GSTPAM News Bulletin May 2023

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2022-23

Respected Members,

It is 6th year of the GST act is implemented. After implementation of GST, whole fraternity of Indirect Tax Practitioners and Trade are facing various challenges with regard to implementation, transition, interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various notices related to ITC mismatch and so on.

We all are aware about the practical dificulties we are facing while applying the rules and procedures of the GST law and the frequent amendments to the law especially due to frequent lockdown. With the view to update our fellow members on the latest development in law and to discuss the practical issues arising there from, our association has been regularly conducting Intensive Study Course. This year the Intensive Study Course is designed to enable the members to study and discuss various issues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybrid mode Intensive Study Course for the year 2022-23 from Friday, 16-09-2022 onwards, upto June, 2023.

The Intensive Study Course is such an academic activity of our association which is designed to facilitate the members to study and discuss various issues in group. At the intensive study Course, one of the members acts as a group leader and leads the discussion on issues of the relevant subject/ topic and one of the seniors in the profession monitors the discussion. The meetings are generally arranged ON Hybrid mode on 1st, 3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m.. There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday, 16-09-2022 onwards, upto June, 2023. between 3.00 p.m. – 6.00 p.m. on hybride mode on the subject “Issues in Assessment and Recovery proceedings under GST” The topic will be lead by Group Leader CA Dharmen Shah and the Monitor of CA Ashit Shah.

The group strength is restricted to a limited number of members to facilitate better interaction within the group. The Intensive Study Course Fee is fixed at Rs. 1,650 – including GST for Members and Rs. 1,850 – including GST for Non members. You are requested to enroll at the earliest to avoid disappointment.

Member interested to act as group leader should inform by filling up the option in the Form of “I wish to be a group leader for the subject” and are requested to contact the Convener on the mobile numbers mentioned-on Cell No. 9552451930/ 98211 21433/9324541329

Note:

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulated through mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meeting and to come prepared for the subject, which will be helpful for the discussion.

