 and others. |

| 30/2023 | 24/05/2023 | The Central Government notifies the following class or classes of persons, for the purposes of sub clause (ii) and proviso to clause (viib) of section 56(2) of the Income Tax Act, 1961, as specified in this notification. |

| 24/05/2023 | The CBDT notifies that the provisions of 56(2)(viib) of the Income Tax Act, 961, shall not apply to consideration received by a company for issue of shares that exceeds the face value of such shares, if the said consideration has been received from any person, by a company which fulfils the conditions specified in para 4 of the notification number

G.S.R. 127(E), dated the 19th February, 2019 issued by the Ministry of Commerce and Industry in the Department for Promotion of Industry and Internal Trade and files the declaration referred to in para 5 of the said notification of the DPIIT. |

|

| 31/2023 | 24/05/2023 | The Central Government, having regard to the maximum amount receivable by its employees as cash equivalent of leave salary in respect of the period of earned leave at their credit at the time of their retirement, whether superannuation or otherwise, hereby specifies the amount of Rs. 25,00,000 (twenty-five lakhs rupees only) as the limit in relation to employees mentioned in Section 10(10AA)(ii) of the Incometax Act, 1961, who retire, whether on superannuation or otherwise. |

| 32/2023 | 29/05/2023 | Income-tax (6th Amendment) Rules, 2023 notified, making amendments in Rules 45, 46A and in Form no. 35 of Appendix II. |

| 33/2023 | 29/05/2023 | E-Appeals Scheme, 2023 notified by the Central Government. |

| 34/2023 | 30/05/2023 | Income-tax (7th Amendment) Rules, 2023 notified, substituting subrule

(7) in Rule 11AA. |

| 35/2023 | 31/05/2023 | Income-tax (8th Amendment) Rules, 2023 notified, substituting clause

(4) in Rule 11UAC. |

| 36/2023 | 07/06/2023 | The Central Government specifies the pension fund, namely, 2743298 Ontario Limited (PAN: AACCZ0130B), as the specified person for the purposes of section 10(23FE)(iv)(c) Expln 1, in respect of the eligible investment made by it in India on or after the date of publication of this n o t i f i c a t i o n i n t h e O f f i c i a l G a z e t t e b u t o n o r before the 31st day of March, 2024 (hereinafter referred to as the said investments) subject to the fulfilment of the conditions, as per this notification. |

DGFT & CUSTOMS UPDATEBy CA. Ashit K. Shah |

|

1.Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

|

37/2023 – Customs |

Imports of Crude Soya-bean Oil whether or not degummed and Crude Sunflower Oil covered under chapter heading 1507 10 00 & 1512 1110, at zero Basic Customs Duty and zero Agriculture Infrastructure and Development Cess (AIDC) is allowed for TRQ license holders for FY 2022-23 up to the 30th June, 2023 subject to certain conditions. | 10-05-2023 |

|

01/2023 – Customs (CVD) |

Impose of Countervailing Duty (CVD) on imports of Saturated Fatty Alcohols of Carbon Chain length C10 to C18 and their blends covered under chapter heading 2905 17, 2905 19 and 3823 70 of Custom Tariff Act, originating in or exported from Indonesia Malaysia and Thailand for a period of 5 Years. | 04-05-2023 |

|

11/2023 – Customs Circular |

Amnesty Scheme for one time settlement of defaults in export obligation by Advance and EPCG authorization holders. | 17-05-2023 |

|

13/2023 – Customs Circular |

Faceless assessment – Re organization of National Faceless Assessment

Centres and Faceless assessment Groups |

31-05-2023 |

|

17/2023 – Instruction Customs |

Requirement of EPR registration certificate for import of battery as well as equipment containing battery | 18-05-2023 |

|

16/2023 – Instruction Customs |

E-waste (Management) Rules 2022 – regarding release of imported consignments of producers of 85 EEEs items (ITEW 17 to ITEW 27, CEEW 6 to CEEW 19, LSEEW 1 to LSEEW 34, EETW 1 to EETW 8, TLSEW 1 to TLSEW6, MDW 1 to MDW 10 and LIW1 to LIW 2) | 17-05-2023 |

