GSTPAM News Bulletin November 2023

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2023-24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GSTReview, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org.The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscriptioncharges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference

| Type of Membership | Membership Fees incl. GST | Admission Fees Incl.GST | Subscription Charges for GST

Review |

Total |

|

New Membership Application |

||||

| Donor Member | 24,780.00 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,365.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

New Membership Application (Firm/LLP)

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,174.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

Advance Membership/ Subscription charges for subsequent two years 2024-25& 2025-26 (Non-Refundable)

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,665.00 | – | – | 2,665.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1200.00 | 1,200.00 |

| Patron Member | 0 | – | 1200.00 | 1,200.00 |

| Donor Member | 0 | – | 1200.00 | 1,200.00 |

Subscription for GST Review for F.Y. 2023-24 by Non-Members

| Subscription fees for GSTR | – | – | 1000.00 | 1,000.00 |

Advance Membership / Subscription charges for subsequent two years 2024-25& 2025-26 (Non-Refundable)

| Subscription Fees -GSTR | 0 | – | 2000.00 2,000.00 |

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra

Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070. Online generated transaction Acknowledgement should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at

Mazgaon Library – Mazgoan: 1st Floor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Bandra Library – GST Bhavan, Ground Floor, A Wing, BandraKurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower– 8 & 9, Mazgaon Tower, 21, MhatarPakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity

(New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) | Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I- cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org.Members are requested to download Members Renewal form from website.Update the latest details in the form, scan it and mail at email [email protected]

Payment Link : https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 21.07.2023

Vinod Mhaske

Jatin Chheda

Hon. Jt.Secretary

Guidance Cell Email ID for queries

Members can send their queries at [email protected]

ORDER FORM FOR GSTPAM REFERENCER 2023-24

(Members are requested to take out the photocopy of the Order Form for booking)

For Office use only

| Date | Receipt No. | Coupon No. | Amount |

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon,

Mumbai

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2023-24 as given below.

| Sr. | Particulars | Price per copy if booked prior to 15th July 2023 | Price per copy if booked afterto 15th July 2023 | Qty | Total RS. |

| 1 | GSTPAM Referencer 2023-24 Part I & II(GST, VAT & Allied Law Referencer & Updated GST Rate schedules). |

700 | 750 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 130 | 130 | ||

| 3 | Courier Charges (For Local members only) (per set) | 100 | 100 |

Note :

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer & Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of ………………………………………………………………………. … (Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No. ………….……dated ……….……. drawn on……………………………………………… Bank………………… Branch, Mumbai.

Signature …………………………….

Membership Number………………………….. Address.…………………………………………………

Name …………………………………………………………………………………………………………………………………………………………………………………………………………………………… Office Tel No…………………………………… Residence Tel No………………………………………

E-mail: …………………………………………. Mobile No.…………………………………………….

PROVISIONAL RECEIPT

Received with thanks payment of. ………………… from………………… vide………………………………Cash /Card /Cheque /NEFT/Demand Draft No. …………………………. Date ……………….

drawn

on…………………………………………………Bank ……………………….Branch, Mumbai.

Signature ……………………………

Date…………………………………. Name of staff of GSTPAM……………………

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office at Tower or at Mazgaon library along with requisite payment. For Direct Deposit / NEFT payment –

- Bank of India, Mazgaon – Account No. 007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should be sent by email: [email protected] along with duly filled form.

- Please mention your name and membership number on the reverse side of the Cheque / Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque / DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

48th RESIDENTIAL REFRESHER COURSE

Hotel Novotel, At Visakhapatnam

Thursday 29th February, 2024 to Sunday 3rd March,2024

The Residential Refresher Course Committee is pleased to announce its 48th Residential Refresher Course (RRC) on GST at Visakhapatnam, the port city and Industrial Centre in the State of Andhra Pradesh on the Bay of Bengal. The City is famous for its Port, Beautiful Beaches, caves, ancient Buddhist sites and the eastern ghats as well as wild life sanctuaries. It is also know as Vizag and nick named as the “City of Destiny” and the “Jewel of the East Course”.

The object of RRC is to share the essence of professional experience and expertise of the faculties they have gained over the years and where members can study in afresh at mosphere and rejuvenate.

The topics selected for RRC will cover an in-depth and practical understanding of GST Law and the challenges faced in the GST Era. In addition, the Delegates can seek views from seniors on issues they face regarding the interpretation of the law and practical difficulties. These topics are of immense importance and will help professionals/Delegates handling Indirect Tax Matters.

Along with studies, we have planned to visit various tourist places such as local sightseeing in Visakhapatnam which Includes Submarine Museum, Air Craft Museum, Kailasagiri. Simhachalam Temple, Beautifull beaches and many more.

Dates: Thursday 29th February, 2024 to Sunday 3rd March, 2024.

Venue: Hotel Novotel Varun Beach

Dr NTR Beach Rd, Krishna Nagar, Visakhapatnam, Andhra Pradesh 530002 The RRC includes 3 Nights–4 Days accommodation on double occupancy basis and the course material. The Package will start from Lunch on 29th February, 2024 and end with breakfast on 3rd March, 2024.The Paper at the RRC are as under:

|

Paper |

Topics |

Paper Writer |

Chairman |

| Paper 1 | Cross Border Transactions – Export,Import, Bond Transfer, Out to Out Transactions | CA Deepali Mehta | Eminent Faculty |

| Paper 2 | Interest, Penalties and offences under GST | CA Aloke Singh | Eminent Faculty |

| Paper 3 | Insights and How to deal with various Parameters of ASMT-10 | Adv. Amol Mane | Eminent Faculty |

| Brains’ Trust Session | Eminent Faculties |

The enrollment Fees are as under:

|

Enrollment Fees |

Amount |

GST18% |

Total |

|

|

DELEGATE FEES FOR MEMBERS |

||||

| 1 | Fees Paid on or Before 15/11/2023 | Rs.19,500/- | Rs.3,510/- | Rs.23,010/- |

| 2 | Fees Paid After 15/11/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Child rates (With Extra Bed)

*Age 6-12 years Sharing room with parents |

Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

DELEGATE FEES FOR NON- MEMBERS

| 1 | Fees Paid on or Before 15/11/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Fees Paid After 15/11/2023 | Rs.22,500/- | Rs.4,050/- | Rs.26,550/- |

| 2 | Child rates (With Extra Bed)

*Age 6-12 years Sharing room with parents |

Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

Notes:-

- In case of cancellation, the refund will be at the discretion of the RRC Committee, the same shall be refunded after completion of event.

- Hotel Check-in Time is 02.00 PM, and Check out Time is 12.00 PM. Early Check-In and Late Checkout will be subject to availability.

- Delegates joining late or leaving early in RRC should inform the Convenor / Office Bearers well in advance.

- All delegates are requested to carry their AADHAR, Driving License, Election Card, and Passport for Photo & Address identification (Any Two) for Train or Air Travel. In addition, members are requested to send a Xerox copy of his/her photo ID with address proof along with Enrollment Form.

- Delegates are advised to carry their medical kit with them.

- Room Service and items other than provided for in the Hotel package will have to be paid Directly in Cash separately by the Delegates to the hotel.

- Tea/Coffeemakers are placed for consumption in all the rooms.

- Delegates are strictly requested to deposit room keys at the reception counter on leaving.

- Please carry our water bottles during Sightseeing Program.

- Members are requested to keep their Identity Cards Compulsory during all Sightseeing programs.

- Allotment of Room shall be at the sole discretion of the RRC Committee only. Any changes required in the program will be at the sole discretion of the RRC Committee.

- We request all Delegates to get themselves fully vaccinated as per the directions of the Government of India and carry their copies of their final certificates as issued.

- Members who enroll for RRC have to renew their Membership for the year 2023-24 before registering for the event; otherwise, they will be treated as Non-Member.