| Pravin Shinde Chairman |

Dilip Nathani Convenor 9821121433 |

Pravin Jadhav Convenor 9324541329 |

Manakchand Baheti

Convenor 9552451930 |

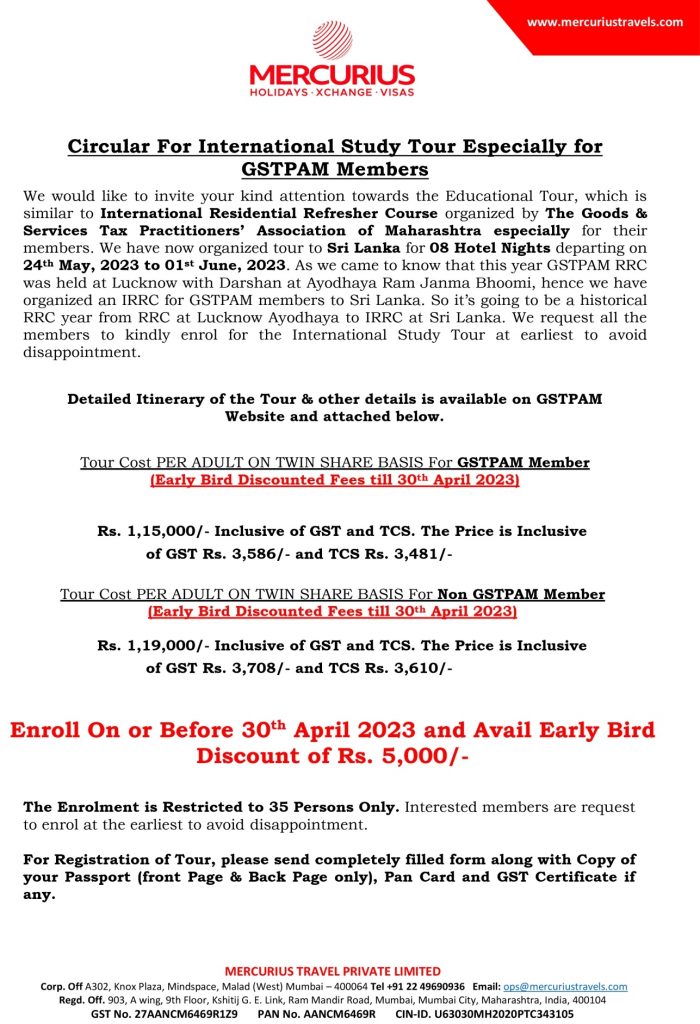

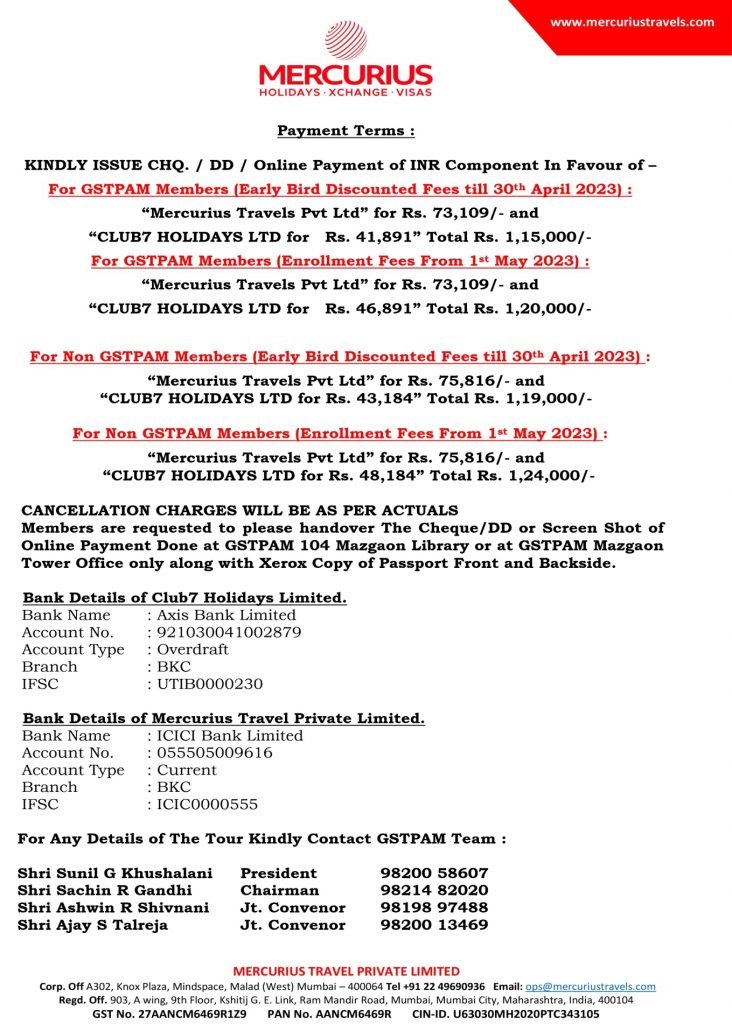

CIRCULAR FOR INTERNATIONAL RESIDENTIAL REFRESHER COURSE TO SRI LANKA

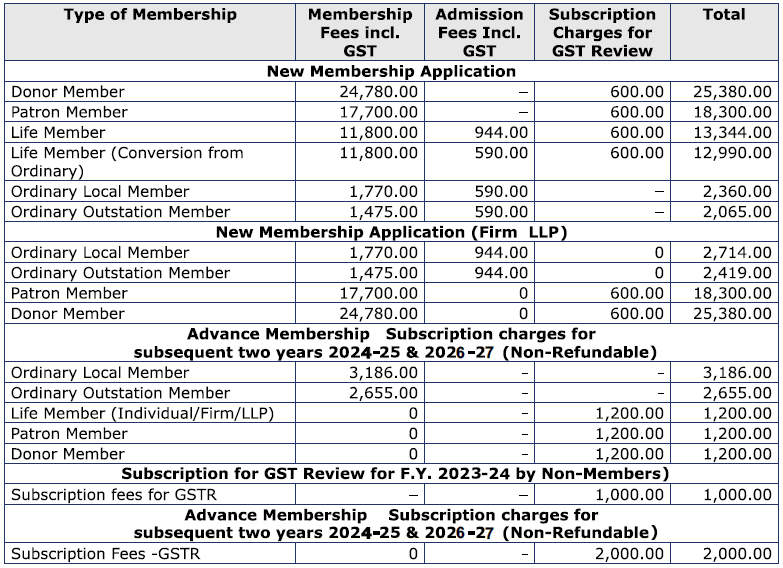

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2023 – 24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission

Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership Subscription Fees are given below for your ready reference:

Mode of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070. Online generated transaction Acknowledgment should be sent by email on once gstpam.org along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and once record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on al working days except Saturday at our Once at Mazgaon Library – Mazgoan: 1st Floor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or

Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai- 400 051. Or Mazgaon Tower-8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai 400 010. |

| Identity (New Members | New Members should provide the following as Identity Proof: PAN, Aadhar Card, Constitution Document. Address Proof(any one): Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals | Ordinary Local/Outstation Members should provide Two Photographs along. with the Renewal Form for issue of I-cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org. Members are requested to download Members Renewal form from website. Update the latest details in the form, scan it and mail at emailo ce gstpam. org

Payment Link: https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

| Dated: 31:01:2023 | Parth Badheka Vinod Mhaske Hon.Jt Secretary |

INVITATION OF NOMINATIONS

|

(For the posts of office Bearers and Members of the Managing Committee for the year 2023-2024)

Pursuant to the appointment made by the Managing Committee as provided in Article 17(1) of the Constitution of the Association and in exercise of the powers conferred under Article 17(2), Nominations are hereby invited from the members of the Association, eligible to contest as per Article 17(3) of the Constitution, for the following posts for the year 2023-24:

|

- The nomination forms for the above posts can be procured from the office of the Association or from the Library at Mazgaon and also available on GSTPAM website.

- The nomination Form should reach the office of the Association at Mazgaon Tower not later than 5.00 p.m. on Wednesday, 21.06.2023 as per article 17(2) of the Constitution. No Nomination Form will be accepted on the last day; i.e. on Wednesday, 21.06.2023 at Library at GST Bhavan, Mazgaon, Mumbai 400010.

- As per article 17(2) of the Constitution, the last date of submission of duly filled up and signed nomination Forms is Wednesday, 21.06.2023 up to 5 p.m. Nomination Form can also be submitted through e-mail of the candidate to the specially created e-mail ID of the Association for the purpose of the election i.e. at:[email protected] and also can be filed physically at Mazgaon Library and Mazgaon Tower respectively as per the date mentioned in clause 2. The procedure of how to submit the online Nomination Form is prescribed at point No. (13) of this circular.

- Any member of the Association who is not in arrears of fees and whose delay in payment of fees has been condoned by the Managing Committee on or before the date of filing of his / her nomination Form, shall be eligible to file the nomination, subject to the provision of Article 17(3) of the Constitution which is reproduced herein below at point No. (12)

- The nomination should be proposed by one member and seconded by another member of the Association (other than the members of the Election Committee), who are not in arrears of fees and whose delay, if any, in payment of fees has been condoned by the Managing Committee on or before the date of filing of such Nomination Form, as per provision of Article 17 (4) of the Constitution. The further procedure for online submission of nomination form is explained in point No. (13) of this circular.