|

15/2023 – Instruction Customs |

Acceptance of Electronic Certificate of Origin (e-COO) issued under the India-Sri Lanka FTA (ISFTA). | 03-05-2023 |

|

05/2023 – DGFT |

Amendment in import policy of Apples covered under 08081000. Import of Apples are under “prohibited” wherever the CIF Import price is less than equal to INR 50 per kilogram. Minimum Import Price (MIP) condition shall not be applicable for imports from Bhutan. | 08-05-2023 |

|

06/2023 – DGFT |

Amendment in import policy of Cough Syrup covered under 3004 shall be permitted subject to the export sample being tested and production of Certificate of Analysis (CoA) issued by any of the laboratories mentioned in Para-1 w.e.f. 01-06-2023 | 22-05-2023 |

|

07/2023 – DGFT |

Amendment in Export Policy of broken rice covered under 1006 40 00 is prohibited. However, exports will be allowed on the basis of permission granted by the Government of India to other countries to meet their food security needs and based on the request of their Government. | 24-05-2023 |

|

09/2023 – DGFT |

Amendment in Export Policy of Rice (Basmati & Non-Basmati) to EU member State and other European Countries viz. Iceland, Liechtenstein, Norway, Switzerland and UK only will require Certificate of Inspection (CoI) from EIA / EIC. Exports to remaining European Countries will no require CoI by EIC / EIA for export from the date of this notification for a period of 6 months. | 29-05-2023 |

|

10/2023 – DGFT |

Amendment in Import Policy of pet coke covered under chapter 27 for fuel purpose is “prohibited”. However, condition 6 of chapter 27 of Schedule I of ITC (HS) 2022 has been amended to allow import of Needle Pet Coke for making graphite anode material for Li-Ion battery as feedstock / raw material, and Low Sulphur Pet Coke by integrated steel plants only for blending with coking coal in recovery type coke ovens equipped with desulphurization plant, subject to terms and conditions set out by MOEF & CC. | 02-06-2023 |

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

Clarifications regarding Provisions relating to Charitable and Religious Trust issued vide Circular no 6 of 2023 dated 24th May 2023.

- Condonation of delay in filing Form no. 10A and 10ABThe due date for application in Form No. 10A by existing charitable institutions for registration or approval under sections 10(23C), 12AB and 80G(5) of the Act was earlier extended till 25th November 2022. Also, the due date for application in Form 10AB by provisionally registered charitable institutions for regular registration / approval was earlier extended till 30th September 2022.Charitable institutions not applying for registration in Form 10A / 10AB within the specified due date were subject to provisions of section 115TD from AY 2023-24 i.e F.Y. 2022-23 onwards.In this regard, the CBDT has clarified as follows:

- The due date for filing Form 10A and 10AB has been extended till 30th September 2023.

- The extension shall also apply in case of all pending applications which have already been filed but were so filed after the due date i.e., 25thNovember 2022 or 30th September 2022 as the case may be.

- Where applications in Form 10AB were rejected on account of filing of such applications after the due date, the charitable institutions may furnish a fresh application within the extended due date of 30th September 2023.

- The existing trusts which did not make an application for registration/approval (valid for 5 years) in Form no. 10A by 25th November2022 and subsequently opted for provisional registration/approval (valid for 3 years) in Form 10AB, then the relevant functionality on e-filing portal may be used to surrender Form no.10ABseeking provisional registration/approval and instead make a new application in Form No.10A for registration/ approval by 30th September2023

- Extension of due date in filing Form no. 10BD and 10BEForm 10BD (statement of donations) and Form 10BE (certificate of such donations) were required to be filed by the done on or before 31st May immediately following the financial year in which the donation is received. The said duedate to file Form 10BD and 10BE has been extended to 30th June 2023 for financial year 2022- 23.

- Clarification regarding applicability of provisional registrationWith a view to bring consistency, it has been clarified that the provisional approval / registration shall be effective from the assessment year relevant to the previous year in which the application is made.