We Wish You All Good Luck in Study at RRC

The Goods &Services Tax Practitioners’ Association of Maharashtra

| Pravin V. Shinde

President |

Sachin Gandhi

Chairman |

Dilip Nathani

Convenor |

Premal Gandhi & Ajay Talreja

Jt. Convenor |

| 9821482020 | 9821121433 | 9324383636/ 9820013469 |

Suggested Train Details from Mumbai to Visakhapatnam on 28th February, 2024

| From | To | Train

Number |

NAME | Departure

Time |

Arrival

Time |

| LTT

Mumbai |

Visakhapatnam | 18520 | Visakhapatnam Express | 6:55

(Wednesday) |

10:40

(Thursday) |

Train Details from Visakhapatnam to Mumbai on 3rd March, 2024.

| From | To | Train

Number |

NAME | Departure

Time |

Arrival

Time |

| Visakhapatnam | LTT Mumbai | 22847 | Vskp Ltt S F | 8:20 AM

(Sunday) |

1:00 PM

(Monday) |

| Visakhapatnam | LTT Mumbai | 18519 | Vskp Ltt Express | 11:20 PM

(Sunday) |

4:15 AM

(Tue) |

Suggested Flight Details from Mumbai to Visakhapatnam on 29th February, 2024.

|

From |

To | Flight Number | Airline

Name |

Departure

Time |

Arrival

Time |

| Mumbai | Visakhapatnam | 6E 5107, 6E 581

(Via Chennai) |

Indigo Airlines | 7:00 | 11:45 |

| Mumbai | Visakhapatnam | 6E 5246, 6E 879

( Via Hyderabad) |

Indigo Airlines | 8:00 | 11:50 |

| Mumbai | Visakhapatnam | 6E 5352, 6E 6336

(Via Bengaluru) |

Indigo Airlines | 6:05 | 13:55 |

| Mumbai | Visakhapatnam | 6E 5296, 6E 6336

(Via Bengaluru) |

Indigo Airlines | 7:30 | 13:55 |

Suggested Flight Details from Visakhapatnam to Mumbai on 3rdMarch, 2024.

| From | To | Flight Number | Airline

Name |

Departure

Time |

Arrival

Time |

| Visakhapatnam | Mumbai | AI 654 | Air India | 15:50 | 18:05 |

| Visakhapatnam | Mumbai | 6E 5247 | Indigo | 15:10 | 17:15 |

| Visakhapatnam | Mumbai | I5 1529, I5 1782

(Via Bengaluru) |

Air Asia | 11:00 | 15:50 |

| Visakhapatnam | Mumbai | 6E 5309, 6E 5255

(Via Bengaluru) |

Indigo | 14:35 | 19:50 |

ENROLMENT FORM for

48th RESIDENTIAL REFRESHER COURSE Hotel Novotel, At Visakhapatnam

Thursday 29th February, 2024 to Sunday 3rd March, 2024

To,

The Convenor,

Residential Refresher Course Committee,

The Goods and Services Tax Practitioners’ Association of Maharashtra,

8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road,

Mazgaon, Mumbai-400 010.

Dear Sir,

Kindly enroll me /us as the delegate(s) for the 48 th RRC to be held Hotel Novotel, at Visakhapatnam between Thursday 29th February, 2024 to Sunday 3rd March, 2024. My relevant details are as under

- NAME ……………………………………………………………………………………… (Age:…….yrs.)

- ADDRESS……………………………………………………………………………………………………………………………………………………………………………………………………………..

- GSTIN…………………………..………….…..………………………………………………………………..

- GSTPAM Membership No……………….…………………………………………………………………….

- Telephone (O)………………………………®……………………………………………………………………..

- Email:…………………………………………………………………………………………………………………………….

- Mobile……………………………………………………………………………………………………………………………

-

Food preference Veg Non-veg -

Whether Jain food is required Yes No - If joining with family, please fill in the following details:

- Name of Spouse:……………………………………………… (Age yrs.)

- Name of Child/Children: (i) ……………………………………(Age yrs.)(ii) ……………………………………(Age yrs.)

- My preference of Room Partner (in case of not accompanied by a family member)………….………………………………………………………………………………………………….

(Signature)

Delegate Fees:

The fees include 3 Nights – 4 Days accommodation with the course material. The enrollment Fees are as under:

|

Enrollment Fees |

Amount |

GST18% |

Total |

|

|

DELEGATE FEES FOR MEMBERS |

||||

| 1 | Fees Paid on or Before 15/11/2023 | Rs.19,500/- | Rs.3,510/- | Rs.23,010/- |

| 2 | Fees Paid After 15/11/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 3 | Child rates (With Extra Bed)

*Age 6-12 years Sharing room with parents |

Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

|

DELEGATE FEES FOR NON- MEMBERS |

||||

| 1 | Fees Paid on or Before 15/11/2023 | Rs.21,000/- | Rs.3,780/- | Rs.24,780/- |

| 2 | Fees Paid After 15/11/2023 | Rs.22,500/- | Rs.4,050/- | Rs.26,550/- |

| 3 | Child rates (With Extra Bed)

*Age 6-12 years Sharing room with parents |

Rs.11,000/- | Rs.1,980/- | Rs.12,980/- |

Member means a member of The Goods and Services Tax Practitioners’ Association of Maharashtra along with his/her Spouse and Children only. A member who enrolls for RRC has to renew the Membership for 2023-2024 before enrolling for the event.

Details of Payment

Cheque/ D.D.No……..………………… Bank……………………..…………………………..……. Branch…………….……… Dated……………………… NEFT details ….………………………………….

Bank details of GSTPAM are as under:

Bank:- Bank of India

Name:- The Goods & Services Tax Practitioners’ Association of Maharashtra

Branch:- Mazgaon, Mumbai

A/c No. :- 007020100001816 – Current A/c

IFSC Code :- BKID0000070

Notes:-

- Acknowledgment generated through online transactions should be emailed to [email protected] along with Enrollment Form and payment details.

- Online Payment Link:https://www.gstpam.org/online/event-registration.php

- Please issue the Cheque in favour of ‘‘The Goods & Services Tax Practitioners’ Association of Maharashtra’’ (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- Please tick/fill in the appropriate boxes.

- All delegates are requested to attach a xerox copy of his / her photo ID with addressproof.

- Booking for RRC will be accepted and confirmed only on payment of full delegate fees.

- Please attach your Travels details with the enrollment form and email to [email protected]

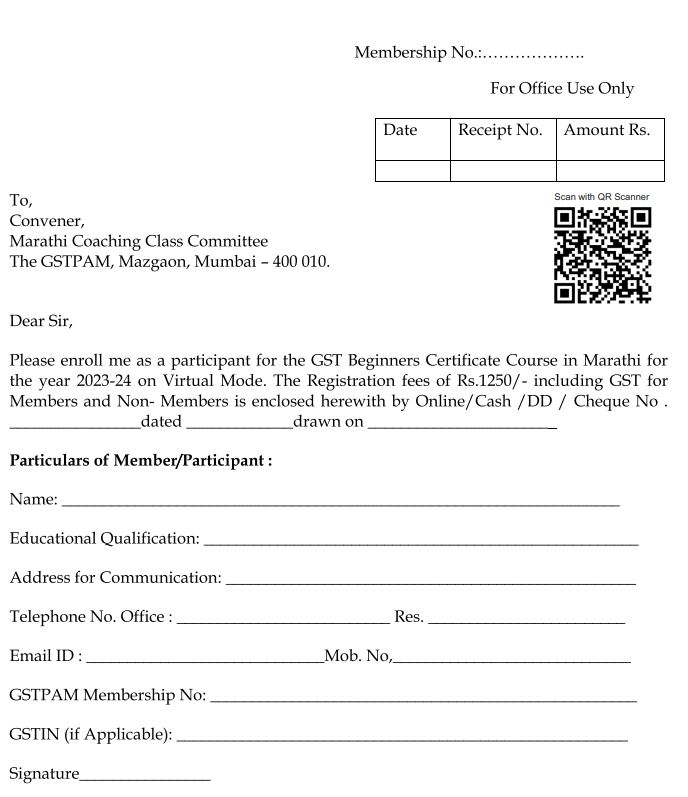

ENROLLMENT FORM FOR GST BEGINNERS CERTIFICATE COURSE IN MARATHI FOR THE YEAR 2023-24.