- No member shall contest for more than one post as per Article 17(5) of the Constitution.

- As per Article 17(6) of the Constitution, a contestant shall be entitled to withdraw his / her nomination if he / she so wishes on or before Saturday, 24.06.2023 up to 5.00 p.m. Intimation of Withdrawal Form may be done through the candidate’s e-mail ID which he / she had provided in his / her Nomination For m t o t h e As s oc i a t i on ‘ s n ew ly c r e a t e d I D f or t h e p u r p os e of e l e c t i on i . e. [email protected]. However, if any candidate wishes to withdraw his / her Nomination Form by submitting it physically he / she can do so by submitting the same at Mazgaon Library or at the Association’s Office at the address herein mentioned before by Friday, 23.06.2023 up to 5.00 p.m. Please note that physical withdrawal of Nomination Form shall be accepted at the Mazgaon Library only up to Friday, 23.06.2023 and thereafter on Saturday, 24.06.2023, the withdrawal Form shall be accepted only at Association’s Office at Mazgaon Tower up to 5.00 p.m.

- Election will be conducted as per Article 17 of the Constitution. Attention of the candidates is invited to Clause 15A inserted in Article 17, whereby a contestant, who desires recounting, shall ask in writing for recounting of votes within 15 minutes from the time of declaration of election results by the Chief Election Officer.

- Election at Mumbai shall be conducted between 11.00 a.m. and 5.00 p.m. on Friday, 21.07.2023 at the GSTPAM, Library, Room No. 104, 1st Floor GST Bhavan, Mazgaon, Mumbai-400 010.

- Election at District places shall take place on Monday, 17.07.2023 as per schedule given here in below.

-

Nominations Forms Proposed / Seconded by any Member of the Election Committee shall be rendered the Nomination Form as invalid

- ELECTION RULES:

Article 17 (3): Any member of the Association who is not in arrears of annual membership fees and/or of Additional Membership Fees of the Association on the date of filing of nomination and whose delay in paying such fee is condoned by the Managing Committee on or before the date of filing of nomination shall be eligible to file nomination for a post of the office bearer or a member of the managing committee.

Provided that a Member of the Association shall be eligible to file the Nomination Form for following posts subject to the fulfilment of the criteria mentioned against each post in the Table given herein below:

| Post | Eligibility Criteria for filing the Nomination Form |

| Managing Committee Member | Eligible only if the Applicant has been a Member of the Association for at least two consecutive years (24 months from the date of admission) on the date of filing Nomination Form. |

| Hon. Jt. Secretary or Hon. Treasurer | Eligible only if the Applicant has been a Member of the Managing Committee for a period of at least two years. |

| Vice-President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

| President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

- Online Procedure to submit Election Nomination Form:

Subject to Note No. (2) and (4) of this circular,the online nomination Form may be filled up and signed by the contestant, proposer and seconder and should be scanned and the same should be sent through the e-mail id of the contestant registered with GSTPAM office.

- In case of any Covid-19 like wave or any force majeure, the election committee is authorized to change or modify any of the directions related to the such election & decision of the Election Committee shall be binding on all. Any such decision shall be informed to all the members through Email/Whatsapp/GSTPAM website/ GST Review etc.

- Outstation Election Centers:

| Sr. No | Election Centre at Outstation Place-as per Article 17A | Time |

| 1. | Dhule | 11.00 AM To 02.00 PM |

| 2. | Jalgaon | 11.00 AM To 02.00 PM |

| 3. | Kolhapur | 11.00 AM To 02.00 PM |

| 4. | Nagpur | 01.00 PM To 04.00 PM |

| 5. | Nashik | 02.00 PM To 05.00 PM |

| 6. | Pune | 11.00 AM To 02.00 PM |

| 7. | Aurangabad | 11.00 AM To 02.00 PM |

| 8. | Sangli | 11.00 AM To 02.00 PM |

| 9. | Solapur | 11.00 AM To 02.00 PM |

| 10. | Thane | 02.00 PM To 05.00 PM |

| 11. | Sindhudurg | 02.00 PM To 05.00 PM |

| 12. | Ratnagiri | 11.00 AM To 02.00 PM |

Note: The list of the above outstation election centers is based on the data available with the Association on the date of Notice, the same can change if updated data is made available to the election committee.

For and on behalf of the Election Committee-GSTPAM

Sd/-

Shri J. D. Rawal

72nd ANNUAL GENERAL MEETING

NOTICE TO MEMBERS

NOTICE is hereby given to all the members of the Association that the 72ndANNUAL GENERAL MEETING of the Association will be held on Friday, 21st July, 2023 at 5.00 p.m. at the GSTPAM Association Library Hall, Room. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

AGENDA

- To read and confirm the minutes of the last Annual General Meeting held on 15th July, 2022.

- To receive and adopt the Audited Statement of Accounts of the Association, ‘Sales Tax /GST Review’ and ‘Books and Bulletin’ for the year ended 31.03.2023 and the Balance Sheet as on that date and to receive and adopt the Annual Report of the Managing Committee for the year 2022-23(A copy of the report and accounts would be sent separately)

- To appoint an Auditor for the year ending 31.03.2024 and fix his honorarium.

- To receive the report of the Chief Election Officer and declare the result of the Election.

- To transact any other business that may be brought with the permission of the Chair.

| Place: Mumbai Dated– 21st April, 2023 |

Parth Badheka Vinod Mhaske Hon.Jt.Secretaries |

NOTES:

- In case, if there is any change the same would be communicated to all the members.