- Clarification in case where Form no.9A and Form no. 10 is not filed by the due date Finance Act, 2023 amended section 10(23C) and 11 to provide that Form no.9A [deemed application] and Form no. 10 [secondary accumulation] should be furnished at least two months prior to the due date of furnishing return of income.The Circular has clarified that deemed application/secondary accumulation will be allowed as long as Form no.9A and 10 are furnished on or before the due date of filing return of income.

- Clarification in case where Form no.9A and Form no. 10 is not filed by the due dateThe audit report in Form no.10B/10BB requires the auditor to bifurcate certain payments or application in electronic modes and non-electronic modes.Notes to the said forms provide that electronic modes shall be the following modes referred to in Rule 6BBA:

- Credit Card.

- Debit Card.

- Net Banking.

- IMPS (Immediate Payment Service).

- UPI (Unified Payment Interface).

- RTGS (Real Time Gross Settlement).

- NEFT (National Electronic Funds Transfer); and

- BHIM (Bharat Interface for Money) Aadhar Pay.

The circular has clarified that the following are also to be regarded as electronic modes.

-

- account payee cheque,

- account payee bank draft and

- use of electronic clearing system through a bank account.

If you need any further assistance, do please feel to contact us on [email protected].

TAX PLANNINGBy Mr. Tushar P. Joshi |

|

Generally, when Tax savings are done in hurry, in a herd mentality or on the advice of a bank relationship manager, it is realised later on that a wrong choice was made.

For tax saving investments everyone gets a time from 1st April of the financial year. So, one full year is at your disposal to decide the asset where investment can be done.

Generally following are the investments considered to save income tax under section 80 C

- Public Provident Fund.

- Life Insurance Premiums

- Mutual Fund Equity Linked Savings Schemes – (Lock in for 3 years)

- Principal Repaid in Housing Loan

- Bank Fixed Deposit (Lock in for 5 years)

An amount of Rs. 150,000 is available as a deduction from your income. Generally, all salaried employees are required to submit a proof of the above investment latest by February end. My suggestion is always to plan the investment at the beginning of the year, that is, from the month of April and a proper advice from an investment advisor is suggested. It is not necessary to adhere to all what the investment advisor advises, but an advice / opinion is a must. I generally recommend certain precautions that may be taken, while selecting a financial advisor. One needs to check his experience, professional qualification, recommendation received if any.

There are certain SURE EVENTS in One’s Life like children’s education, children’s marriage and retired life. I generally suggest that the above investments for tax savings should be done in such a way that the investments done are helpful in meeting the above financial future needs.

One must also take into consideration that when investments are done, tax gets saved; in the same way, when one receives money, the amount received should be tax free.

I would also like to specify certain scientific rules which I also call as the THUMB RULES which one has to take into consideration when he sits across to do his financial planning.

Rule No 1

Out of the total income 30% needs to be saved. Out of this savings 50% has to be towards short term goals and 50 % towards long term goals which I have mentioned above as SURE EVENTS.

Rule No 2

EMI towards housing loan and vehicle loan should never exceed 30% of the income.

Rule No 3

Monthly Expenses should be managed in the balance 40 % of your income.

If one meticulously follows the above thumb rules then certainly financial difficulties will never arise.

For any financial goals that you may have, such as planning for retirement, buying a dream house or child’s education or marriage – the first step is planning.

This planning is all about investing your savings at the right moment, in the right place, with the right advice; so that you have enough wealth to turn your goals into a reality. In simple terms, building a financially strong future where you don’t have to worry about money to achieve your goals.

What can be a better time than the start of the year to put your money at work so that you can experience financial independence.

It is equally important that you take good care of your health as health is the real wealth. While money can remove financial stress, good health can help one earn more money and in turn more happiness.

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 750/- |

| 5 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 6 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 7 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 8 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 9 | 47th RRC Book | 250/- |

Payment Link for Publication on sale : https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2022-23

Ashit C. Shah Chairman |

Sunil D. Joshi Jt. Convenor |

Aloke R. Singh Jt. Convenor |

The opinions and views expressed in this Bulletin are those of the contributors.

The Association does not necessarily concur with the opinions/views expressed in this Bulletin.