GST, MVAT & ALLIED LAW UPDATESCompiled by Adv. Pravin Shinde |

|

|

Notification under Central Tax |

||

| Notification No. | Date of Issue | Subject |

| 52/2023-Central Tax | 26.10.2023 | Seeks to make amendments (Fourth Amendment, 2023) to the CGST Rules, 2017 |

| 53/2023-Central Tax | 02.11.2023 | Seeks to notify a special procedure for condonation of delay in filing of appeals against demand orders passed until 31st March, 2023. |

|

Notification under Central Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 12/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 11/2017- Central Tax (Rate) dated 28.06.2017. |

| 13/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 12/2017- Central Tax (Rate) dated 28.06.2017. |

| 14/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 13/2017- Central Tax (Rate) dated 28.06.2017. |

| 15/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 15/2017- Central Tax (Rate) dated 28.06.2017. |

| 16/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 17/2017- Central Tax (Rate) dated 28.06.2017. |

| 17/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 01/2017- Central Tax (Rate) dated 28.06.2017. |

| 18/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 02/2017- Central Tax (Rate) dated 28.06.2017. |

| 19/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 04/2017- Central Tax (Rate) dated 28.06.2017. |

| 20/2023-Central Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 05/2017- Central Tax (Rate) dated 28.06.2017. |

|

Notification under Integrated Tax |

||

| Notification No. | Date of Issue | Subject |

| 05/2023- Integrated Tax | 26.10.2023 | Seeks to notify supplies and class of registered person eligible for refund under IGST Route |

|

Notification under Integrated Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 15/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 8/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 16/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 9/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 17/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 10/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 18/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 12/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 19/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 14/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 20/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 01/2017- Integrated Tax (Rate) dated 28.06.2017 |

| 21/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 02/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 22/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 04/2017- Integrated Tax (Rate) dated 28.06.2017. |

| 23/2023- Integrated Tax

(Rate) |

19.10.2023 | Seeks to amend Notification No 05/2017- Integrated Tax (Rate) dated 28.06.2017 |

|

Notification under Union TerritoryTax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 12/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 11/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 13/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 12/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 14/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 13/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 15/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 15/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 16/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 17/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 17/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 1/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 18/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 2/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 19/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 04/2017- Union territory Tax (Rate) dated 28.06.2017. |

| 20/2023-Union Territory Tax (Rate) | 19.10.2023 | Seeks to amend Notification No 05/2017- Union territory Tax (Rate) dated 28.06.2017. |

|

Circular under CGST Act |

||

|

Circular No |

Date of Issue | Subject |

| 202/14/2023-GST | 27.10.2023 | Clarification relating to export of services – sub-clause (iv) of the Section 2 (6) of the IGST Act 2017 |

| 203/14/2023-GST | 27.10.2023 | Clarification regarding determination of place of supply in various cases |

| 204/14/2023-GST | 27.10.2023 | Clarification on issues pertaining to taxability of personal guarantee and corporate guarantee in GST |

| 205/14/2023-GST | 31.10.2023 | Clarification regarding GST rate on imitation zari thread or yarn based on the recommendation of the GST Council in its 52ndmeeting held on 7th October, 2023. |

| 206/14/2023-GST | 31.10.2023 | Clarifications regarding applicability of GST on certain services. |

|

Notification / Circular Under Maharashtra Goods and Services Tax Act, 2017 (MGST) |

||

|

Notification / Trade Circular No |

Date of Issue | Subject |

| Notification No. 48/2023 -State Tax Dt.16.10.2023 | 17.10.2023 | Seeks to notify the provisions of MGST (Amendment) ordinance, 2023 (Mah. Ordinance No VII of 2023) |

| Notification No. 49/2023 -State Tax Dt.16.10.2023 | 17.10.2023 | Seeks to notify supply of online money gaming, supply of online gaming other than online money gaming and supply of actionable claims in casinos under section 15(5) of MGST Act. |

| Notification No. 50/2023 -State Tax Dt.16.10.2023 | 17.10.2023 | Seeks to amend Notification No. 66/2017 MGST Dated 15.11.2017 to exclude specified actionable claims |

| Notification No. 51/2023 -State Tax Dt.16.10.2023 | 25.10.2023 | Seeks to make amendments (Secound amendment, 2023) to MGST Rules, 2017. |

| Notification No. GST- 1023/C.R.53, E.O. No.391 Dtd. 16/10/2023 | 25.10.2023 | Ms. Priya Jadhav has been appointed as member of Advance Ruling Authority in the place of Mr. M. Ram Mohan Rao. |

| 23T of 2023 CBIC

Circular No. 202/14/2023-GST |

06.11.2023 | Clarification relating to Export of services – Sub Clause (iv) of the section 2(6) of the IGST Act 2017. |

| 24T of 2023 CBIC

Circular No. 203/15/2023 -GST |

06.11.2023 | Clarification regarding determination of place of supply in various cases |

| 25T of 2023 CBIC

Circular No. 204/16/2023 -GST |

06.11.2023 | Clarification on issues pertaining to taxability of personal guarantee and corporate guarantee in GST. |

| SUMMARY OF RECENT ADVANCE RULING UNDER GST

Compiled by CA Aditya Surte |

|

- Appellate Authority for Advance Rulings, while dealing with an appeal against the order of the Authority Advance Rulings dealing with disallowance of ITC on various expenses incurred by the Appellant for construction of its new building, held as follows:

- Central air conditioner becomes a part of building once it is installed in a building, therefore, it is an immovable property and it ceases to fall under category of plant and machinery, hence, ITC on supply of central air conditioner is not available in terms of section 17.

- Lift/elevator is an integral part of immovable property and after installation, it becomes a part of immovable property, therefore, it is an immovable property and it ceases to fall under category of plant and machinery, hence, ITC on supply of lift/elevator is not available in terms of section 17.

- Electrical fittings on installation, become a part of building which is constructed by appellant- assessee; therefore, it becomes an immovable property and ITC on same is not available terms of section 17.

- Roof Solar Plant is not permanently fastened to building constructed by appellant-assessee; thus, it qualifies as a plant and machinery and is not an immovable property, therefore, it is not covered under blocked credit as mentioned in section 17; Appellant is eligible for ITC on installation of roof solar plant.

- Where fire extinguishers are permanently attached to building and once fire extinguishers are fitted in building, they cease to be a movable property, therefore, it becomes an immovable property and ITC for same is not available in terms of section 17.

- Where Appellant-assessee is constructing a new building and incurring cost on professional services of architect and interior decorator, the same should be capitalised as per Accounting Standard 10, since appellant-assessee did not capitalise the professional fees, therefore, ITC for same is blocked u/s(Gujarat Appellate Authority for Advance Rulings in Order No. GUJ/GAAAR/APPEAL/2023/05, decided on 04/10/2023 in the case of Varachha Co-op. Bank Ltd.)

- Where RWA collects common area electricity charges from members on actual basis and there is no additional loading of any nature on actual charges, then in such case cost of electrical energy supplied by applicant to its members as a pure agent is not taxable at hands of assessee.(Telangana Advance Ruling Authority in Order No. 18/2023 in A.R.Com/10/2023, decided on 29/09/2023 in the case of NCC Urban One Apartment Owners Mutual Aided Co-op. Society Ltd.)

- Services provided to an educational institution, relating to admission to, or conduct of examination, such as online testing service, result publication, printing of notification for examination, admit card and question papers etc., are exempt from GST as per Notification No. 12/2017-Central Tax (Rate). Composite supply involving principal supply of printing pre-examination items like OMR sheets, answer sheets, marks card to an educational institution is also exempt from GST. Printing of post examination items like grade card, certificates to educational boards of up to higher secondary is exempt from GST. Scanning and processing results of examinations is also exempt from GST.(Telangana Advance Ruling Authority in Order No. 16 of 2023, decided on 22/09/2023 in the case of V. S. Hi-Tech Security Forms Pvt. Ltd.)

- For setting up / expanding its manufacturing facility, applicant entered into an MoU with Vapi Enterprises Ltd. (VEL) to transfer leasehold rights in industrial plot held by VEL by virtue of a 99-year lease agreement entered into by VEL with Gujarat State Industrial Development Corporation (GIDC). In terms of said MoU, applicant would be required to deposit an advance equivalent to 40% of total consideration at time of signing along with applicable GST and tax invoice would be issued by VEL on receipt of Final Transfer Order from GIDC. Held that applicant is not entitled to take ITC of CGST and SGST paid by them on services received from VEL in the form of transfer of its rights in leasehold land owned by GIDC in terms of sec. 17(5)(d) of the CGST Act.(Gujarat Authority for Advance Rulings in Advance Ruling No. GUJ/GAAR/R/2023/29, decided on 24/08/2023 in the case of Bayer Vapi Pvt. Ltd.)