- As per Article 13 of the Constitution of the GSTPAM, if the required quorum i.e. 40 members present in person is not there, the meeting shall stand adjourned and the adjourned meeting shall be held after lapse of half an hour from the appointed time at the same venue only to consider the items on the agenda circulated in the notice convening the meeting. Such adjourned meeting shall be deemed to be valid meeting with the members present forming the quorum and no other business than the one circulated shall be transacted at such adjourned meeting

- Any member desiring to seek any information on the Accounts may do so at least 3 days in advance in writing so as to enable the committee to reply to the same to the satisfaction of the member concerned.

- Resolution : Any member desiring to move any resolution, other than alterations in the Articles of the Constitution of The Goods & Services Tax Practitioners’ Association of Maharashtra, in the General Meeting, should send the same duly proposed by a member and seconded by another member so as to reach the office of Association, latest by 24th June,2023

PRIZE DISTRIBUTION TO THE CHILDREN OF THE MEMBERS OF OUR ASSOCIATION WHO HAVE OBTAINED HIGHEST PERCENTAGE FOR THE ACADEMIC YEAR 2022-23

To recognize bright students of members some prizes have been instituted by our association out of specific funds received from our members. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

The following cash prizes are to be awarded to the children of the members of our association who have obtained highest percentage of marks at the following subject or examinations held in the academic year 2022-23.

- POURANA MEMORIAL PRIZE

(For securing the highest percentage of marks at the B.Com. Examination)

- GALA & GALA PRIZE

(For securing the highest percentage of marks in paper of Accountancy paper at the B. Com. Examination)

- SHRI VADILAL C. SHAH PRIZE

(For securing highest percentage of marks at the H. S. C. Examination)

- M/S.CHHAJED & DOSHI PRIZE

(For securing highest percentage of marks at the S.S.C. Examination.)

- LATE SMT. BHANUBEN H. VORA PRIZE

(For securing highest percentage of marks at the M.Com. Examination)

- MR. BHARAT D. VASANI PRIZE

(For passing C.A. Final Exam)

The members are therefore requested to send the Scan copies of the Mark sheet stating the percentage of marks obtained by their children at the Examination or subject as stated above on or before 1st July, 2023 on following email ID [email protected]

GST, MVAT & ALLIED LAW UPDATESCompiled |

|

| Notification under Central Tax (Rate) | ||

| Notification No. | Date of Issue | Subject |

| 05/2023- Central Tax (Rate) | 09/05/2023 | Seeks to amend notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 so as to to extend last date for exercise of option by GTA to pay GST under forward charge. |

|

Notification under Intregated Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 05/2023- Intregated Tax (Rate) | 09/05/2023 | Seeks to amend notification No. 08/2017- Integrated Tax (Rate) dated 28.06.2017 so as to to extend last date for exercise of option by GTA to pay GST under forward charge. |

| Notification under Union Territory Tax (Rate) | ||

| Notification No. | Date of Issue | Subject |

| 05/2023- Union Territory Tax (Rate) | 09/05/2023 | Seeks to amend notification No. 11/2017- Union Territory Tax (Rate) dated 28.06.2017 so as to to extend last date for exercise of option by GTA to pay GST under forward charge. |

| Instructions / Guidelines | ||

| Instructions | Date of Issue | Subject |

| Instruction No. 01/2023- GST | 04/05/2023 | Guidelines for Special All-India Drive against fake registrations – regarding |

| Notification / Trade Circular under Maharashtra Goods and Services Tax Act, 2017 (MGST) | ||

| Notification/ Circular No. | Date of Issue | Subject |

| 09 T of 2023, CBIC circular no. 191/03/2023-GST |

05/04/2023 | Clarification regarding GST rate and classification of ‘Rab’ based on the recommendation of the GST Council in its 49th meeting held on 18th February, 2023 |

| 10T of 2023 | 03/05/2023 | Generation and quoting of Document Reference Number (RFN) on communication / document pertaining to search and inspection received by the officers of the State Goods & Services Tax Department-reg. |

| Notification / Trade Circular MVAT Act 2005 | ||

| Notification/ Circular No. | Date of Issue | Subject |

| MAHARASHTRA ACT No. XVIII OF 2023. (English) |

06/04/2023 | An Act to provide for settlement of arrears of tax, interest, penalty or late fees which were levied, payable or imposed, respectively under various Acts administered by Goods and Services Tax Department and for the matters connected therewith or incidental thereto. |

| MAHARASHTRA ACT No. XVIII OF 2023 (Marathi) |

06/04/2023 | An Act to provide for settlement of arrears of tax, interest, penalty or late fees which were levied, payable or imposed, respectively under various Acts administered by Goods and Services Tax Department and for the matters connected therewith or incidental thereto. |

| No. DC(A&R)3/VAT/ MMB- 2023/1/ADM-8. dated 28th April 2023 |

28/04/2023 | Order under section 19(2) of the settlement Act, 2023 for specifying the forms and manner of the submission of Forms. |

RECENT AMENDMENTS IN GSTCompiled by CA. Aditya Surte |

|

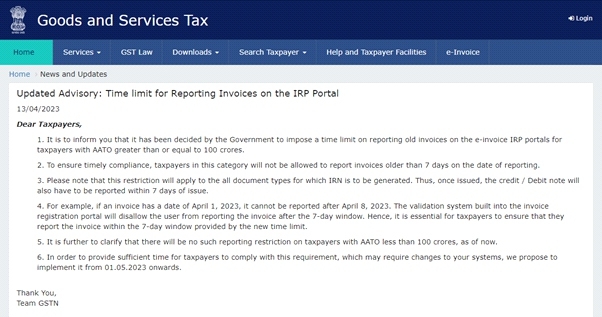

On 12-Apr-2023, GSTN issued an advisory regarding the time limit on reporting invoices on the e-invoicing IRP portal. On 13-Apr-2023, GSTN issued an updated advisory on the same subject. (Updated advisory is enclosed)

According to the updated advisory, taxpayers having annual aggregate turnover of Rs. 100 crores and above will not be allowed to report invoices / debit notes / credit notes older than 7 days on the date of reporting. In other words, for invoices, debit notes and credit notes issued to registered persons, IRN cannot be generated after 7 days from the date of invoice / DN / CN.