- Herbal body oil being commonly understood as a ‘preparations for care of skin’ is to be considered to be a cosmetic product used to get soft and smoother skin and not considered as a medicament used for treatment or prevention of any disease or ailment; same would be covered under Heading 3304 and taxed accordingly.(West Bengal Authority for Advance Rulings in Order No. 19/WBAAR/2023-24, decided on 10/08/2023 in the case of Indranil Chatterjee)

“Dream is not that which you see while sleeping, it is something that does not let you sleep.”

– Dr. Abdul Kalam

| GIST OF TRIBUNAL JUDGEMENTS (VAT)

Compiled by CA Rupa Gami |

|

- M/s P.G.Shah & Co. in Vat Second Appeal No. 40 of 2021 dated 10.01.2023Revised return under MVAT Act and Refund application in Form 501 were filed. However, the refund was rejected on the ground that the revised return based on which refund application was filed, was delayed and therefore, it was not a return. Trade Circular No. AMD-1006/1A/Adm-3, 23T of 2006 dated 11.09.2006 was referred which specifically provided that if the return or revised return is filed after the prescribed date of filing of the last return, then the period of six months for grant of refund shall be counted from the date of filing of such return. Further, reference was made to Prasam Exports vs State of Maharashtra in Vat S.A. No. 215 dated 03.10.2016 where it was observed that the revised return though filed late, the same cannot be ignored. Also, the Tribunal relied on the Bombay High Court judgement in the case of Kisanlal Rajmal dated 20.11.1979 where the Court observed that it would not be right of the Sales Tax Officer who ignored that “returns who seek to assess the case as if no returns had been filed.” Matter was remanded. (Pettioner represented by Adv. C.B. Thakar)

- M/s Grovers Pvt. Ltd. In Vat S.A. No. 638 and 639 of 2019 dated 20/01/2023Set off was disallowed for the period 2007-08 on the ground of non-submission of ledger confirmations. Relying on Trade Circular No.46T of 2019 in Para 5 where the Commissioner has given directions to allow the ITC for the period 2007-08 on verification of tax invoices and books of accounts of the dealer and there is no mention of production of ledger confirmations, the matter was remanded. ( Petitioner represented by Adv. C. B. Thakar )

- M/s Chetak Steel and Shree Sai Rolling Mill in Vat S.A. No. 268, 269 and 270 of 2018 dated 20.01.2023Set off was disallowed using outside material. Copies of the same were not delivered to the appellant and opportunity for cross examination also was not granted. Since the opportunity of hearing and cross examination was not given in assessment and in first appeal and the material relied upon for coming to the satisfaction of the non-payment by vendors of the appellant or about allegation of hawala purchases is not delivered to the appellant along with the notice it was thought fit to remand the case to meet the ends of justice. (Petitioner represented by Adv. C. B. Thakar)

- Rashtriya Metal Industries in Vat S.A.No. 22of 2022 dated 23.01.2023The appellant received the goods for labour job from parties outside Maharashtra. After completing the labour job, the goods were dispatched to the sender of the goods who had given the goods for job work. The appellant received labour charges. F Forms were received for the value of labour charges only. However, it is the goods which are transferred and therefore, the F Forms should have been received for the value of goods. Thus, for admission of appeal, the predeposit has to be made of the entire amount of outstanding tax less the part payment already made. (Petitioner represented by Adv. Nitin Shah)

- Hindustan Aeronautics Ltd. in Stamp No. 32-47 of 2022 dated 27/01/2023Since it was the second round of litigation, it was contended by the appellant that 10% of part payment is not applicable. However, the Tribunal observed that there was nothing prescribed in the MVAT Act about any number of rounds of litigation. Relying on the larger bench judgement of Bombay High Court in the case of United Projects decided on 12th July, 2022 where the constitutional validity of the new sub-sections 26(6A), (6B) and (6C) which were inserted by Mah. Act No. XXXI of 2017 dated 15th April, 2017 was upheld, it was mandatory to make the part payment of 10% for admitting the appeal. (Petitioner represented by CA Sujata Rangnekar)

INCOME TAX UPDATESCompiled By By Adv. Ajay Talreja |

|

Tax Implication on Gifts Under Section 56(2)(x)(b) of Income Tax Act, 1961

Everyone loves gifts, especially when received, but most of them are unaware of income tax implication on the gifts. There are number of occasions in which gifts are exchanged.

we will discuss provisions relevant with taxation of gifts in the hands of individual. First of all, receiver must ensure that gift is from genuine source and is not involving any black money and proceeds of crime. It may be advisable particularly in case of the high value gift that the gift must be registered through a gift deed by paying required stamp duties as prescribed by concerned State Government. It will enable recipient to prove the genuineness of the transaction as a gift and not sale -purchase transaction when scrutiny arises from the tax department. Income Tax Act defines taxable gifts as under “gift means property which is a capital asset of the assessee (i.e., recipient), namely, Money, Immovable property being land or building or both, and Movable property being shares and securities, jewelry, archaeological collections, drawings, paintings, sculptures, any work of art or bullion” received without consideration or for an inadequate consideration.

Tax Free Gift Received from the specified relative. This is further explained in next paragraph. Gift received from non-relative & relative on the occasion of marriage of the receiver are exempt from tax. It is important to note that the gift received from non-relative on other occasions like birthday, anniversaries and housewarming will attract tax if the aggregate value of gift exceeds 50,000. Gifts received by way of will or inheritance are exempted from tax. Gifts received in contemplation of death of the donor (i.e., gifts given by a person in anticipation of his/ her death in the near future). Gift received from a local authority, charitable trust, foundation or university or other educational institution or hospital or other medical institution. Property received by way transaction not regarded as transfer under section 47(i)/(iv)/(v)/(vi)/(vib)/(vid)/(vii). Gift from relatives Gift received from specified relative is exempt from income-tax in the hands of receiver.

Taxable gifts Other than above maintained exempt category, the following kind of gifts are taxable in the hands of the recipients:

Money: – This gift could be given in cash/cheque/electronic mode. If the aggregate value of money gift received during the year by an individual exceeds RS 50,000, the whole of the aggregate value of such sum is taxable as “income from other sources” in the hands of recipient. The important point to be noted in this regard is the taxability of the gift is determined on the basis of the aggregate value of gift received during the year and not on the basis of individual gift.

Movable Property:-

If movable property is received without consideration: The “aggregate fair market value” of movable property gift on the date of receipt would be taxed as the income of recipient in the year of receipt, if it exceeds Rs.50,000. If movable property is received for inadequate consideration: If the difference between the “aggregate fair market value” and inadequate consideration exceeds 50,000, such difference would be taxed as the income of the recipient in the year of receipt. Movable property is a capital asset of the recipient namely, – shares and securities, jewelry, archaeological collections, drawings, paintings, sculptures, any work of art or bullion. It is important to note that the movable property gift would be taxable only if such property is in the nature of a capital asset of the recipient and not stock-in-trade, raw material or consumable stores of any business of the recipient. In this case also the taxability of the movable property gift is determined on the basis of the aggregate value of gift received during the year and not on the basis of individual gift.

Immovable Property:– Land and/or building may be acquired by an individual without consideration or for an inadequate consideration. (1) When property is received without consideration (i.e., without payment), and the stamp duty value (i.e., the values adopted by the authorities for payment of stamp duty) of such property exceeds 50,000, the entire stamp duty value of the property would be taxable in the hands of the beneficiary. In this case, the limit of 50,000 applies per property acquired/received. (2) If property is acquired for an inadequate consideration and difference between the stamp duty value and cost of acquisition is more than the higher of 50,000 and 10% of the consideration, then the stamp duty value in excess of the cost of acquisition would be taxable as income in the hands of beneficiary. When such immovable property is subsequently sold, the cost of acquisition for the computation of capital gains will be based on the value considered under section 56(2)(x)(b). A question may arise regarding which stamp duty value will be considered for the determination of the taxable imcome under section 56(2)(x)(b) when the date of the agreement fixing the consideration differs from the date of registration of the property acquired for an inadequate consideration. This question gives rise to two possible scenarios. In the first scenario, where token money has been paid by the acquirer on or before the date of entering into the agreement by way of account payee cheque or account payee bank draft or the use of electronic clearing systems such as IMPS, UPI, RTGS, NEFT, Net banking, debit card, credit card, or BHIM Aadhar Pay. In this case, the stamp duty value as of the date of entering into the agreement will be considered for determining taxable income under section 56(2)(x)(b). In the second scenario, token money has been paid by the acquirer on or before the date of agreement not by way of the mode prescribed in the first scenario. In this case, the stamp duty value as of the date of property registration will be considered for determining taxable income under section 56(2)(x)(b). The taxability of the immovable property gift is determined on an individual acquisition basis.

Taxation of gifts received by NRIs

Non-resident Indian (NRIs) will have to pay taxes on gifts received in India, or accruing or arising in India, or deemed to accrue or arise in India. Gift in the hands of NRIs will be charged to tax under the head income form other sources. A resident gift-giver has to deduct tax at a rate of 30% when giving a gift to an NRI, but only when the value of the gift exceeds 50,000. However, when a gift is given by a resident to another resident, there is not requirement to deduct tax at source (TDS).

Representation on adjustments (over & above 20% of disputed demand) by CPC

The Karnataka State Chartered Accountants Association (KSCAA) has submitted a formal representation to the Commissioner of Income Tax in Bengaluru, challenging the Central Processing Centre’s (CPC) tax adjustments that have created financial distress for taxpayers. The association asserts that the CPC’s actions undermine both legal principles and the intentions behind CBDT guidelines. Legal Provisions: According to Section 220(6) of the Income Tax Act of 1961, if a taxpayer has filed an appeal under Section 246 or 246A, the Assessing Officer (AO) may allow the disputed amount to remain unpaid until the appeal is settled. In 2016 and 2017, the Central Board of Direct Taxes (CBDT) even relaxed this rule, allowing a stay on demand subject to 15% and later 20% pre-payment of the disputed amount. The Issue: Taxpayers who have abided by the rules, filed their appeals, and paid the 20% pre-payment are finding that CPC is still adjusting their other years’ refunds against the disputed amounts. This action contradicts the guidelines and judgments that are meant to offer a reprieve to taxpayers awaiting the outcome of their appeals. It also affects the taxpayers’ financial stability.

Natural Justice Violated: The KSCAA alleges that these actions violate the principles of natural justice. The notices proposing adjustments are not sufficiently justified, and as a result, taxpayers are left with reduced financial means to pursue their cases effectively. Undermining the Appeals Process: According to the representation, the CPC’s current method of immediate adjustment negates the very purpose of filing an appeal and seeking a stay on the disputed amounts. It undermines the essence of CBDT’s Instruction No. 1 9 1 4 d a t e d 2 1 . 0 3 . 1 9 9 6 , d e s i g n e d t o e n s u r e f a i r n e s s i n t h e a p p e a l s p r o c e s s .

Representation: The KSCAA, in its letter, has appealed for a more balanced approach that respects the law and financial stability of taxpayers. It has earnestly requested the concerned authorities to review the practices of the CPC in this regard. Conclusion: The KSCAA’s representation brings to light a significant issue affecting both chartered accountants and taxpayers in Karnataka. If the authorities heed their request, it could set a precedent for a more balanced approach to tax collection, respecting both the state’s needs for revenue and the taxpayers’ right to a fair process. It also highlights the essential role that associations like the KSCAA play in safeguarding the interests of professionals and the public.

Rectification of Mistake Under Section 154: A Comprehensive Guide

Rectification of Mistake Under Section 154 of Income Tax Act, 1961 allows for the correction of errors in official orders and documents, making it a crucial aspect of legal and administrative processes. This provision empowers authorities to rectify orders, where errors or inaccuracies are detected, even if those orders are subject to appeal or revision. The initiation of rectification can be carried out by the authority that issued the order, ensuring that rectifications are made promptly and accurately. There is a specific time limit for rectification, and the procedure for applying for rectification is well-defined. Understanding the nuances of this provision is essential for those navigating legal and administrative matters. Discover the key points through our informative Points on Rectification of Mistake Under Section 154, ensuring you stay updated and informed in your professional endeavors.

Introduction Sometimes there may be a mistake in any order passed by the Assessing Officer. In such a situation, mistake which is apparent from the record can be rectified under section 154. The provisions relating to rectification of mistake under section 154 are discussed in this part. Order which can be rectified under section 154 With a view to rectifying any mistake apparent from the record, an income-tax authority may, – a) Amend any order passed under any provisions of the Income-tax Act.

b) Amend any intimation or deemed intimation sent under section 143(1).

c) Amend any intimation sent under section 200A(1) [section 200A deals with processing of statements of tax deducted at source i.e. TDS return].

d) amend any intimation under section 206CB. (*) Under section 200A, a TDS statement is processed after making correction of any arithmetical error in the statement or after correcting an incorrect claim, apparent from any information in the statement Similarly a new section 206CB is inserted by Finance Act, 2015 to provide for the processing of TCS statement. If due to rectification of mistake, the tax liability of the taxpayer is enhanced or refund is reduced, the taxpayer shall be given an opportunity of being heard. Rectification of order which is subject to appeal or revision If an order is the subject-matter of any appeal or revision, any matter which is decided in such an appeal or revision cannot be rectified by the Assessing Officer. In other words, if an order is subject matter of any appeal, then the Assessing Officer can rectify only those matters which are not decided in such appeal.

Initiation of rectification by whom :-The income-tax authority can rectify the mistake on its own motion. The taxpayer can intimate the mistake to the income-tax authority by making an application to rectify the mistake. If the order is passed by the Commissioner (Appeals) or the Joint Commissioner (Appeals), then such the Commissioner (Appeals) or the Joint Commissioner (Appeals) can rectify mistake which has been brought to notice by the Assessing Officer or by the taxpayer. Time-limit for rectification No order of rectification can be passed after the expiry of 4 years from the end of the financial year in which order sought to be rectified was passed. The period of 4 years is from the date of order sought to be rectified and not 4 years from original order. Hence, if an order is revised, set aside, etc., then the period of 4 years will be counted from the date of such fresh order and not from the date of original order. In case an application for rectification is made by the taxpayer, the authority shall amend the order or refuse to allow the claim within 6 months from the end of the month in which the application is received by the authority. The procedure to be followed for making an application of rectification Before making any rectification application the taxpayer should keep following points in mind. The taxpayer should carefully study the order against which he wants to file the application for rectification. Many times the taxpayer may feel that there is any mistake in the order passed by the Income-tax Department but actually the taxpayer’s calculations could be incorrect and the CPC might have corrected these mistakes, e.g., the taxpayer may have computed incorrect interest in return of income and in the intimation the interest might have been computed correctly. Hence, to avoid application of rectification in above discussed cases the taxpayer should study the order and should confirm the existence of mistake in the intimation, if any. If he observes any mistake in the order then only he should proceed for making an application for rectification under section 154. Further, he should confirm that the mistake is one which is apparent from the records and it is not a mistake which requires debate, elaboration, investigation, etc. The taxpayer can file an online application for rectification of mistake. Before making an online application for rectification the taxpayer should refer to the rectification procedure prescribed at https://incometaxindiaefiling.gov.in/ For rectification of intimation under Section 200A(1)/206CB online correction statement is to be filed; the procedure thereof is given at http://contents.tdscpc.gov.in/en/filing- correction-etutorial.html An amendment or rectification which has the effect of enhancing the assessment or reducing a refund or otherwise increasing the liability of the taxpayer (or deductor) shall not be made unless the authority concerned has given notice to the taxpayer or the deductor of its intention to do so and allowed the taxpayer (or the deductor) a reasonable opportunity of being heard. Important Points on rectification Of Mistake Under Section 154

- Any mistake which is apparent from the record in an order passed by the Assessing Officer can be rectified under section 154.

- As per section 154, any mistake apparent from the record can be rectified by the Income Tax Authorities in following cases:.