For example, if an invoice has a date of 01-Apr-2023, it cannot be reported after 08-Apr-2023. The validation system built into the invoice registration portal will disallow the user from reporting the invoice after the 7-day window. Hence, it is essential for taxpayers to ensure that they report the invoice within the 7-day window provided by the new time limit.

The advisory also clarifies that the reporting restriction does not apply to taxpayers having annual aggregate turnover less than Rs. 100 crores.

The restriction shall be brought into force from 01-May-2023.

Taxpayers having annual aggregate turnover above Rs. 100 crores are requested to make necessary arrangements for compliance with the new requirement.

INCOME TAX UPDATESBy CA. Ajay Talreja |

|

Reassessment proceedings without issuance of notice u/s 143(2) is bad in law

S A Syncon Infrastructure Services Pvt. Ltd. Vs ACIT (ITAT Delhi)

ITAT Delhi held that reassessment proceedings without issuance of notice under section 143(2) of the Income Tax Act is bad in law and liable to be quashed.

Facts- Assessee company has electronically filed its return of income for A.Y. 2009-10 on 26.09.2009 declaring income of Rs.1,58,12,400/-. AO has noted that notice u/s 148 of the Act was issued on 31.03.2016 after recording reasons. Thereafter, the case of the assessee was taken up for scrutiny and consequently, assessment was framed u/s 147 of the Act vide order dated 30.12.2016 and the total income was determined at Rs.2,45,19,077/-. Aggrieved by the order passed by AO, assessee carried the matter before CIT(A) who vide order dated 22.02.2018 (in Appeal No.120/17-18) granted partial relief to the assessee. Aggrieved by the order of CIT(A), Assessee is now in appeal and has raised the various grounds whereby assessee is challenging the validity of reassessment u/s 147/148 of the Act and on merits challenging the addition made. Conclusion- Hon’ble Delhi High Court in the case of PCIT vs. Silver Line (2016) 383 ITR 455 (Delhi) has held that reassessment order cannot be passed without compliance with the mandatory requirement of notice being issued by the Assessing Officer to the assessee u/s 143(2) of the Act. It has held that the requirement of issuance of such notice is a jurisdictional one and it goes to the root of the matter as far as the validity of the assessment proceedings u/s 147/148 of the Act is concerned. It has further held that the failure of the AO, in reassessment proceedings, to issue notice u/s 143(2) of the Act prior to the finalizing the reassessment order cannot be condoned by referring the Section 292BB of the Act. Held that since the notice u/s 143(2) of the Act was not issued to the assessee by the AO, the reassessment order is bad in law. We accordingly set aside the re-assessment. Since the entire assessment is quashed, we find no reason to adjudicate the appeal on other grounds as they have been rendered academic.

In absence of proof Brokerage on Sale of Property not allowable

Lakshminarayana Gupta Vs CIT(A) (ITAT Bangalore)

The solitary issue that is raised in this appeal is with regard to the disallowance of brokerage claim amounting to Rs.2,17,000/-. It is claimed that assessee had incurred brokerage of Rs. 3,10,000 regarding sale of a property. The assessee has not produced any proof/evidences to substantiate that he had paid brokerage on the sale of property. Since there is no evidence on record, ITAT confirmed the disallowance of brokerage claim amounting to Rs. 2,17,000.

Withholding of Income Tax refund for issue of section 143(2) is unjustified

Case Name : Oyo Hotels And Homes Private Limited Vs Deputy Assistant Commissioner of Income Tax (Delhi High Court)

Delhi High Court held that withholding of Income Tax refund merely because notice has been issued under section 143(2) of the Income Tax Act is unjustified and bad in law. Facts- The Petitioner filed a ROI for AY 2020-2021 declaring a loss of Rs.16,13,83,22,476/- and claimed a refund of Rs.31,46,26,494/- on account of tax deducted at source under Section 139 of the Income Tax Act, 1961. Pursuant to a de-merger and to give effect to the Scheme of Arrangement, the Petitioner filed a revised return of Income Tax for AY 2020-2021 on 27.03.2021 declaring a loss of Rs.16,70,16,05,998/- and claiming a refund of Rs.43,91,40,294/-. The Petitioner was subjected to a scrutiny assessment u/s. 143(2) of the Act by notice dated 29.06.2021 which was responded to by the Petitioner with all the necessary clarifications as sought for, on 29.07.2021. Subsequently, a notice u/s. 142(1) of the Act was sent to the Petitioner on 14.12.2021, wherein detailed information and documents were sought by the Revenue. The Petitioner submitted a response to the same on 27.12.2021. On the same day, the Petitioner received an intimation u/s. 143(1) of the Act.

which stated that a refund of Rs.33,05,84,840/- (inclusive of interest) has been calculated as due to the Petitioner. Despite the lapse of several months after the passing of the Refund Intimation, no refund was received by the Petitioner. Conclusion- Merely because a notice has been issued under Section 143(2) of the Act, it is not a sufficient ground to withhold the refund under the provisions of the Act. As has been held in Maple Logistics case, it would be wholly unjust and inequitable for the AO to withhold a refund by citing the reason that a scrutiny notice has been issued and such an interpretation of the provision would be contrary to the intent of the legislature.