- If an order is the subject-matter of any appeal or revision, then any matter which is decided in such an appeal or revision cannot be rectified. In other words, if an order is subject matter of any appeal, then the Assessing Officer can rectify the matter which is not decided in by the appellate authority.

- The income-tax authority can rectify the mistake on his own. The taxpayer can also intimate the mistake to the income-tax authority by making an application to rectify the mistake. If the order is passed by the Commissioner (Appeals) or the Joint Commissioner (Appeals), then such the Commissioner (Appeals) or the Joint Commissioner (Appeals) can rectify mistake which has been brought to notice by the Assessing Officer or by the taxpayer.

- No order of rectification can be passed after the expiry of 4 years from the end of the financial year in which order sought to be rectified was passed. The period of 4 years is from the date of order sought to be rectified and not 4 years from the date of original order. Hence, if an order is revised, set aside, etc., then the period of 4 years will be counted from the date of such fresh order and not from the original order.

- In case of an application made by the taxpayer, the authority shall amend the order/refuse to do so within 6 months from the end of the month in which the application is received by the authority.

- The taxpayer can file an online application for rectification of mistake. Before making an online application for rectification the taxpayer should refer to the rectification procedure prescribed at https://incometaxindiaefiling.gov.in.

- An amendment or rectification which has the effect of enhancing the assessment or reducing a refund or otherwise increasing the liability of the taxpayer (or deductor) shall not be made unless the authority concerned has given notice to the taxpayer or the deductor of its intention to do so and allowed the taxpayer (or the deductor) a reasonable opportunity of being heard.

Double Taxation: What to Do If You’re Taxed in Two Countries on Same Income

The global economy has made it easier than ever for people to work and invest across borders. However, it also poses unique challenges, especially when it comes to taxation. If you’re a tax resident in one country but have income streams in another, you could be subject to double taxation. This article delves into how countries like those following Residence-Based or Citizen-Based Tax Systems handle this issue and offers solutions for mitigating double taxation.

In countries following a Residence-Based Tax System or a Citizen-based Taxed System, individuals are subject to taxation on their global income by their respective country of residence or citizenship.

What is “Global Income”? Global income encompasses all income earned by a taxpayer in the country where they qualify as a tax resident due to their residential status. This includes income earned within the country as well as income generated from financial assets or investments in other countries, such as interest, dividends, rental income, or capital gains. Let’s illustrate this concept with a couple of examples:

Example 1: Mr. Rahul, an individual of Indian origin, has settled in the UK. He works as a software engineer in a UK-based software company, earning his salary in British Pounds (GBP). Additionally, Mr. Rahul owns a property in India, which he has rented out, generating rental income.

Answer: Mr. Rahul is considered a tax resident of the UK, and he is obligated to pay taxes on his global income, which includes both his salary earned in GBP and the rental income from India when filing his tax return in the UK.

Example 2: Mr. Sam, originally from Germany, has settled in India and works as a doctor. Additionally, he has investments in Germany that generate income.Answer: Mr. Sam is regarded as a tax resident of India, subject to Indian taxation on his global income. This includes income earned from his medical practice in India and income generated from investments in Germany. In such scenarios, taxpayers being taxed in two countries on the same income (i.e interest, Rental capital gain etc) as a resident on global income and simultaneously as a non-resident in another Country Where his investment sourced. This double taxation can be alleviated through Double Taxation Avoidance Agreements (DTAA) between the individual’s resident country and the source country. These agreements provide provisions for Foreign Tax Credit (FTC), allowing taxpayers to offset double taxation when filing tax returns in their resident country. Foreign Tax Credit (FTC) rules in each country outline the procedure for claiming credits for taxes paid in another country.

The key provisions typically include: Taxpayers can claim credit and exemption in their resident country for taxes paid as non-residents in another country.

FTC is allowed in the year when the corresponding income is taxed as global income in the resident country.

FTC is restricted to the amount of tax payable in the resident country on the corresponding income. Any excess foreign tax paid beyond the resident country’s tax liability will not be credited.

FTC can only offset tax, surcharge, and cess payable on the corresponding income in the resident country.

FTC cannot be used against interest or penalty payable under resident country’s income tax law. In cases where a taxpayer qualifies as a tax resident in both the source and residence countries, tax residency is determined by DTAA tie-breaker rules or by competent authorities as specified in the DTAA.

So, what is Tie-breaker concept, and what are the rules per the India – USA treaty Agreement?

Suppose a U.S. citizen or Green Card holder lives and works in India for an entire year. In such a case, due to U.S. citizenship, they become a tax resident of the U.S. because of citizenship-based taxation. Additionally, they become a tax resident of India because of residence-based taxation, as they have lived in India for more than 182 days in the tax year. Therefore, they are considered residents in both countries. In this situation, tax residency is determined by DTAA tie-breaker rules or competent authorities to provide tax benefits. In the context of the India-USA DTAA, the tie-breaker rule for determining an individual’s tax residency typically follows the “permanent home” and “center of vital interests” criteria.

Permanent Home: An individual will be considered a resident of the country where they have a permanent home available to them. If they have a permanent home in both India and the USA, the tie- breaker rule proceeds to the next criterion.

Center of Vital Interests: If the individual has a permanent home in both countries or none, they will be considered a resident of the country where they have their center of vital interests. This determination considers factors such as their personal and economic ties, family, social and professional activities, and other significant connections. The country where the individual has stronger connections will be considered their tax residency. Habitual Abode: If it is still not possible to determine tax residency based on the above criteria, or if the individual has a habitual abode in both countries or none, the authorities of both countries will negotiate and resolve the residency issue by mutual agreement.

Conclusion: When liable to taxed in two countries, follow these steps to avoid double taxation and maximize benefit in your Resident country. 1. Determine Your Eligible Resident Country for FTC (Foreign Tax Credit): First identify your resident country, which is eligible for foreign tax credit relief Either with Normal rule or Tie- breaker rule prescribe in DTAA

2. Timely submission of Required form: Ensure that you submit the necessary forms promptly to claim the benefits of foreign tax credits within prescribed timeline (for claiming FTC in India, Form 67 need to be dully filed verified and certified by a Chartered Accountant on or before furnishing the Return of income under section 139(1))

3. Maintain Proof of Foreign Tax Payment: Keep records of the foreign taxes you’ve paid. These records serve as evidence when you seek relief in your resident country for taxes paid abroad. Proper documentation is essential to support your claim.

4. Comply with Foreign Country’s Tax Laws: In the foreign country where you’ve earned income and paid taxes as a non-resident, adhere to their tax laws and regulations. This may involve filing income tax returns in that country, following the specific guidelines for non-resident taxpayers.

5. Include Global Income in Resident Country’s Tax Returns: When filing your income tax returns in your resident country, make sure to include your global income. This means reporting all income, including that which you’ve earned abroad and for which you’ve already paid taxes in another country.

6. Claim Relief for Taxes Paid Abroad: In your resident country’s tax return, you can claim relief for taxes paid in the foreign country. This relief can come in various forms, such as exemptions, deductions, or foreign tax credits, depending on your resident country’s tax laws and any existing tax treaties or agreements between the two countries.

“Focusing on what you want to have makes you miserable. Focusing on what you want to become makes you happy”

DGFT & CUSTOMS UPDATEBy CA. Ashit K. Shah |

|

- Notifications issued under Customs Tariff:

Notifications No

Remark Date

58/2023 –

Customs

Safeguard duty on imports of ferro-molybdenum covered under chapter 529A, 529B & 529C, from South Korea for two years, seeking to alleviate pressure on domestic converters. Imports of ferro-molybdenum from South Korea will attract a 5% duty from 10th October 2023 to 9th October 2024, Earlier rate of duty was 3.75% until 10th October 2025. 09 -10 -2023 59/2023 –

Customs

Export duty of 20% on Parboiled rice extended up to March 31, 2024 by amending N. No. 55/2022 – Customs, dated 31st October, 2022. 13 -10 -2023 60/2023 –

Customs

Foreign-going vessels covered under chapter heading 8901, are liable to pay 5% IGST on the value of the vessel if it converts to a coastal run. GST Council recommends conditional IGST exemption to foreign flag foreign going vessel when it converts to coastal run subject to its reconversion to foreign going vessel in six months. 19 -10 -2023 61/2023 –

Customs

The Government imposed a 40 % duty on the export of onions vide N. No. 48/2023-Customs to check price rise and improve supplies in the domestic market till December 31, 2023. By instituting a 40% export duty on onions, the government aims to regulate the export of this essential commodity while maintaining a stable supply in the domestic market. 28 -10 -2023 62/2023 –

Customs

Exemption of Export Duty on export of Onions by amending N. No. 27/2011, dated 01-03-2011. It means, no export duty on Onions covered under HSN 0703 10 w.e.f. 29th October, 2023 28 -10 -2023 77/2023 –

Customs

(NT)

CBIC revised the all Industry Rates of Duty Drawback w.e.f. 30th October, 20 -10 -2023 10/2023 –

Customs (ADD)

Impose Anti-dumping duty on imports of flax yarn of below 70 lea covered under chapter 5306 10 or 5306 20, originating in or exported from China PR for a period of 5 years from the date of publication of this notification. 20 -10 -2023 Notifications No Remark Date Policy Circular

–

6/2023-24

Implementation of Import Management Systems for IT Hardware as Import of certain specified IT Hardware was ‘Restricted’. This extension of exemption applies to:

- Reference SEZ Rule 27 and Para 6.01(d) of the FTP 2023, SEZ units and EOUs/EHTP/STPI/BTP are not required to obtain a ‘restricted import authorisation’ for import of IT hardware restricted vide Notification 23/2023 dated 03.08.2023;

- There are no import restrictions on spares, parts, assemblies, sub- assemblies, components, and other inputs necessary for the IT hardware devices as specified under Notification 23/2023 dated 03.08.2023.

- Notified IT hardware items essential for Capital Goods are exempt from import licensing requirements. For instance, laptops/tablets accompanying machinery such as MRI machines, CNC machines, Unmanned Arial Vehicles (UAVs), etc., are examples of allowed exemptions. However, if servers or laptops etc. themselves are the primary capital goods, this exemption does not apply.

19-10-2023 39/2023

–

DGFT

Import of Human Embryo and Human Gametes covered under HSN 0511 99 99, is put under “Prohibited” in accordance with the ART (Regulation) Act, 2021 and The Surrogacy (Regulation) Act, 2021, from “Free” Import Policy. 23 -10 -2023 40/2023 –

DGFT

All Vegetable Oils/ Refined Vegetable Oils/ Solvent extracted Oils covered under chapter 15, specified in Food Safety and Standards (Food Products Standards and Food Additives) Regulation, 2011 (made under the Food Safety & Standards Act, 2006) and conforming to standards specified in these regulations are freely importable except where otherwise stated. Import of coconut/copra oil is permitted through State Trading Enterprises. 26 -10 -2023 41/2023 –

DGFT

Streamlining the Halal certification process for export of meat and meat products from India. Time period for accreditation of Halal Certification Bodies and registration of Export Units have been extended by a period of six months i.e., up to 5th April 2024. 27 -10 -2023 42/2023 –

DGFT

Imposition of a minimum export price (MEP) of USD 800 per tonne on onion exports till December 31 this year with a view to increase availability of the vegetable in the domestic market and contain prices. 28 -10 -2023 “A sincere attitude of gratitude is a blessing for secured altitudes. Appreciate what you have been given and you will be promoted higher”

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

Are all Non-profit organization required to register on NGO Darpan?

The Union ministry of finance has notified amendments to the Prevention of Money-laundering (Maintenance of Records) Rules enhancing the compliance net for non-government organisations (NGOs), politicians and financial institutions.

The amendments notified in the gazette include a new clause defining politically exposed persons (PEPs) and another one asking a bank or financial institution (FI) or intermediary to register details of an NGO on the Darpan portal of NITI Aayog, if not already done.

“Non-profit organization” now means “any entity or organization, constituted for religious or charitable purposes referred to in clause (15) of section 2 of the Income-tax Act, 1961 (43 of 1961), that is registered as a trust or a society under the Societies Registration Act, 1860 (21 of 1860) or any similar State legislation or a Company registered under the section 8 of the Companies Act, 2013 (18 of 2013).”

Further, “Every Banking Company or Financial Institution or intermediary, as the case may be, shall register the details of a client, in case of client being a non-profit organization, on the Darpan Portal of NITI Aayog, if not already registered, and maintain such registration records for a period of five years after the business relationship between a client and a reporting entity has ended or the account has been closed, whichever is later.”

Impact of the amendment:

- The Prevention of Money Laundering Act, 2002 (PMLA), passed in line with the Financial Action Task Force (FATF) recommendations, aims to prevent and penalize money laundering. Besides individuals, the money laundering laws are now also applicable to all NGOs/NPOs established for ‘charitable purpose’ as provided under section 2(15) of the Income tax Act 1961.

- Registering on the NGO Darpan portal will allow all relevant information in respect of the NGOs/NPOs to be easily accessible through a centralized database.

- Onus of ensuring such registration on DARPAN portal has now been placed on banks and financial institutions handling financial transactions of NGOs. Thus, even if the NGO/NPO is not registered under FCRA and does not receive any government grant, the bank will require NGOs/NPOs to register on the Darpan Portal of NITI Aayog and provide the unique identification number. If you need assistance, you may contact us on [email protected]

Life Insurance – Vis-a-Vis Sec 10 (10D) of Income Tax Act 1961.Compiled By By Mr. Tushar P. Joshi |

|

1) Understanding the Amendment.

In the budget for the year 2023-24 it was proposed to amend Sec10 (10D) of Income tax Act 1961 and later on it became a part of the Finance Act 2023.CBDT has thereafter issued clarifications regarding applicability of exemption u/s 10(10D) in respect of receipts from Life Insurance Policies in different situations, vide Circular 15/2023 dated August 16, 2023.

Some of the highlights of that amendment is discussed in this article.

ULIPS are not governed under this amendment and they will continue to be treated according to the Finance Act 2021. The Finance Act, 2021 made amendments that governed unit linked insurance policies (ULIPs) issued on or after 01.02.2021. If the premiums exceeded Rs. 2,50,000 in any previous years during the policy’s term, any sum received would not be exempted under the clause. Instead they will be subject to Long term capital gain tax provisions.

There are 3 important provisos of the Finance Act 2023 that we will focus now, and also on Sec 56:

-

- Sixth proviso – Limit on Single Policy Premium: From the financial year 2023-24, if the premium payable for any previous year during a policy term surpasses Rs. 5,00,000 the money received will not be exempted.

- Seventh Proviso – Aggregate Premium for Multiple)

Policies: If premiums are due on more than one life insurance policy, the exemption is applicable solely for such policies for which the aggregate premium doesn’t exceed Rs.5,00,000 for any of the previous years during the term.

-

- Eighth Proviso –

Death Benefits – Remain -Exempt: The above provisions concerning premium limitations are not applicable if the sum received is due to the death of the policyholder

Sec 56(2):

Inclusion of a new clause (xiii), in Section 56(2) provide that amounts received from life insurance policies not fulfilling criteria under clause (10D) of Section 10 will be considered as “Income from other sources” and therefore taxable.

Some suggest assignment of the policy to another person close to the maturity to avoid tax, but how far this will be considered by the tax authorities is doubtful. Because, the policy is classified under not eligible for Sec 10(10D) benefit. The recipient may be asked to bear the tax payable. The Differential tax slabs of the investor and the recipient might result in some benefit in this case.

- Suitability to the Policyholder.Now let us consider if savings through life insurance policies is still an attractive proposition to the policyholder. A life insurance policy covers the life risk to provide an assured amount upon the death of the life assured to the nominee/s. It is therefore not comparable with other investment options available in the market.Savings through life insurance policies gives a feeling or financial obligation to the life assured, with the result that it develops a discipline of Income – Savings = Expenses. It helps to maintain regularity in the investments because the amount to be invested is fixed and the dates of remittances are also fixed.In other savings/investment products this is left to the will of the investor. So the investor might break its regularity due to other tempting or (seemingly) compelling wants/needs.When investing in Life insurance savings products there is less temptation to keep seeing the amount accrued in the amount, this is one reason why the persistence in life insurance is higher than many other savings/investments products.With suitable riders added a life insurance policy can mitigate both these risks:

- Income stopping after Death

- Income stopping before death.