No section 10AA deduction if return of income not filed before due date.

The existing provisions of the section 10AA of the Act, inter alia, provides 15-year tax benefit to a unit established in a SEZ which begins to manufacture or produce articles or things or provide any services on or after 01.04.2005. The deduction is available for units that begin operations before 01.04.2020, which has been extended to 30.09.2020 through the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 and is allowed in the specified manner therein.

2. However, the said section does not provide for the condition to file return before due date provided under sub- section (1) of section 139 of the Act for claiming deduction as is provided for similar deductions. Section 143(1) however provides that the deduction under section 10AA shall be eligible if such return is filed before the due date. Hence, it is proposed to align the two provisions by inserting a proviso to sub-section (1) of section 10AA of the Act to provide that no deduction under the said section shall be allowed to an assessee who does not furnish a return of income on or before the due date specified under sub-section (1) of section 139.

3. Further, it has been observed that there is no time- limit prescribed in the Act for timely remittance of the export proceeds from sale of goods or provision of services by SEZ Units for claiming deduction under the said section as is provided under other similar export related deductions in the Act. Hence, it is proposed to insert a new sub-section to provide that the deduction under section 10AA of the Act shall be available for such unit, if the proceeds from sale of goods or provision of services is received in, or brought into, India by the assessee in convertible foreign exchange, within a period of six months from the end of the previous year or, within such further period as the competent authority may allow in this behalf.

4. For the purpose of this newly inserted sub-section, the expression “competent authority” shall mean the Reserve Bank of India or such authority as is authorized under any law for the time being in force for regulating payments and dealings in foreign exchange.

5. Also, it is proposed that if the export proceeds from sale of goods or provision of services shall be deemed to have been received in India where such proceeds from sale of goods or provision of services are credited to a separate account maintained for the purpose by the assessee with any bank outside India with the approval of the Reserve Bank of India.

6. Further, it is proposed to substitute clause (i) of Explanation 1 of the said section to define the term “convertible foreign exchange” and give reference to new sub section (4A) in the definition of “Export Turnover”.

7. Further, it is also proposed to make consequential amendment in sub-section (11A) of section 155 of the Act, to insert section 10AA to allow the Assessing Officer to amend the assessment order later where the export earning is realized in India after the permitted period.

8. These amendments will be effective from the 1st day of April, 2024 and shall accordingly, apply in relation to the assessment year 2024-25 and subsequent assessment years.

Taxation of Stock Market Transactions

Taxes on long-term capital gains for equity and mutual funds are discussed below

– For stocks/equity – Exempt for 1st 1 lakh and 10% exceeding 1 lakh if STT is paid. If STT is not paid then LTCG is taxed at a flat rate of 20% Generally, STT is not paid on only those transactions which are not from the recognized stock exchanges.

For mutual fund – Exempt for 1st 1 lakh and 10% exceeding 1 lakh for the equity-oriented mutual fund if the fund is non-equity oriented then LTCG is taxed at a flat rate of 20%. A mutual fund is considered equity-oriented if at least 65% of the investible funds are deployed into equity or shares of domestic companies. You have to stay invested for 3 years for the investment to be considered as long-term capital gain in the case of non-equity-oriented mutual funds. When calculating capital gains in the case of non-equity-oriented mutual funds, property, gold, and others where you are taxed on LTCG, you get the indexation benefit to determine your net capital gain Taxes on short-term capital gains for equity and mutual funds are discussed below –

For stocks/equity – 15% if STT is paid. If STT is not paid then STCG is taxed as per the applicable slab rate. For mutual funds – Similar to STCG for equity delivery-based trades, any gain in investment in equity-oriented mutual funds held for lesser than 1 year is considered STCG and taxed at 15% of the gain. However, if the fund is non-equity oriented then STCG is taxed as per applicable slab rates. Long-term capital loss/Short term capital loss can be carried forward for 8 years. LTCL can only be set off from LTCG however STCL can only be set off from LTCG/STCG

Taxation for Trader Here we will discuss all aspects of taxation when trading is declared as a business income, which can be categorized as Speculative or Non-speculative business income

1. Speculative business income– Income from intraday equity trading is considered speculative.

2. Non-speculative business income– Income from trading F&O (both intraday and overnight) on all the exchanges are considered non-speculative business income. Speculative losses can be carried forward for 4 years and can be set off only against any speculative gains you make in that period. Non-speculative losses can be set off against any other business income except salary income in the same year. So, they can be set off against bank interest income, rental income, and capital gains, but only in the same year. You carry forward non-speculative losses to the next 8 years. As a trader has to show his income as Business Income so he has to prepare proper books of accounts as per section 44AA.

Calculation of Turnover In the case of Equity – Buy Value + Sale Value is considered as Turnover. Profit = 500, Buy of Reliance = 2000, Sale of Reliance = 2500. Turnover = 4500 Loss = 500, Buy of Reliance = 2000, Sale of Reliance = 1500. Turnover = 3500 In the case of Futures – Profit and Loss is considered as Turnover. Profit = 500, Buy of Reliance future = 2000, Sale of Reliance Future = 2500. Turnover = 500 Loss = 500, Buy Reliance future = 2000, Sale Reliance Future = 1500. Turnover = 500 In the case of Options – Profit and Loss + Sales Value is considered as Turnover. Profit = 500, Lot size = 25, Buy of Bank Nifty option = 300, Sale of Bank Nifty Option =

= 320. Turnover = 500 + (320 * 25) = 8500 Profit = 500, Lot size = 25, Buy of Bank Nifty option = 300, Sale of Bank Nifty Option = 280. Turnover = 500 + (280 * 25) = 7500

Audit of the Books of Accounts will be compulsory to be done if the turnover is more than 10 crores as per Section 44AB of the Income tax act 2016. If a taxpayer is both trader and investor then all the above provisions of trader and investors will apply.

Profit is taxed at 30% flat Set off of loss –

Set off can be from the same script Example- Loss in Bitcoin can not be set off from Gain in Ethereum. Loss in bitcoin can only be set off by Gain in Bitcoin.

Vague Penalty Notice Invalidates Proceedings under section 271(1)(c)

Thakur Dass (since deceased) Through legal heir Karan Harjani Vs ITO (ITAT Delhi)

It can be observed from penalty notice that the AO had failed to distinguish and inform the Assessee as to if the notice was issued for concealment of income or for furnishing inaccurate particulars and a proforma in a mechanical manner the notice was issued. The judgment relied by the ld counsel for the Assessee in the case of Ganga Iron & Steel Trading Co. Vs. CIT (supra) reiterates the settled provision of law that if notice is vague then the penalty proceedings initiated on that basis were vitiate and for that purpose Hon’ble High court relied its full bench judgment in Mohd. Farhan A Shaikh Vs. CIT (2021) 424 ITR 1. In the light of the aforesaid, the penalty proceedings are void ab initio.

‘Rummy Khelo Paisa Jeeto’ is Now Taxable under Section 115BBJ

Earlier there were no specific provision for taxation for winning from online games. Generally, no one pays on such winning and those who pays, that taxed under Income from other sources at slab rates. For how much time this winning is stay away from the eyes of income tax, so new section 115BBJ is inserted by Finance Bill, 2023 for taxing net winning from online games at 30%. It means from FY 2023-24 winning from Dream 11 will be taxable @ 30%.

Further, Section 194BA also introduced for deducting taxes on net winnings from online Games.

However, if net winning is comprised of wholly in kind or partly in cash and partly in kind & Where amount to pay TDS is not sufficient then The person responsible for deducting TDS, shall ensure before releasing the winning that tax has been paid in respect of net winnings.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled By CA. Aloke R. Singh |

|

Income Tax Circulars

| Circular

No |

Date of Issue | Subject |

| 03/2023 | 28/03/2023 | Consequences of PAN becoming inoperative as per the newly substituted rule 114 AAA |

| 04/2023 | 05/04/2023 | Clarification regarding deduction of TDS under section 192 read with sub- section (1A) of section115BAC of the Income- tax Act, 1961 |

Income Tax Notifications

|

Notification No |

Date of Issue |

Subject </td > |

| 16/2023 | 04/03/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Bhadohi Industrial Development Authority’, (PAN AAALB0141M), an Authority constituted by the state government of Uttar Pradesh, in respect of the income arising to that Authority Board, as per this notification. |

| 17/2023 | 06/04/2023 | The CBDT makes amendments in Notification no. 78/2018 dt. 05.11.2018, as per this notification. |

| 18/2023 | 10/04/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Greater Noida Industrial Development Authority’, (PAN AAALG0129L), an Authority constituted by the state government of Uttar Pradesh, in respect of the income arising to that Authority, as per this notification. |

| 19/2023 | 10/04/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Central Board of Secondary Education’, Delhi (PAN AAAAC8859Q), a Board constituted by the Central Government, in respect of the following income arising to that Board, as per this notification. This notification shall be deemed to have been applied with respect to the financial year 2013-2014. |

| 20/2023 | 10/04/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Central Board of Secondary Education’, Delhi (PAN AAAAC8859Q), a Board constituted by the Central Government, in respect of the following income arising to that Board, as per this notification. This notification shall be deemed to have been applied for the financial year 2020-2021 (for period from 01-06-2020 to 31-03-2021) and for the financial year 2021-2022 to financial year 2022-2023 and shall be applicable with respect to the financial years 2023-2024 and 2024-2025. |

| 21/2023 | 10/04/2023 | The Central Government makes amendment in the Notification no. SO. 1790 (E) dated 05.06.2017, declaring the ‘Cost Inflation Index’ for the Financial Year 2023-24 as ‘348’. |

| 22/2023 | 17/04/2023 | The Central Government makes amendment in the Notification no. 34/2020 dated 23.06.2020, by inserting paragraph 1 after clause (1) deemed to have effect from 23.06.2020. |

| 23/2023 | 21/04/2023 | In exercise of the powers conferred by clause (ii) of sub-section (1) of section 35 of the Income-tax Act, 1961 (43 of 1961) read with Rules 5C and 5E of the Income-tax Rules, 1962, the U/s 35(1) of the Income Tax Act, 1961, and Rule 5C and 5E of the Income-tax Rules, the Central Government approves ‘National Institute of Design, Ahmedabad (PAN: AAATN1137D)’ under the category of ‘University, College or Other Institution’ for ‘Scientific Research’.This Notification shall be applicable for Assessment Years 2024-2025 to 2028-2029. |

| 24/2023 | 03/05/2023 | U/s 90(1), the Central Government notifies that all the provisions of Agreement and Protocol between the Government of the Republic of India and the Government of the Republic of Chile for the elimination of double taxation and the prevention of fiscal evasion and avoidance with respect to taxes on income, signed on the 9th day of March, 2020 at Chile, shall be given effect to in the Union of India, as per this notification. |