You can observe that post tax; yield is reasonable while comparing the other investments in this segment considering the benefits of the risk cover availed.

The other benefits that Life insurance policies can be used as collaterals for availing credits and flexibilities provided in the contract are also to be considered in deciding the suability to an individual.

“The world is full of beautiful mountains and meadows, spectacular skies and serene lakes, lush forests, flowered fields and sandy beaches, plenty of stars and the promise of a new sunrise and sunset every day. What the world needs more of is, people to appreciate and enjoy it.” Do take time off to enjoy these beautiful things.”

Our members have an option to subscribe to our monthly academic magazine, “GST Review”, which is one of the oldest monthly publications on indirect tax laws in the Country. You get access to indepth articles, analysis and updates on all aspects of indirect tax laws by veteran experts. Latest notifications and circulars are also printed in the same for the benefit of the subscribers.

For the benefit of our readers we are reproducing the index of the topics covered in the last month. Subscription form is available in this News bulletin. Please take this opportunity and become our member and subscribe to the GST Review.

Contents Vol. 6 No. 02 | Mumbai | October, 2023 GST Review JOIN GSTPAM AS A MEMBER

| Topic | Writer | Page No. |

| Part – I | ||

| Editorial | Mayur R. Parekh | 5 |

| From the President | Pravin V. Shinde | 7 |

| Bidding Adieu to Hon’ble Shri P. G. Kadu | 11 | |

| Roving Eye | D. H. Joshi & Vijay M. Sachiv | 12 |

| GST Updates | Deepali Mehta | 14 |

| GST on Construction Services where residential flats are allotted Free of Cost after Redevelopment | Ratan Samal & Manohar Samal | 18 |

| ITC reversal on Retention – Is it a tension ? | Pranav Kapadia | 24 |

| Time of Supply of Services – A Refresher and Certain Issues Part 2 | Umang Talati | 28 |

| Garnishee proceedings under section 79, by which petitioner’s bankers were directed to debit alleged tax dues is invalid | Pranav Mehta | 33 |

| रबर तुटे पय त ताणू नका | Kishor Lulla | 38 |

| VAT Update | Janak Vaghani | 40 |

| Service Tax Updates | Vasudev Mehta | 41 |

| Income Tax Update – Highlights on Recent Amendments | Sonakshi Jhunjhunwala & Sunil Jhunjhunwala | 50 |

| Do You Know? | Moti B. Totlani | 57 |

| Replies to Queries | Deepak Thakkar & Ronak Thakkar | 57 |

| Speaker’s Forum | D. J. Ruparelia & Ashish Ruparelia | 63 |

| Representation & Response | 63 | |

| Association News | Vinod Mhaske & Jatiin N. Chheda | 70 |

| Part – II | ||

| From the Courts | Dhaval Talati | 76 |

| Gist of Advance Rulings | Ashit Shah | 78 |

| Part – III | ||

| Recent Amendments – Notifications/Trade Circulars | ||

| CGST Notification and Circulars | ||

| Notification No. 46/2023-Central Tax, New Delhi, the 18th September, 2023 | 82 | |

| Notification No. 48/2023 – Central Tax, New Delhi,

dated the 29th September, 2023. |

83 | |

|

Notification No. 49/2023 – Central Tax, New Delhi, dated the 29th September, 2023 |

83 | |

| Notification No. 50/2023 – Central Tax, New Delhi,

dated the 29th September, 2023 |

83 | |

| Notification No. 51/2023 – Central Tax, New Delhi,

dated the 29th September, 2023 |

84 | |

| Notification No. 11/2023- Central Tax (Rate), New Delhi,

dated the 29th September, 2023 |

89 | |

| NOTIFICATION No. 02/2023 – Integrated Tax, New Delhi,

dated the 29th September, 2023. |

90 | |

| NOTIFICATION No. 03/2023 – Integrated Tax, New Delhi,

dated the 29th September, 2023. |

90 | |

| NOTIFICATION No. 04/2023 – Integrated Tax, New Delhi,

dated the 29th September, 2023. |

90 | |

| MAHARASHTRA ORDINANCE No. VII OF 2023. | 91 | |

| Trade Notice No. 27/2023, Dated: 25th September, 2023 | 93 | |

| Announcements | ||

| Announcement For New Membership, Renewal of Membership &

Subscription For Year 2023-24 |

Page 75 | |

| Congratulations | ||

| Goods and Services Tax Bar Association, Nagpur | Page 58 | |

| Obituaries | ||

| Shri. Pravin Shah | Page 17 | |

| Advertisement | ||

| Taxmann’s Publications | 2nd Cover | |

“The way to develop what is best that is in a person is by appreciation and encouragement”

“The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart.” – Helen Keller

“Wishing our members a very HAPPY BIRTHDAY!!”

| Members Name | Date of Birth |

| Shah Rajesh Ratilal | 13, November |

| Bihani Omprakash D. | 13, November |

| Jain Navin Naranji | 13, November |

| Mahadik Dattaram Krishna | 13, November |

| Kudia Jamal Ayoob | 13, November |

| Gupta Manojkumar R. | 15, November |

| Rao Arety Sreenivasa | 15, November |

| Shinde Manohar Tanaji | 15, November |

| Lohia Chandraprakash Ashram | 15, November |

| Gupta Ravi Deoraj | 15, November |

| Vakharia Anvesh Anil | 15, November |

| Bagadia Jayesh R. | 16, November |

| Shah Rakesh B | 16, November |

| Kolambekar Nayana Arun | 16, November |

| Dalal Kamlesh Hamir | 17, November |

| Warankar Pradeep Ramachandra | 17, November |

| Khakhar Payal Nimish | 17, November |

| Dharnidharka Mayur Saral | 17, November |

| Sharma Pankaj Shreekant | 17, November |

| Wani Arjun Vishvanath | 18, November |

| Dhuri Shreeram Madhusudan | 18, November |

| Kotecha Mehul Ramniklal | 19, November |

| Surte Aditya Suhas | 19, November |

| Gandhi Siddhant Tushar | 19, November |

| Shah Vijay J. | 20, November |

| Shah Arvind Parmanand | 21, November |

| Jajoo Vinod Hiralal | 21, November |

| Saboo Niral Karan | 21, November |

| Raichura Sitansh Puroshottam | 22, November |

| Merchant Shahid Mohd. Husain | 22, November |

| Shah Himanshu P | 23, November |

| Kamath Narayan S. | 23, November |

| Savani Dhanesh Amritlal | 23, November |

| Shah Dharmen Rajendra | 23, November |

| Herlekar S. D. | 24, November |

| Gindra Purav Ketan | 24, November |

| Chavan Sandeep Vishnu | 25, November |

| Khare Saleel Subhashchandra | 26, November |

| Kulkarni Santosh Ambadas | 26, November |

| Kadam Raju Keru | 26, November |

| Khania Hiren Chandrakant | 26, November |

| Thanawala Anil Kantilal | 27, November |

| Dhut Ramanlal Balkisan | 27, November |

| Gala Kirti Arjun | 27, November |

| Kulkarni Ravindra Ramchandra | 27, November |

| Jha Narendra Kantilal | 28, November |

| Dayama Amol Purushottam | 28, November |

| Mukherjee Arpita Subhrarag | 29, November |

| Mehta Chirag Jitendra | 29, November |

| Mangaonkar Siddesh Pradip | 30, November |

| Chokshi Subodh S | 01, December |

| Kapadia Pravin Morarji | 01, December |

| Talati Rajat B | 01, December |

| Sisodia Shirish Dhanraj | 01, December |

| Thombare Amit Satish | 02, December |

| Kedia Pratik Dinesh | 02, December |

| Bhatia Kaushik Shantikumar | 03, December |

| Dhruve Kiran K. | 03, December |

| Doshi Tushar M. | 03, December |

| Momaya Mayur Kishor | 03, December |

| Tatiya Rakesh Tansukdas | 03, December |

| Shah Kinchit Hemant | 04, December |

| More Sayali Sunil | 04, December |

| Agrawal Umesh Prakash | 05, December |

| Gandhi Premal Hemant | 05, December |

| Patil Sanjay T | 06, December |