DGFT & CUSTOMS UPDATEBy CA. Ashit Shah |

|

1.Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

| 21/2023

– Customs |

Implementation of Advance Authorisation Scheme under Foreign Trade Policy, 2023 | 01-04-2023 |

| 22/2023

– Customs |

Implementation of Advance Authorisation Scheme for deemed export under Foreign Trade Policy, 2023, 2023 | 01-04-2023 |

| 23/2023

– Customs |

Implementation of Advance Authorisation Scheme for annual requirement under Foreign Trade Policy, 2023, 2023 | 01-04-2023 |

| 24/2023

– Customs |

Implementation of Advance Authorisation Scheme for export of prohibited goods under Foreign Trade Policy, 2023 | 01-04-2023 |

| 25/2023

– Customs |

Implementation of Duty Free Import Authorisation Scheme under Foreign Trade Policy, 2023 | 01-04-2023 |

| 26/2023

– Customs |

Implementation of EPCG Scheme under Foreign Trade Policy, 2023 | 01-04-2023 |

| 27/2023

– Customs |

Exemption for import of fabrics under Special Advance Authorization Scheme under para 4.04A of Foreign Trade Policy, 2023 for manufacture and export of garments. | 01-04-2023 |

| 30/2023

– Customs |

Exempt Rice in the husk (paddy or rough), of seed quality, from export duty of 20% | 10-04-2023 |

| 32/2023

– Customs |

Amnesty Scheme for one time settlement of default in export obligation by Advance and EPCG authorization holders. | 26-04-2023 |

| 03/2023

– Customs (Add) |

Continuation of anti-dumping duty on imports of “Fishing Net” falling under Tariff Heading 5608 11 10 of the First Schedule to the Customs Tariff Act, originating in or exported from China PR, for a further period up to 09-09-2023. | 06-04-2023 |

| 04/2023

– Customs (Add) |

Impose definitive anti-dumping duty on imports of “Ursodeoxycholic Acid (UDCA)” falling under Chapter 29, originating in or exported from China PR and Korea RP for a period of 5 Years. | 10-04-2023 |

| 04/2023

– Customs (Add) |

Levy of anti-dumping duty on imports of “Vinyl Tiles other than in roll or sheet form” falling under heading 3918, originating in or exported from China PR, Taiwan and Vietnam, for a period of 5 years. | 19-04-2023 |

RETIREMENT COSTBy Mr. Tushar P. Joshi |

|

COST OF RETIRMENT

When it comes to men, women and money, much have been written about the differences between the two genders. Saving patterns, spending habits, goals and retirement-savings activities are just a few financial areas where men and women differ. Interestingly, it appears the costs of retirement also differ depending on his/her gender. As the large Baby Boomer generation moves into retirement, Identifying and understanding those differences, can help couples and singles individuals make more accurate financial plans for retirement.

WOMEN LIVE LONGER, SPEND MORE.

Many of the differences in retirement costs between men and women result simply because by and large, the life of a woman is longer than man. As of 2022, the life expectancy of a 65-year-old woman is 86, two years more than the expected lifespan of a man of that age. This means that if a husband and wife of the same age retire at the same time, the woman is likely not only to survive longer, but also will enjoy more retired period, living alone and surviving on a single income. In 2022, just 45% of woman aged 65 and over were married, while 75% of men aged 65 and over were still to be married.

HOW SPENDING PATTERNS DIFFER.

Men spend more on alcohol and electronic gadgets while women may engage in what is known as “retail therapy”, spending on clothes, shoes and food. Women-headed households are also more likely to contribute to charitable organizations. At the same time, it is widely reported that women save less than men for retirement due to lower salary and shorter period in the workforce, as a result of taking time off to look after children.

Since many women have a lower retirement income than men, they will correspondingly have less discretionary income. This may lead to a situation described as retiree paralysis. Some retirees fear spending money on necessities- what if they live longer than anticipated and the cash they spend now is needed later on for medical or living expenses?

HIGHER HEALTHCARE EXPENSES: WOMEN SEE DOCTORS MORE, FREQUENTLY .

That’s not a theoretical question. Retired women do face higher costs than men for healthcare. One reason could be that women are more likely to seek medical attention than men. In 2022, the number of medical visits for women between the ages of 65 and 74 were higher than men from the same age group. For every 1000 people, 741 visits to physicians’ consulting rooms. Outpatient hospital clinics and hospital emergency rooms were Occupied more by women, as compared to just 680 by men.

WHEN SENIORS CAN’T LIVE ALONE.

Given that women live longer than men, they are more likely to outlive their spouse and reach the age where they may require an assisted-living arrangement or a room in a nursing home.

A/2022 study shows the average annual cost for a private room was way higher than the shared room cost. Where possible, this potential cost should be factored into retirement planning.

THE BOTTOM LINE.

With women generally living longer than men, they need to budget more for retirement. Women face higher healthcare costs due to a combination of longer life spans and more frequent medical visits than men, and are more likely to need assisted-living or nursing-home care. A longer retirement is also likely to include more time living on a single income.

“DEBTS BECOME ASSETS IF YOU HAVE A PLAN. MAKE SURE INSURANCE IS PART OF THAT PLAN”.

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr.No. | Name | Price(Rs) |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 750/- |

| 5 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 6 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 7 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 8 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 9 | 47th RRC Book | 250/- |

Ashit C. Shah Chairman |

Sunil D. Joshi Jt. Convenor |

Aloke R. Singh Jt. Convenor |

| The opinions and views expressed in this Bulletin are those of the contributors. The Association does not necessarily concur with the opinions/views expressed in this Bulletin. |